Edtech in Bangladesh has been growing steadily in recent years. With a population of over 164 million people, of which a large portion is under the age of 26, and the government's focus on digitization, there has been a meaningful growth in the use of technology in education. From virtual classrooms to online learning platforms, edtech has gained mainstream awareness and has slowly been changing the way education is delivered in Bangladesh.

Some of the major players in the Bangladeshi edtech market include 10 Minute School, Shikho, Interactive Cares, Ostad, EduHive, Sohopathi, etc. These platforms offer a wide range of courses and educational resources online across academics, skills, competitive exams, job preparation, etc, through videos, live classes, quizzes, and other learning materials.

Many traditional educational institutions in Bangladesh are also adopting technology to deliver and enhance their teaching. Some schools and universities are using learning management systems (LMS) to facilitate remote learning and to manage interactions between teachers, students, and parents. Others are partnering with edtech platforms to produce courses and run MOOCs and so on.

One major challenge facing the edtech market in Bangladesh is the apparent digital divide. Access to high-speed internet is unevenly distributed in the country. In many parts of the country, students don’t have access to high-speed internet. The internet remains expensive for many people. This makes it difficult for many students and teachers to use online platforms and digital resources effectively. In addition to that, online learning also suffers from certain perception challenges where people view only teaching as suboptimal.

Despite these challenges, the edtech market in Bangladesh is expected to continue to grow in the coming years.

The sector benefits from a positive policy environment. The government has recognized the importance of technology in education and has implemented various initiatives to support the adaptation of tech.

