In Bangladesh, a large number of people are unbanked, meaning they don't have access to basic financial services such as savings accounts, loans, and insurance. This makes it difficult for them to manage their money, save for the future, and protect themselves from financial risks.

At the same time, mobile phone penetration in Bangladesh is high, with over 165 million mobile phone users in the country. This presented an opportunity to leverage mobile technology to provide financial services to people who may not have access to physical banking services.

Thus, the founders of bKash saw an opportunity to use mobile phones to create a mobile financial service platform that would allow people to easily send and receive money, pay bills, and access other financial services. By doing so, they aimed to help drive financial inclusion in Bangladesh, making it easier for people to manage their money, save for the future, and protect themselves from financial risks.

The idea of bKash was originally conceived by the brother duo Kamal Quadir and Iqbal Quadir. Qudir brothers previously played a significant role in Bangladesh’s telecom and e-commerce industry. As a pioneer in the mobile telecom industry in Bangladesh, Iqbal Quadir has been a long proponent of the power of mobile phones to transform societies. In 2015, he gave a talk on TED on the power of mobile phones to fight poverty.

On the other hand, Kamal Quadir was the founder of Bangladesh’s first mobile phone base e-commerce platform Cellbazaar, which he later sold to Grameenphone. This understanding of the power of mobile phones made the Quadir brothers a perfect protagonist for a venture like bKash.

Not only they had the first experience of this revolution, they saw the success of mobile financial services in emerging markets like the Philippines and Kenya and decided to bring it to Bangladesh. But in order to do this, they needed a local partner. They started communicating with Sir Fazle Hasan Abed, the founder of BRAC, in 2008. In 2010, they agreed to create a joint venture between Money in Motion and BRAC Bank.

"No matter how serious the bank or the government is about financial inclusion, it would not be achieved through this model (transaction through banks). So I thought of a system that would protect the client's interest by remaining fully regulated by the central bank and at the same time, reduce the cost of the transaction,” Kamal Quadir to told TBS in a recent interview.

So bKash was founded in 2010 as a joint venture between BRAC Bank Limited, one of Bangladesh's leading private banks, and Money in Motion LLC, a United States-based technology company. The company was officially launched in 2011. Over the years, bKash has grown to become the leading mobile financial service provider in Bangladesh with a network of nearly 300,000 agents and 300,000 merchants across the country. Today, bKash has expanded in all directions.

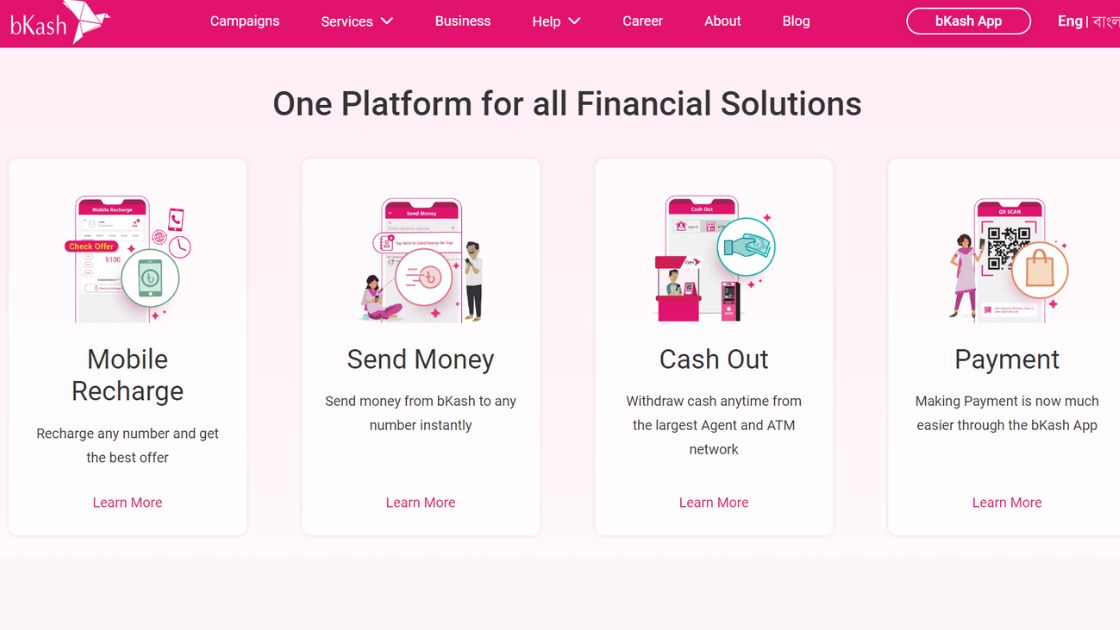

The company has not only become an on-in-all platform for all kinds of financial services from P2P money transfer to payment to various bill payment and shopping services, but it has also become an integral part of the digital services ecosystem in Bangladesh as an underlying platform to power the payment for the growing digital economy in the country.

The company is poised to become much more than what it originally started with.

Let’s take a look at the history of bKash and its evolution over the years.

Company History

Product and services

Add Money: Add money from your bank account to bKash, from Mastercard to bKash, and from any Visa card to your bKash account without any charge.

bKash to Bank: By using the bKash to bank service, now people can directly deposit money to bank accounts from bKash App through Banks & Bangladeshi-issued Visa Debit Card.

Pay Bill: Can pay electricity, gas, telephone, water, internet, cable tv, City Bank American Express (AMEX) credit card, Visa credit card bills, etc.

Cash In: To deposit money or Cash into bKash Account

Cash Out: If there is sufficient balance in any bKash Account, the account holder can cash out anytime from any bKash Agent and also from partner banks’ ATMs at a low rate of 1.49%.

Send Money: Can send money to any bKash number and non-bKash users. But the recipient can receive the sent amount once s/he opens a bKash Account within 72 hours.

Education Fee: One can pay the schools, colleges, universities, and other fees by using bKash.

Payment: People can make payments from their bKash Account to any “Merchant” who accepts “bKash Payment”. Now more than 47,000 outlets nationwide.

Mobile Recharge: bKash users can auto recharge on their phone

Remittance: Can send international remittances legally to loved ones' bKash accounts in the easiest way through authorized and enlisted Foreign Banks and Money Transfer Operators (MTO) anytime. And freelancers can also withdraw money from Payoneer through bKash.

Interest on Savings: Along with keeping money safe, people can also enjoy up to 3% Interest (per annum) on Savings on their bKash Account.

Donation: Can donate money for the prosperity of the society

Government Services: There are various online services available at the Bangladesh Road Transport Authority (BRTA) service portal. Car owners, drivers, and sellers can apply for various services through online payment upon registration. And can also pay the bills of any kind of NID fee.

Savings: bKash has two types of savings formats, one is “General Savings” where people can save their money easily and safely through bKash with attractive interest from the listed financial institutions. And another one is “ Islamic Savings” where people can save money and get Shariah-based profit from listed financial institutions.

Personal retail account: Personal Retail Account or PRA is a new type of business account by which micro and small businesses operating in retail and f-commerce segments can collect bKash payment easily from bKash customers against goods and services.

Insurances: Can pay insurance premiums easily with bKash

Loan: Launched a nano-loan product in partnership with The City Bank

Microfinance: Allows people to pay their loan, DPS, or savings installment to listed microfinance institutions through bKash. Users can get digital receipts and passbooks.

Endnote

Today, bKash is the leading mobile financial service provider in Bangladesh, with over 50 million registered users and a network of around 300,000 agents across the country. Its success has helped to drive financial inclusion in Bangladesh, providing access to essential financial services for millions of people who previously had limited options.

Useful Resources