While there is an obvious necessity of government patronization for the healthy blooming of entrepreneurial class, as same as there can in the absence of government regulation also create disastrous circumstance in overall business environment. Because of lethargic mood of regulatory institutions many fraudulent business schemes may come out to despoil money from general public and leaving them destitute. Recently, media unveiled the information about many fraudulent business schemes which, in fact, proves such lethargy in regulatory agencies of government. After the massive scam in the share market, which visibly has ruined lives of at least 3 million people in Bangladesh, the next catastrophe that is taking place in the country is from the Multi Level Marketing (MLM) Companies. These MLM business schemes are, appears to be, a carbon copy of the most heinous type of fraudulent scheme, called Ponzi scheme.

“Ponzi scheme is a fraudulent investment firm that pays returns to its investors from their own money or the money paid by subsequent investors, rather than from profit earned by the organization running the operation.” These types of schemes attract new investors by offering higher returns than other investments, in the form of short-term returns that are either abnormally high or unusually consistent. In many Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier-stage investors instead of engaging in any legitimate investment activity. Often the high returns lead and lure investors to leave their money in the scheme; the schemes simply have to send statements to investors showing them how much they earned.

The scheme is named after Charles Ponzi, who deceived thousands of New England residents into investing in a postage stamp speculation scheme in the 1920s. At a time when the annual interest rate for bank accounts was five percent and Ponzi promised investors that he could provide a 50% return in just 90 days. Ponzi initially bought a small number of international mail coupons in support of his scheme, but quickly switched to using incoming funds to pay off earlier investors.

Usually this type of scheme usually follows certain steps to be established as a company. At first, convince a few investors to place money into the investment. After the specified time return the investment money to the investors plus the specified interest rate or return. Pointing to the historical success of the investment, convince more investors to place their money into the system. Typically the vast majority of the earlier investors will return. This cycle rotates until they fled away.

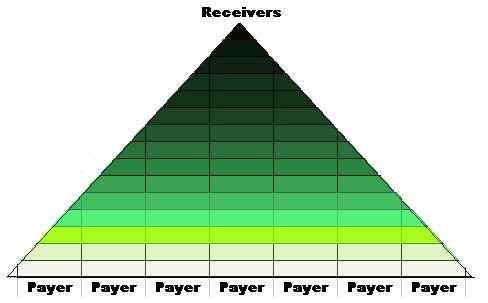

Multi-level marketing (MLM) operating, some of them have been banded by authority, in Bangladesh is nothing more than Ponzi scheme. MLM uses the same strategy in which the sales force is compensated not only for sales they personally generate, but also for the sales of others they recruit, creating a down-line of distributors and a hierarchy of multiple levels of compensation. Other terms for MLM include pyramid selling, network marketing, and referral marketing.

MLM companies have worldwide been subject of criticism of price fixing of products, high initial start-up costs, potential exploitation of personal relationships which are used as new sales and recruiting targets. Yes, of course, some people, usually of upper stage of pyramid, make money in MLM not from the product or service but from the losses of people lower down in the organization. MLM uses Rumors as their Sales Technique to delude people and invoke them to invest more.

Dozens of companies, operating in Bangladesh, have allegation to be as fraudulent as Ponzi scheme by system and nature. One of biggest companies of this type is Destiny 200 Ltd. There are specific allegations against Destiny Multi Purpose Cooperative Society of openly operating as a bank without any permission of license issued by the Bangladesh government, advertising for a fake Airline Company and of cheating millions with fake tree plantation story. Revnex (BD) Ltd, another one, has around 1.0 million members countrywide. They also have plundered the investment of the member’s by delusion ranges from Tk 70,000 to Tk 1.05 million.

To increase economic prosperity there is required a sufficient amount of investment and to make this investment an environment of trust to be created. It is government duty is to protect investment of general public. Government has to take the matter seriously and regulate these types of schemes and to punish them. At the same time invested money has to be given back to investors. Government is working to finalize a law for MLM. The draft of this denotes that the MLM companies will have to be enlisted with the Registrar of Joint Stock Companies and Firms. There is also a need to make people aware of such investment schemes. SEC and central bank can promote some advocacy programs on electronic and print media in this regard.

lack of awareness about the safer investment sectors and extra lure for money among the general people also can be the causes of spread of such fraudulent business schemes.A necessary write-up!