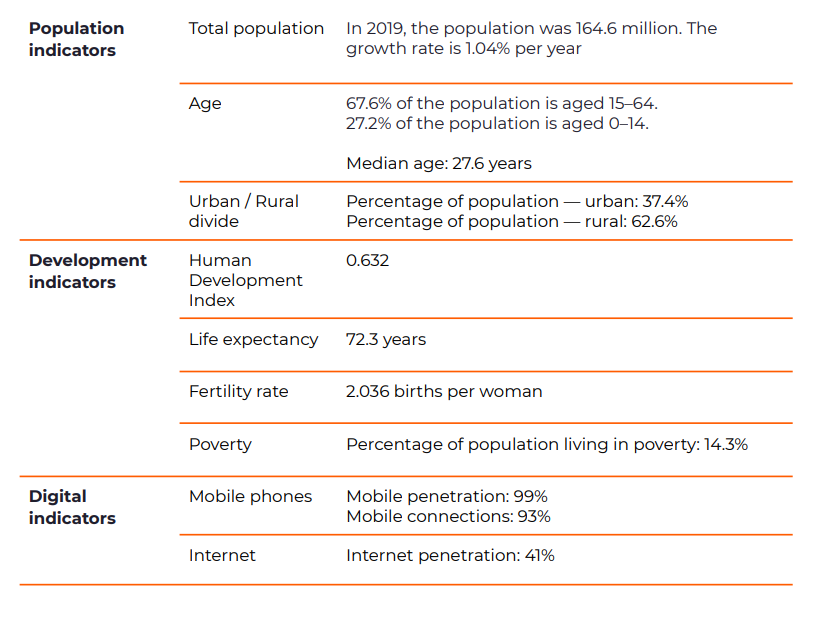

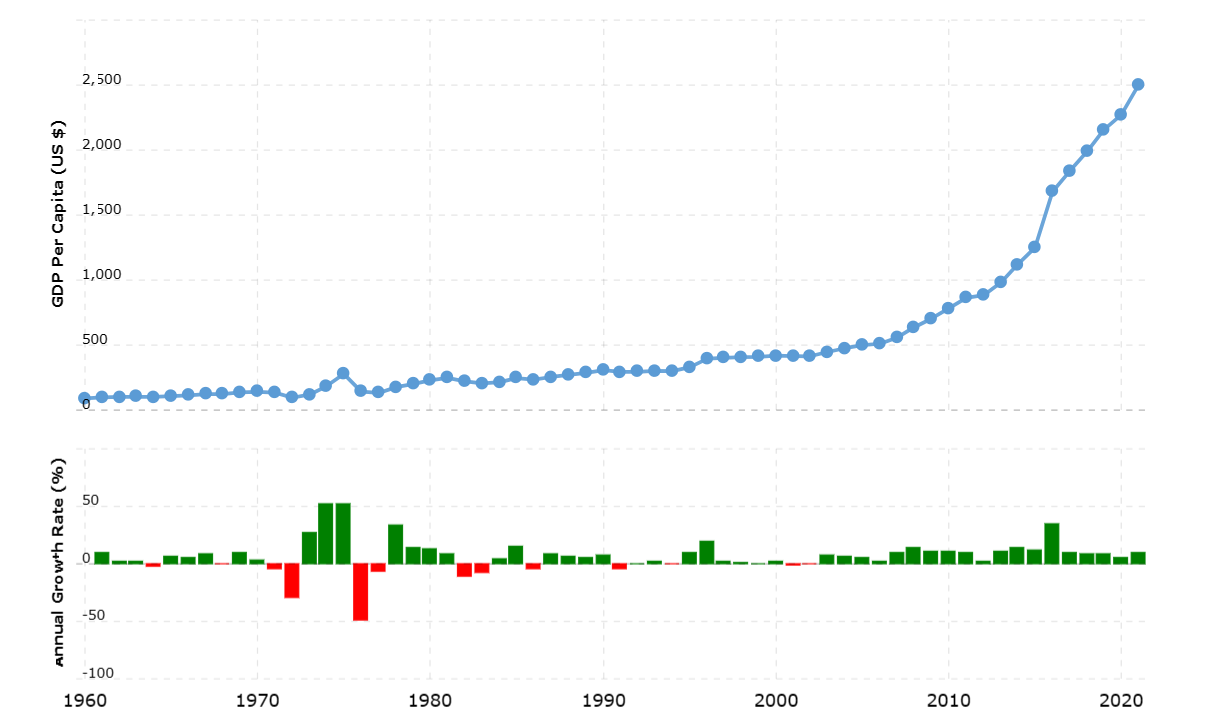

It benefits from growing internet and mobile phone penetration as shown in the table below. More importantly, a new crop of new edtech companies is pushing the market with their innovative solutions.

In this article, we aim to explore the current state of edtech in Bangladesh, and the challenges and opportunities that lie ahead for this growing industry.

As we discussed at the beginning, Bangladesh is the eighth-most populous country in the world. It is a densely populated country with diverse living conditions across the population. While more than 20 million people reside in the capital city Dhaka, 61% of the population live in rural areas.

Since 1990, Bangladesh’s policymakers have paid consistent attention to enhancing access to the quality of education. This has led to some incredible achievements in education such as access to primary education, women's literacy, and phenomenal growth in many other such indicators. In addition to that, this focus has made education one of the most important sectors.

There has been an incredible rise in awareness that education is important. As a result, parents are highly invested in the education of their children. This has made education a big market in Bangladesh. While the sentiment around education remains that it should be a public good and should not be for-profit, private spending in the sector has consistently increased over the years. Bangladesh is one of the largest private spenders on education globally.

The demographic dynamic of the country, with a median age of about 26 years, has made it an even more lucrative market for emerging verticals such as life-long learning, skills development, and employability training. The growing realization that everyone needs to continuously upgrade themselves to thrive in the new world of work has also helped the growth.

Despite the tremendous progress made in the sector, education also faces some pervasive challenges. Quality education is unevenly distributed. There is a shortage of qualified teachers in the country. Often classroom teachings remain inadequate. Poor teacher training and inadequate resources for teachers and schools make it difficult for educational institutions to deliver quality education.

