2018 was a fascinating year for us at FS in many ways. We have expanded our coverage and delved into industries like FMCG, finance, telecom, food and learned a ton. Food is one of the most promising and interesting sectors that we came to see closely in 2018 through our regular coverage as well as a research project that we conducted on the food processing industry in collaboration with the EMK Center. We have covered giants like Pran, Kazi Food Industries, ACI as well as small upstarts like Khaas Food, Chaldal.

Overall, food as a business is going through a tremendous transformation. Once a rare thing, CPG has become a norm in the industry. Smaller players are increasingly making concessions to the big players while big players continue to expand their product line and reach. The industry is just getting started. According to some estimate, the average growth rate of the food processing industry is about 8%. The total size of the domestic market is about US$2.2bn (AVC, 2011). But these numbers do not give you the full picture of a burgeoning sector. Some of the subsectors, for example, frozen food, is growing at a 16% rate annually.

We spoke with a long list of industry insiders and entrepreneurs in order to understand the pulse of the sector and here some of the major trends that we believe will share the business of food in Bangladesh in the coming days.

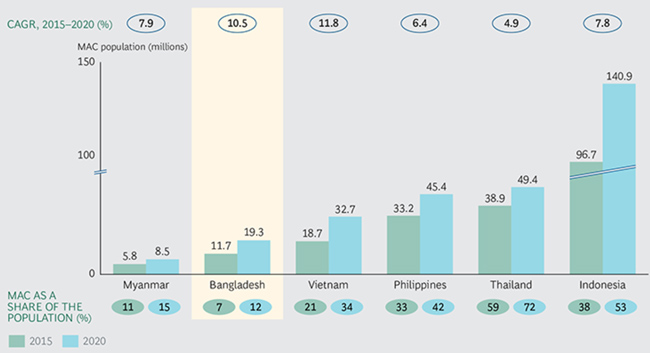

A 2017 report from the Boston Consulting Group (BCG) describes Bangladesh as “the surging consumer market nobody saw coming" and suggests that the population of “middle and affluent consumers” (or MACs) has grown to about 12 million people or about 7% of the population in Bangladesh. Most importantly, that middle-class base is growing at a rapid pace at around 10% or 11% per annum. “If Bangladesh can maintain this pace, its MAC population will grow by 65% over the next five years,” says BCG. “By 2025, it is expected to nearly triple, to about 34 million.”

If this trend continues this will not only change the dynamics of the food business in Bangladesh, it will also change the dynamics of many other industries. But the most immediate impact of this change will one the food sectors because people will start spending more on food and that too on what they feel better for them.

It also denotes that food is a very much demand-driven market where customers are (and will be) asking for more and hence offering solid growth opportunity for new businesses with meaningful product offerings.

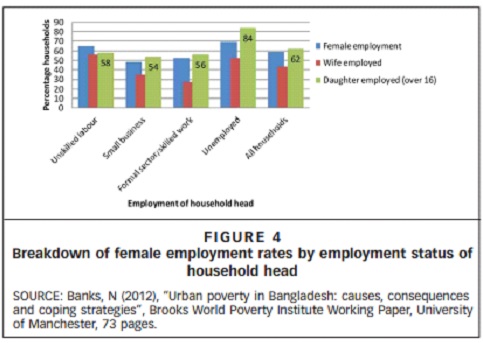

An increasing number of women are participating in the workforce. A 2012 study on the female employment in Dhaja suggests female members or wife participate in full-time employment in about 40% households.

It means increasingly both husband and wife in a household are becoming busy leaving limited room for household activities. With the growth in household income, interest in recreation has also increased. Over the past year, eat out has become a dominant culture in Dhaka. Busy families mean the demand for convenience is likely to grow in the coming days. We have also seen a rise in the number of food delivery companies in Dhaka.

Major players like PRAN, Square, ACI, New Zealand Dairy, and every other big player in the market are exploring almost every corner of the food business starting from biscuits to noodles to frozen food. Compared to that the number of the new mentionable entrants to any particular segment of the sector is slim. There are opportunities to launch sector specific niche brands that could offer superior values to the customers.

While trends like direct to consumer and subscription are increasingly becoming dominant trends in many advanced markets, there is none in Dhaka. The advantage for any new entrant with a superior product is that technology has virtually brought down the distribution cost to zero.

Building a direct relationship has become a feasible option for brands, which was not the case in the past. However, very few companies are properly trying to take advantage of what technology has to offer and match that with the growing consumer demand for convenience. To effectively compete with the incumbents, new entrants can take advantage of technology explore ideas like direct to consumer and subscription.

For modern men and women, food is increasingly becoming the ultimate medicine. Eat healthy, stay healthy. You are what you eat. Over the past few years, public awareness of food safety and healthy food has reached a new height. It has created new challenges for business. Similarly, like any other challenge in business, it has created new opportunities as well.

Several estimates said that the global market for organic and healthy food is expected to reach US$321 billion by 2025. The consumer demand for safe and pure healthy food has grown steadily over the last few years.

This reality reflects on a sudden influx in the number of companies that are offering safe and healthy food. In fact, many mainstream retail chains such as Shwapno is betting on the trend. A host of new generation companies are offering varieties of safe and farm-to-table food in Bangladesh.

Companies are now making active effort to communicate that they maintain safety standard in their manufacturing process. The food safety-related lawsuits have increased. Products like mango juice and drinks suffered in the market due to negative word of mouth.

A small but growing social movement around safe food has already begun. It indicates a strong trend. All indications suggest that this trend is just getting started and it is here to stay. A certain segment of the population is already willing to pay extra for safe and healthy food. And this segment (of the population) is growing as the middle class expands in the country.

Cover photo: Photo by Erwan Hesry on Unsplash