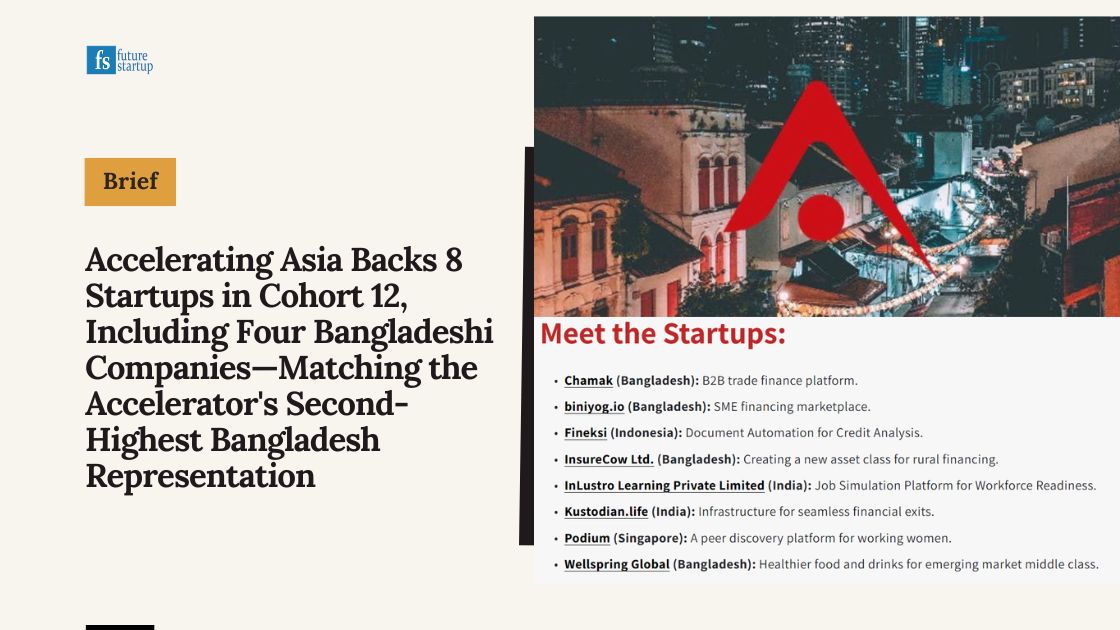

Singapore-based Accelerating Asia Ventures has announced its investment in eight startups for its 12th cohort, with Bangladesh claiming half the spots. This matches Cohort 10's four Bangladeshi companies and trails only Cohort 2, which included five startups from Bangladesh. The cohort, selected from over 700 applicants with an acceptance rate of just 1%, brings Accelerating Asia's portfolio to 100 startups collectively valued at over $1.1 billion, according to an announcement.

The four Bangladeshi startups—Chamak, biniyog.io, InsureCow Ltd., and Wellspring Global—represent diverse sectors from trade finance and SME lending to livestock insurance and consumer health products. They join companies from Singapore, Indonesia, and India in a cohort averaging $37,881 in monthly revenue, significantly higher than typical early-stage accelerator participants.

"We saw a major theme of AI in the applications, but we filter for substance," said Amra Naidoo, General Partner of Accelerating Asia Ventures in an announcement published on the firm’s website. "The founders in Cohort 12 exemplify this. They aren't building AI for its own sake; they are on the ground, using it as a practical tool to solve tangible, real-world problems in their emerging markets."

The cohort includes three female-founded startups, maintaining Accelerating Asia's commitment to gender-lens investing. The accelerator's portfolio now stands at 45% companies with at least one female founder, with portfolio companies having raised over $152 million in follow-on funding.

The Startups:

Chamak (Bangladesh) operates a B2B trade finance platform, addressing the significant financing gaps in Bangladesh's import-export ecosystem.

biniyog.io (Bangladesh) runs an SME financing marketplace, connecting small and medium enterprises with capital sources in an underserved market.

Fineksi (Indonesia) provides document automation for credit analysis, streamlining lending processes through AI-powered tools.

InsureCow Ltd. (Bangladesh) is creating what it describes as a new asset class for rural financing through livestock insurance, targeting Bangladesh's massive agricultural sector.

InLustro Learning Private Limited (India) offers a job simulation platform for workforce readiness, bridging the gap between education and employment.

Kustodian.life (India) builds infrastructure for seamless financial exits, helping individuals and families manage wealth transfer and legacy planning.

Podium (Singapore) operates a peer discovery platform specifically designed for working women to build professional networks.

Wellspring Global (Bangladesh) produces healthier food and drinks targeting the emerging market middle class.

Accelerating Asia has been one of the most consistent backers of Bangladeshi startups among regional accelerators. The firm started investing in Bangladesh in 2019, becoming one of the first international VCs to back companies in the market. Since then, it has funded more than 20 Bangladeshi startups across its 12 cohorts—a number that exceeds most other countries in its portfolio outside of Singapore, Indonesia, and India.

The accelerator's inaugural cohort in 2019 included two Bangladeshi companies. Over the years, this representation has fluctuated—Cohort 8 in 2023 had two Bangladeshi startups, while some cohorts had none. The four companies in Cohort 12 represent not just the second highest number from Bangladesh in a single batch, but also signal the deepening maturity of the country's startup ecosystem.

Accelerating Asia has viewed Bangladesh as an emerging opportunity comparable to Indonesia's earlier stage, with GDP growth and a young demographic creating fertile ground for tech startups. Several Accelerating Asia portfolio companies from Bangladesh have gone on to raise multiple rounds of funding, validating the accelerator's early bet on the market. Companies like Shuttle, iFarmer, PriyoShop, backed in earlier cohorts, have successfully expanded.