This has led to the rise of private tutoring and coaching centers in the country. Many people suggest the coaching center market in the country borders on tens and thousands of crores taka. Despite that, access to quality education is hard for many students living outside the metros. Qualified teachers don’t want to go to distant places to teach. The number of quality coaching centers is also slim.

Then comes the higher education, competitive exams, job preparations, and upskilling of young people who have completed their education and are about to enter the job market or people who have already entered the job market and need upskilling. This segment also faces significant challenges. Skilled human resource is a challenge. There is a growing gap between academia and the industry. Moreover, real-world skills are hard to teach in academic settings. You have to face the real world to learn the skills that the real world requires. The changing landscape of work has exacerbated this challenge. With the advancement of technology, we’re seeing the rise of new professions and skills. It is hard for academia to catch up with these changes. Many of these skills also don’t require full-length degrees to master.

Skills like programming, product management, and project management are sought after but are always changing, requiring humans to invest additional resources to learn these skills.

This is, roughly speaking, the context where ed-tech comes into play. To make sense of the ed-tech in Bangladesh and in many other markets, you have to understand these different facets and realities. Similarly, these challenges make ed-tech solutions, that can make quality education accessible to more people, lucrative.

Then came the coronavirus pandemic in 2020. Bangladesh came to a standstill overnight. Like everything else, schools announced shutdown for months. This led to an unprecedented rise in online learning. Online learning was already growing before the pandemic but the pandemic helped push its awareness to the mainstream. Various government initiatives to continue K to 12 learning via online mediums also helped expand that awareness.

Similar to markets like India where companies like Byju’s became overnight sensations cashing on the pandemic-induced online education growth, Bangladesh also saw some of the most major events in the online learning space between 2020 and 2022. Multiple companies raised meaningful capital. We saw a couple of smaller acquisitions. The discussion around online learning reached a fever pitch.

That pandemic-induced growth has returned to normal in recent months as Bangladesh discarded the pandemic restrictions and offline education centers reopened to normal operating schedules. This, however, is the case in markets like India as well. Global economic uncertainties coupled with Bangladesh’s economic woes have also affected the sector in recent times. Investments have dried up. Consumer spending has also taken a beating.

While education, to a certain extent, is pandemic proof — weary parents will always spend on the future of their kids, growing inflation and belt-tightening have certainly affected the market.

The slowdown across verticals has also created a spirited discussion around whether ed-tech can address real challenges of education — quality, and access. People have also been talking about the real TAM of Bangladesh internet users. Many people recommend that ed-tech companies should explore opportunities at the intersection of offline and online. Amid all these various opinions, people generally agree that edtech is important for Bangladesh and is here to stay.

Education as a challenge is complex that involves policy, access, affordability, and much more. It is more so for a country like Bangladesh. In all honesty, ed-tech alone can’t address all these problems. But it can address part of the challenges and help address others.

Several ed-tech companies in Bangladesh have shown excellent tenacity and courage. A number of edtech startups have built excellent businesses, which has led to rapid growth in Bangladesh’s edtech industry in recent years.

With the growing internet penetration and smartphone usage in the country, the vertical hold significant promise.

The government of Bangladesh has also been promoting digital education through initiatives like “Digital Bangladesh” which has encouraged private investment in the sector.

The vertical is still in its early stages. The opportunity is unfolding in real-time. This is the context you have to remember when going through this market map.

Over the last three decades, Bangladesh has seen a slow but steady rise in the private education sector. While the predominant sentiment about education is that it should be a public good, this sentiment has slowly been changing. The cost of education has gone up. It started with small private kindergarten schools. Then came the private universities — Bangladesh now has more private universities than public universities. English medium schools have been around for a long time.

There has also been a rise in shadow education aka coaching centers and after-school teaching services. Today, private-sector institutions partly dominate the education sector. Out-of-pocket spending for people on education is likely to rise in the coming years. But limitations and challenges in the sector remain.

Ed-tech is a relatively new addition to this myriad of education services and comes partly as a response to many challenges that exist in the sector. As digitization accelerates and the push for equal access to quality education gains momentum, the edtech market in Bangladesh has enormous potential in the coming years.

