Startup valuation is a little tricky job. Since it is tricky and often seems not that important while building a company, most of the founders try to avoid the hassle of understanding how it works. However, understanding valuation is critical for every entrepreneur, especially when you are considering to build a big business and raise fund to do so. Your valuation determines the share of the company you have to give away to your investor to raise a particular amount of money. So, spending time behind understanding how startup valuation works is not entirely worthless. We often receive questions related to startup valuation but never wanted to reinvent the wheel since there are many great materials on startup valuation. This is our attempt to help.

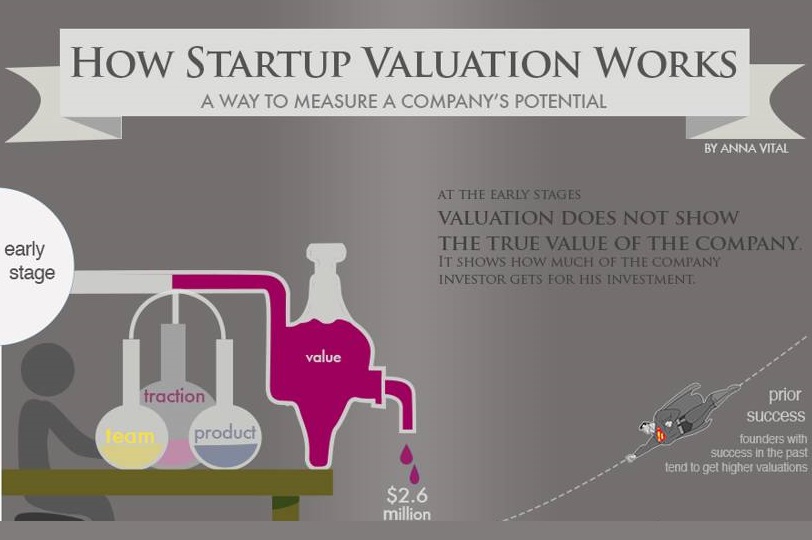

Following infographic, by Funders and Founders, explains the process of startup valuation, how it works, how to measure value of an early stage company, what investors look for in a startup. It also breaks down stage-wise, early stage, growth stage, exit, and big company, valuation process and valuation metrics and illustrates brilliantly.

![How Startup Valuation Works [Infographic] 1 How startup valuation works -infographic](http://futurestartup.com/wp-content/uploads/2015/09/How-startup-valuation-works-infographic.jpg)