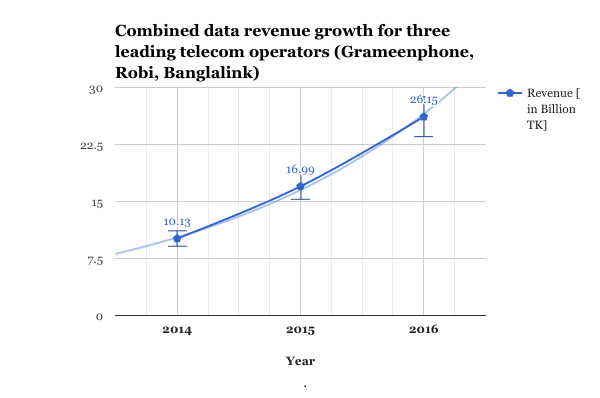

With the rapid growth of smartphone penetration, the number of people using internet through their handheld devices is on the rise resulting in a sharp growth in data revenue for the operators. Top three mobile operators have seen a steady growth in data revenue since the launch of 3G in 2013, suggests a report by the Daily Star.

Grameenphone: Grameenphone, the leader in the telecom sector, has been investing heavily in digital infrastructure over the past years with a view to morph itself in a digital service partner of its users with a plethora of digital services. Data, being at the center of any digital ecosystem, is an important piece of that strategy.

The company saw the biggest spike in data revenue, a 77% year-on-year growth, in 2016. Almost 12.53 percent of its total revenue, Tk 14.40 billion, came from data, up from Tk 8.50 billion last year and Tk 5.50 billion in 2014.

Robi: Robi, the second largest operator after the merger, has also seen a significant growth in its data revenue. The company reportedly saw a 31% growth in data revenue in 2016, BDT 6.84 billion in 2016 which is nearly 13 percent of total revenue.

Banglalink: As we reported early this month Banglalink, the country's third-largest operator, saw a big spike in its data revenue. The operator saw a 51.2% year-on-year to BDT 4.90 billion which 10% of its total revenue up from 6.9% in 2015, as reported by Vimpelcom.

What matters: Data business growth for any operator depends on a number of factors such as device, while smartphone penetration continues to grow, feature phone still dominates the market, local content, Dhaka’s internet infrastructure has a long way to go, overall digitization of services and quality network. All the three leading telecom operators are working on building a digital service infrastructure in some form. Despite that, there is an overall dearth of local content in Bangladesh, which, according to a report we published in July last year, is one of the key reason why people don’t use mobile internet in emerging markets.

Moreover, although mobile data consumption continues to grow for the operators, the service remains costly and poor. Despite the fact that 3G network is available countrywide, the connection quality is below standard in most places.

Data is going to be one of the big parts of telco business in the coming years, either you consider telco as a digital service provider or a carrier. While it might take some time to get there as many insiders predict, it is worth an effort that telcos invest in ensuring a better data experience for its users and also take a hard look into data price because you can only do so much with poor quality service.