Bangladesh’s general education system comprises five main phases:

| Phases | Age group |

| Pre-primary education | 5–6 |

| Primary education | 6–10 |

| Junior secondary education | 11–13 |

| Secondary education | 14–15 |

| Higher secondary education | 16–18 |

Outside of the formal educational phases, if you break down the education services market in Bangladesh, it would look something like this below:

1. Government educational institutions: schools to universities

2. Private educational institutions: schools to universities

3. Private educational and learning services

The third segment, private educational services, is where ed-tech companies, til now, are primarily playing. That market can further be broken down into a few segments:

1. K to 12 coaching centers

2. After-school educational programs

3. Admission coaching programs

4. Competitive exams and job preparation coaching programs

5. Skills development

Using this map, let’s take a look at the ed-tech landscape and where different players are:

| Markets/verticals | Edtech players | Prominent offline players |

| Kto 12 | Shikho, 10 Minute School, Cholpori, Shohopathi | This is a highly fragmented market with smaller local players along with national players like Udvash. |

| After-school programs | Cholpori | Kumon, KidsTime |

| Admission coaching | Shikoho, 10 Minute School, Interactive Cares, Udvash | This market is also equally fragmented. While Udvash now operates nationally, there are many smaller local players throughout the country. |

| Competitive exams and job preparation | Interactive Cares, Uttoron, 10 Minute School | Again there are many offline players in this space. |

| Skills development | 10 Minute School, Interactive Cares, Bohubrihi by Shikho, BDjobs Training | Creative IT Institute, BITM, Chalk Pencil, BDjobs Training, NIIT, and many other institutes again. |

Although the current market structure is quite fragmented with many different types of players, edtech players, however, enjoy several benefits. First, of course, the growing internet and smartphone penetration.

Second, aggregation. The internet allows aggregation. This has many implications. Two important implications are: you can serve as many users as you want and that too from anywhere and you can organize and aggregate myriad services into one platform.

If you are a vertical service provider, this aggregation can prove even more useful. You can aggregate all the services in your vertical. Since many vertical services are interconnected, it also makes everything easier for customers allowing them to enjoy a smoother experience.

Aggregation on the internet works because consumers also prefer platforms where they could find comprehensive services. More so, if it is about a particular service. This dynamic can help create a virtuous cycle for edtech companies. You can scale your service. The scale allows further market power.

This is one of the many reasons why people find edtech companies so fascinating and investors want to bet on these companies.

The lack of comprehensive data makes it difficult to accurately estimate the size of the edtech market in Bangladesh. However, industry insider suggests the market is likely to become several billion dollars in size in the next few years.

The offline coaching market in Bangladesh is estimated at BDT $25,000 crore and is growing at a stable rate. If you include segments like job preparation and skills development, it is quite a huge market. Offline education services offer a potential parallel for the edtech market. In fact, edtech has the potential to go even bigger than the offline market because edtech can expand both in depth and breadth. According to industry insiders, over the past several years more than one crore of students have already used online learning services. Several estimates suggest that the edtech market in Bangladesh is expected to reach several billion dollars by 2030.

Several factors are aiding this growth. A large and growing population. Increasing adoption of technology in education. Various government initiatives support the development of the sector. The rising internet and smartphone penetration. And growing awareness and changing public perception about online learning have also driven this growth.

Similarly, edtech is changing several verticals within education such as skills development, competitive exams, and job preparation. Each of these markets, according to several industry insiders, is several crore taka in size and is growing consistently. This makes the overall potential of edtech significantly large.

It is worth noting that the edtech market in Bangladesh is still relatively small compared to other countries in the region, such as India and China. This means there is significant room for growth in the coming years. In line with that, the sector is expected to continue to expand.

