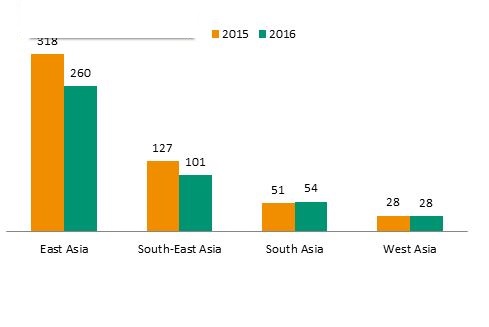

Foreign direct investment (FDI) inflows to developing Asia shrank by 15 percent to $443 billion in 2016, the first decline since 2012, according to UNCTAD's World Investment Report 2017. This affected three sub-regions, with only South Asia spared (figure 1). However, an improved economic outlook in major economies, such as ASEAN, China and India, will likely boost investor confidence, propping up the region's FDI prospects for 2017.

For the first time, China was the world's second-largest investor, as FDI outflows surged by 44 percent to $183 billion, a new high. By contrast, flows from other subregions and major investing economies in developing Asia declined substantially. Overall, FDI outflows from developing Asia rose by 7 percent to $363 billion (figure 2), driven by cross-border mergers and acquisitions purchases by Chinese firms.

The double-digit drop in FDI inflows to East Asia was mainly due to a decline in flows to Hong Kong (China), from $174 billion in 2015 to $108 billion in 2016. Flows to China were down by 1 percent to $134 billion. However, inflows to non-financial services in the country continued to grow, while FDI in manufacturing was shifting towards the high-end. Flows to the Republic of Korea more than doubled to $11 billion, from a low of $4 billion in 2015, as cross-border merger and acquisitions deals (M&A) remained robust.

In South-East Asia, FDI inflows dropped by one-fifth to $101 billion. Flows to Singapore, the leading recipient country in ASEAN, remained sluggish, down by 13 percent to $62 billion in 2016. In Indonesia, Malaysia and Thailand, FDI plunged due to significant divestments by foreign multinational enterprises (MNEs). In Indonesia, a large amount of negative equity flows in the fourth quarter dragged total inflows to a level as low as $3 billion. By contrast, the Philippines and Viet Nam performed well.

In South Asia, FDI inflows increased by 6 percent to $54 billion (figure 2). Flows to India were stagnant at $44 billion. Cross-border mergers and acquisitions deals have become increasingly important for foreign multinational enterprises to enter the rapidly-growing Indian market. In 2016 there were a number of significant deals, including the $13 billion acquisition of Essar Oil by Rosneft (Russian Federation). Pakistan’s inflows increased by 56 percent due to significant investment in infrastructure from China in support of the One Belt One Road Initiative.

The impact of low commodity prices persisted in West Asia, with FDI down by 2 percent to $28 billion. In particular, Saudi Arabia felt the effect with FDI declining by 8 per cent. Flows to Turkey plunged by 31 percent to $12 billion as the failed coup attempt likely cast doubt on the political stability in the country.