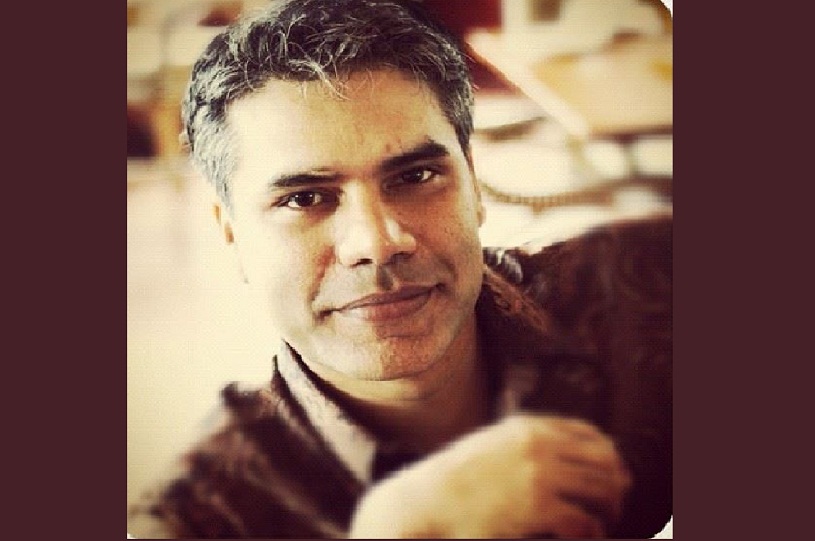

Sajid Rahman is an entrepreneur and investor. He is the director of Founder Institute Bangladesh. Mr. Rahman has an astounding body of work in finance. He has worked in a number of countries around the world and managed a few billion-dollar banking businesses in Asia and Africa. He is currently setting up the first wind turbine power plant in Bangladesh. He sits in the board of many financial services, technology and energy companies in US, Europe and Asia.

We recently spoke to Mr. Rahman, as part of our ongoing ‘Conversation With Investor’ series to better understand his take on investment, startup eco-system in Bangladesh, what makes a startup funding worthy and a founder tick, and what makes a good pitch and more.

Tell us a bit about yourself and your passion.

I am a finance professional by training and have worked in a number of countries around the world developing banking businesses. Then I switched to start my own business as well as to help early stage companies and founders in building businesses. My passion is where finance and technology intersects. I am very passionate about helping founders to build global businesses.

How many startups have you invested in so far?

I have invested in a few startups from all over the world. Every month I go through roughly anywhere between 30/40 startup pitches from founders, mostly from Silicon Valley, but also from other markets in Asia and Europe, and from there I select where to invest.

What do you look for in a startup when you invest?

I personally look at the experience and track record of founders, whether there are 2 or more founders, whether they have launched and executed the product, traction beyond the idea-stage, and also how big the market is for the product/services in terms of customer and dollar value.

Saying goes, if you want to build a billion dollar company, try to solve the problems of a billion people. If you look at all the companies that are big today, such as, Facebook and Google, they are not trying to solve one problem in a particular geography , they are solving problems globally.

The good thing about today’s start-up environment is that a number of them are showing very good early traction unlike the times in dotcom bubble. There are companies that are generating million plus in revenue within a few months of the launch. The market for technology startups has grown exponentially. With billions of customers connected online via smartphones, a great product with the right team behind it can grow very fast.

I personally look at the experience and track record of founders, whether there are 2 or more founders, whether they have launched and executed the product, traction beyond the idea-stage, and also how big the market is for the product/services in terms of customer and dollar value.

In the idea or initial stage, when the company is not targeting a huge market, how do you know if it’s going to be a good investment or not?

Depends on how potential the market is for the startup. At initial stage, the company may be in a particular vertical. But once, the founders have cracked that vertical, they can always grow geographically or in other verticals. In many cases, the potential is misunderstood.

When Uber was first launched, everyone thought, including the founder, that they are going to solve the “ “private taxi” problem in a particular city. From that point, the company has grown to solving transportation problems globally and now solving delivery issues as well.