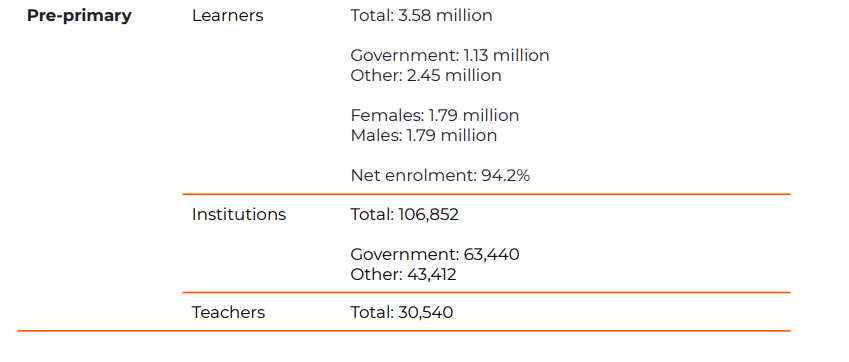

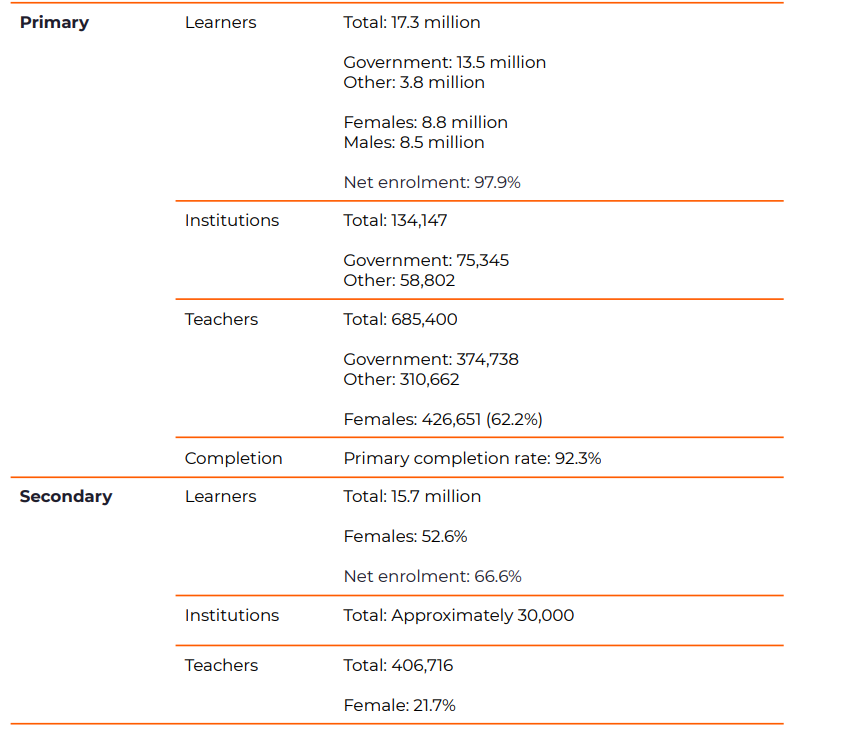

Overview of different segments of education in Bangladesh

The trajectory — where the market is heading

So far, ed-tech in Bangladesh has been seeing consistent growth over the past several years. The use of technologies in education was already widespread before COVID. The pandemic and subsequent lockdowns accelerated the adoption and reach of online education, resulting in significant growth in the industry. With a large young population and increasing internet and smartphone penetration, the market has only one way to go — up. The speed of this growth might vary, but edtech is in for an excellent growth ride.

The trend towards online education, both in formal settings such as schools and universities, as well as in the corporate sector, has become more pronounced, leading to the emergence of new trends.

The number of ed-tech startups and investment in the sector has increased. The government has shown support for the development of the ed-tech industry, providing various incentives and funding opportunities for local companies.

The other interesting development of the past ten years is the growing emphasis on digitization on the part of the government. This has created an incentive in the market for moving things digital. The government has recently announced a large scheme for skill development, which will create new movements in the space.