Accelerating Asia operates through a fixed-term, cohort-based accelerator program that typically runs 3-6 months and provides startups with capital, mentorship, network access, and a pathway to additional funding. With this model, Accelerating Asia has built a portfolio that now numbers 100 companies across more than 20 verticals in Southeast and South Asia.

"For our investors, these numbers prove the effectiveness of our system," said Craig Bristol Dixon in the announcement. "Our fund is backed by a community of angels, mentors, and successful founders who want a smarter way to invest in the region. We provide the qualified, vetted deal flow they can't access alone and de-risk the opportunity by managing diligence and portfolio support."

The inclusion of four Bangladeshi startups in Cohort 12 can be seen as a validation of trends Accelerating Asia has been betting on for years. The firm has consistently maintained that Bangladesh offers opportunities comparable to Indonesia's earlier stages, and this cohort suggests that thesis is playing out.

What's notable about the four Bangladeshi companies is their sectoral diversity and market positioning. Chamak and biniyog.io are both attacking fundamental infrastructure gaps in finance—trade finance and SME lending respectively—areas where Bangladesh has enormous unmet demand but limited institutional solutions. These aren't consumer plays requiring massive user acquisition; they're B2B platforms solving clear pain points for businesses that already understand they need solutions. Accelerating Asia previously backed companies like Drutoloan in the fintech space in Bangladesh.

InsureCow's livestock insurance represents an interesting bet. Creating "a new asset class for rural financing" through livestock insurance addresses an important problem in Bangladesh's agricultural economy: the lack of collateral and risk mitigation tools for rural households. This again reminds of micro-insurance platform Chhaya, another Accelerating Asia portfolio company in Dhaka operating in a similar vertical.

Wellspring Global, targeting healthier food and drinks for the emerging market middle class, speaks to the consumption story in Bangladesh—a growing middle class with increasing purchasing power and health consciousness.

The AI Practicality Test

Naidoo's emphasis on "filtering for substance" in AI applications deserves attention. The venture capital world has been flooded with AI pitches since ChatGPT's emergence, with many founders adding AI narratives to existing products. Accelerating Asia's approach—selecting companies using AI as a practical tool rather than AI for its own sake—suggests a more mature investment lens.

In the Bangladesh context, this is particularly relevant. The country's infrastructure challenges and market inefficiencies create enormous opportunities for applied AI in areas like document processing, credit analysis, and operational automation. Fineksi's document automation for credit analysis, while an Indonesian company, represents exactly this kind of practical AI application that could work across South and Southeast Asian markets.

Regional Accelerators as the Gateway

The continued presence of Bangladeshi startups in regional accelerators like Accelerating Asia reinforces a pattern that has been evident for several years: for most Bangladeshi startups, international funding still flows primarily through participation in regional or global accelerator programs.

As we've written previously, "A majority of Bangladeshi startups that have raised international investments over the past several years have a root in a regional or global incubator/accelerator program." This remains true. While Bangladesh has seen increased investor interest, the country still struggles to attract direct venture capital at the same scale as India, Indonesia, or even Vietnam.

Regional accelerators serve multiple functions for Bangladeshi startups: they provide initial capital, validate the business model to other investors, offer access to networks that would otherwise take years to build, and help founders understand what international investors look for in terms of metrics, positioning, and growth trajectories.

The Broader Ecosystem Play

Accelerating Asia's consistent investment in Bangladesh—now totaling 21 companies—represents something more strategic. The firm is building a portfolio and network effect in the market by backing multiple companies in adjacent verticals. Portfolio companies can help each other, make introductions, and create a community of founders who understand both the local market and international expectations.

This network effect becomes particularly valuable as portfolio companies mature. When Shuttle expands into B2B services or when other alumni companies raise Series A rounds, they become proof points that help newer cohort members pitch to investors. They also become potential acquirers, partners, or mentors for other companies.

Portfolio Milestone: 100 Companies, $1.1 Billion Valuation

Reaching 100 portfolio companies with a collective valuation exceeding $1.1 billion, as the firm claims, positions Accelerating Asia as a significant player in the regional early-stage funding landscape. The $152 million in follow-on funding raised by portfolio companies suggests the accelerator's selection and support processes are working—companies are successfully raising subsequent rounds and scaling.

For emerging markets like Bangladesh, this track record matters. Founders considering which accelerators to apply to can look at these numbers and understand that Accelerating Asia provides genuine pathways to additional capital, not just initial seed funding and mentorship.

Looking Ahead

Accelerating Asia has been betting on Bangladesh for five years, through various market conditions and ecosystem developments. This cohort represents the second largest single batch from the country, but it's consistent with the firm's thesis that Bangladesh offers opportunities comparable to Indonesia's earlier stages.

For Bangladesh's ecosystem, the more important question is: what comes next? Can local accelerators and investors evolve to provide similar pathways for startups? Can the country develop enough domestic capital to amplify the regional accelerators as the primary gateway to international funding?

For now, the real test for these four companies—and for Bangladesh's representation in future cohorts—will be their performance over the next 12-18 months. Can they use the Accelerating Asia network and capital to raise subsequent rounds? Can they expand beyond Bangladesh into regional markets? Can they hit the operational milestones that justify venture-scale returns?

If they can, it will further reinforce investor confidence in Bangladeshi startups. If they struggle, it won't necessarily reflect poorly on Bangladesh as much as on the specific companies and their execution. But perceptions matter in venture capital, and success breeds more attention.