What are the sectors you are interested to invest in?

One is marketplaces. We are seeing astronomical growth in the successful companies in this space. But I believe this is still at an early stage. Most of the transactions are still happening offline and as the experience becomes frictionless, we will see the growth at a faster pace. Also, more and more people will come online to take advantages of the conveniences that these marketplaces offer.

Health and medical sector, is another sector that I focus in. While there are regulatory challenges in this space, this is amongst the least disrupted space. Given the situation, growth potential is inevitable for startups in this area.

Software services for enterprises are also an exciting space. Software experiences for consumers have improved a lot but not so for enterprise customers. Enterprise software will be more mobile friendly in the coming days.

Education is another sector: companies that are trying to disrupt the education sector, and changing the method of teaching have great potential to grow big.

Financial technology is another very interesting space. The way financial institutions operate now must change in the long run.

What are some of the potential sectors in Bangladesh?

Given the marketplace trend globally, it will also grow in Bangladesh. Logistics would be another area to watch. Health, education and fintech offer lots of opportunities as well.

Do you have an investment philosophy of your own?

I look at the beneficial use of information technology. I think technology could be the driving factor in many markets as it could lead disruptive change for good. I also look at whether the founders are trying to solve a large enough problem or not.

What do you look for in a founder when you invest?

The first thing is how good the founder is in terms of sticking to her conviction. When the founders are trying to build a company, they will have to go through many ups and downs, so grit is the most critical skill. It also helps to see that founders have a very ambitious goal.

Secondly, I look at the communication skill. The founder must be able to articulate the problem she is trying to solve in few sentences. This is important because this will help founders to hire the right people, get the funding and negotiate with other stakeholders.

Third, track record. It always helps if the founders have been there and done that.

What do you look for in a startup pitch?

Passion, conviction and confidence. The market size of the problem, initial traction of the company and the team composition.

The first thing is how good the founder is in terms of sticking to her conviction. When the founders are trying to build a company, they will have to go through many ups and downs, so grit is the most critical skill. It also helps to see that founders have a very ambitious goal.

What do you think about startup eco-system in Dhaka?

The eco-system is developing fast in Bangladesh, and we are seeing many international investors entering into the game.The eco-system is also going through its pains of growth. Startup is also becoming the buzzword in our society. I think in a few years time, the startup space in Bangladesh will be very different.

The one thing we don’t have yet is a solid funding infrastructure for startups. This is very critical. Unless you have people writing cheque to founders at early stages, it will be difficult to grow the funnel. Established businesses need to come forward. This is how it happened in other geographies and our market is no different.

Growth will unfold rapidly once we have a batch of successful startups or entrepreneurs who have exit experiences. They will come back in the system as investors or entrepreneurs for their next company building, like in Silicon Valley, creating a beautiful cycle.

Do you think the government has a big role to play here at the early stage?

Bangladesh Government has been very active in supporting this space. In Singapore, government has created a fund to invest in established VCs to fund startups. In Malaysia, the government is working closely with Founder Institute to identify potential startups. We can also do the same here.

If a founder comes to you and ask for your advice what would you tell him?

There has never been a better time in human history to build a technology company. The costs have dropped significantly while the market is growing at an extraordinary pace. So, she should take advantage of this unique possibility. One note of caution though. The market is very brutal. If the product is not good, the team is not strong, founder is not giving her 100%, don’t do this. In a large organisation, there are many ways to give 50% and survive through the years. Not in entrepreneurship. Either you are full in or not. If you are not in for the long haul, don’t waste others (my) time.

There has never been a better time in human history to build a technology company. The costs have dropped significantly while the market is growing at an extraordinary pace. So, she should take advantage of this unique possibility. One note of caution though. The market is very brutal. If the product is not good, the team is not strong, founder is not giving her 100%...don’t do this.

[su_note note_color="#f8f9f9" text_color="#25618a" radius="13"]Credit: Interview by Ruhul Kader, Transcription by Rounak Ahmed[/su_note]