The ed-tech market in Bangladesh is currently composed of a mix of government initiatives, private organizations, and startups. The government is working to integrate technology into the education system and has launched several initiatives to promote the use of technology in education.

On the other hand, private organizations and startups offer a wide range of ed-tech products and services, such as online learning platforms, educational mobile apps, and digital content. Several key companies are emerging. Some of the notable companies in the sector include:

10 Minute School: Founded in 2012, 10-Minute School provides learning materials for school and college curriculum and skill development. It also offers a video library, preparation tips, model tests, and live classes for admission preparation and competitive exams. The company says it currently has 28 million social media subscribers across platforms, 30,000 free videos on its website, more than 100,000 quizzes, and many notes and guides for students. It is one of the highest-installed ed-tech apps in Bangladesh.

10 Minute School broadly operates in two verticals: academics and non-academics. The academics section covers 1-12 and university admission. The non-academic section covers all the skills development courses and recruitment exams. To date, the company has raised a total $4 million in investment from national and international investors.

Shikho Technologies: Founded in April 2019, Shikho is focused on grades 9, 10, 11, and 12, with plans to introduce content for the entire K to 12, university level, and continuous education. The company says it works with educators and subject experts to create learning materials. To keep students engaged, it uses gamification techniques such as points, leaderboards, and virtual awards.

In addition to its academics segment, the company also has a skills segment separately run as Bohubrihi, a company it acquired in 2021.

Shikho claims that it reached over two and a half million students in 2022 and its learning platform offers a data-centric, personalized, and engaging learning experience that empowers students to learn at their own pace and in their preferred style whilst creating access to some of the best teachers in the country. To date, the company has raised $6.5 million in investment.

Interactive Cares: Interactive Cares is one of the best edtech startups in Dhaka’s edtech space. The company operates at the intersection of skills development, competitive exam preparation, and test preparations. The company describes itself as a “one-stop virtual edtech platform for creating employability through courses, career paths, and master classes.”

Founded in 2020, the company says it has over 300,000 registered learners on its platform. Interactive Cares creates online courses across four segments: Career Paths that includes courses like web development, digital marketing, etc., Higher Studies preparation such as GRE, IELTS preparation, etc., Academia such as IBA MBA Admission, ISSB, etc., and Skill Development such as Graphic Design, AutoCAD, Coding, etc.

In addition to offering online courses, Interactive Cares has also been focusing on addressing the employability and skill gap challenges in the market. To that end, the company has been building partnerships with local and international companies across sectors to ensure placement for its students from select courses. The company says it has already helped more than 5000 students find placement after completing courses on its platform.

Interactive Cares has so far raised $150,000 in investment.

Sohopathi: Officially launched in 2019, Sohopathi describes itself as “a social learning platform for connecting students with their best fit educators.” To date, the company has raised seed funds of $162K.

EduHive: EduHive is a Dhaka-based ed-tech platform that aims to make online education accessible to all. Founded in 2019, the company says it has more than 150,000 registered users and over 100,000 app downloads. EduHive offers a broad selection of educational material, catering to students from classes 9 to 12, university applicants, BCS candidates, and other job seekers. The platform has partnerships with teachers and coaching centers that exclusively offer their MCQ model tests and video courses on EduHive. The company raised its seed funds from Startup Bangladesh.

Ostad: Launched in 2020 by a group of friends from KUET, Ostad aims to create a skilled workforce by making online education accessible to everyone. Ostad offers live courses instead of recorded courses and students can interact with teachers in real-time during the class. The company initially launched several offline training programs but eventually moved to online learning as the coronavirus pandemic hit in early 2020. The first online course on Ostad was on IELTS preparation. Gradually, with the number of learners and instructors, the number of topics and course contents has also increased. Over the past years, Ostad has seen excellent growth and continues to launch new features and courses. The company raised $127k in total investment.

Thrive EdTech: Thrive Edtech is a Dhaka-based ed-tech startup that aims to personalize education in classrooms in Bangladesh. A regional education technology platform began its operations in 2019 after completing the NSU Startups Next incubation program. Moreover, the company raised a total of $355K.

Shikkhok Batayon: A project of the government of Bangladesh that aims to bring the digitalization of education in our country into a reality. This online portal is mainly enriched with PPT presentation slide contents explaining different terms and topics of school-level academic studies.

Ghoori Learning: A virtual learning portal that offers exclusive skill-based courses taught by industry professionals. Started with offering BBC Janala English Courses, Ghoori Learning is now delivering fresh and fascinating courses in a variety of areas. Ghoori Learning has 180+ innovative and fascinating courses in a variety of areas.

CholPori: Started its journey in 2019 and fully launched in 2021 with the aim to establish a platform and offer educational materials for primary-level children in Bangladesh, equipping them with the necessary skills to achieve grade-level competencies, enhance their social and emotional learning, and prepare them for the future. Currently, it has more than 3000 registered students.

Some of the notable investors in the Bangladesh ed-tech market include venture capital firms and private equity funds. See some of the active investors are:

Key Opportunities: Edtech in Bangladesh is in its early days and is a largely untapped market. The market is expected to keep growing for the next five to ten years at a very high rate. As the technology penetration and acceptance grow, the variety of TAM will increase for the sector.

Key Risks: Despite the positive developments, poor infrastructure, such as expensive internet connectivity, cultural resistance to new technology, and the strong emphasis on traditional forms of education can slow the growth of edtech in Bangladesh.

Ed-tech companies face several perception challenges such as online learning materials should be free because you can find a ton of free content on Youtube and other places and online is cheap and low quality, etc. Edtech companies will have to find ways to overcome these challenges.

The digital divide is going to be another big challenge for the edtech companies that want to scale. For convenience, you can divide the Bangladesh edtech market into two: students and parents who live in urban centers and already have access to the best quality teachers and education, and students who live in suburban and rural areas. Urban students have all the access. Many parents would be hard-pressed to pay for an online service when they can access dedicated teachers offline and other benefits that better meet the needs of holistic education for their kids. Regardless, many students and parents are already using, and many others would like to use, an online education service for complementary learning. But it is also true that the competition for these students is high and it is a small market. TAM and business models don’t work if an edtech company only relies on urban students.

On the other hand, suburban and rural students, the main target as per the narrative of the many edtech companies, remain hard to reach. Yes, internet and smartphone penetration is excellent in Bangladesh. If you use Facebook user data as a proxy for real internet users, it shows an excellent number. But online learning penetration remains dismal for rural students. Moreover, the perception challenge that edtech startups are facing in urban centers is a hundred times harder in rural areas. A recently published Education Watch Report 2020-21 by Campaign for Popular Education (CAMPE) suggests that various distance learning initiatives by the government for K-12 students amid the pandemic were largely ineffective for various reasons including a lack of devices.

As you could see, many students in suburban and rural areas don't have access to data or devices to access online education. Moreover, mobile data remains of poor quality and expensive for users outside urban centers. One founder of a K-12-focused edtech startup tells us that students often count the price of mobile data along with the price of the course which makes the course quite expensive.

Edtech companies will have to find ways to deal with these challenges through partnerships with telcos, and the government, and by introducing other incentives for the users.

In addition to that, companies face various operational challenges across engineering, content, product management, etc. A lot will depend on how companies navigate these challenges.

The future of the ed-tech market in Bangladesh is promising. With a growing demand for education and training opportunities and increasing access to technology, the edtech market is promised continuous growth in the coming years. Additionally, positive government policies are also likely to help the sector grow.

By overcoming the above-mentioned challenges and leveraging the opportunities, the edtech industry in Bangladesh has the potential to significantly improve access to quality education and training for the country's population.

The growing investors and stakeholder attention edtech is enjoying indicates that the future is bright for the sector.