Deligram, an omnichannel eCommerce startup that aims to operate at the intersection of online and offline and integrate the power of digital commerce with offline retail by enabling existing corner shops in neighbourhoods to act as their collection points, announced that it has raised US$2 million in Series A investment from a network of institutional and angel investors including Skycatcher and Everblue Management, reports the Daily Star. It had previously raised US$500,000 as seed money in 2017. With the investment, the startup aims to expand its agent-led model to build out its distribution channel further, grow its numbers, and expand to a few more cities by the end of this year.

Over the last few years, eCommerce has seen a steady growth in Bangladesh, but the new mode of digital commerce is far from becoming a mainstream thing. Despite a consistent push from players like Daraz and AjkerDeal, eCommerce continues to be an option for bounty shopping where shoppers go for discounts and special offers. There is, of course, a growing user base who rely on ecommerce for shopping but the overall growth has been lackluster at best.

After years of experiment and fine tuning, Deligram says it has found a silver bullet of a sort to crack the ecommerce nut in Dhaka. It says its corner shops led distribution model coupled with its web and app has helped the company to grow quickly. With the investment, the company now aims to build on its initial success.

What you need to know

- Founded in 2017 by Waiz Rahim, Deligram started as a pilot in Comilla. It partnered with 40 retail stores with an ambition to figure out a new model for ecommerce distribution by leveraging the presence of local corner shops to overcome infrastructural challenges. Deligram calls these partners dgAgents. Since Deligram is a Rahimafrooz affiliated company, it could easily use Rahimafrooz’s existing retail channel to build a distribution model. After months of the experiment, it moved to Dhaka in January this year. It partnered with another 60 stores to deliver their products.

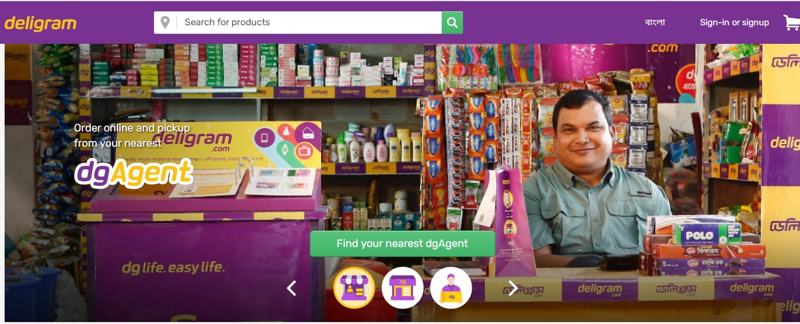

- What Deligram is trying to do is solving some serious challenges that have been exacerbating ecommerce in Bangladesh due to lack of infrastructure through a localized distribution model that companies like bKash and Telecom operators have used successfully in the past. Like any other ecommerce companies, Deligram has a website and also launched an app through which users can order and get their products delivered. Apart from these two channels, it also partners with corner shops who do two things for Deligram: 1) these corner shops work as a selling point for Deligram. Deligram provides these shops a tablet and product catalog and customers can come and place orders through them 2) these shops also work as delivery points from where customers can pick up or return their products. This could meaningfully improve cost efficiency for Deligram.

- This addresses two problems for Deligram, one it improves trust factor, a person who is not used to eCommerce would be more comfortable to order to someone he knows. And number two, it makes delivery straight forward. Deligram aims to take this delivery part one step further through the introduction of a smart locker in these localities.

- Deligram says it aims to expand to 10 biggest cities by the end of this year and take its agent shop number of 1,000.

- Deligram fulfills about 300-400 orders on an average per day. It has about 15,000 products and 200 brands on its platform.

- Deligram raised total US$2.5 million in investment. Its investors include Skycatcher and Everblue Management.

Why it matters

- An agent-led ecommerce distribution model is not something entirely new for the ecommerce companies in Dhaka. Companies like Ajkerdeal, PriyoShop have been trying to work out a similar partnership-led distribution model in rural areas with varying degrees of success. This exact reason, however, what makes Deligram so much more interesting.

- Unlike other players, an agent-led model is a core part of Deligram's strategy. It has taken it one step further and its goals and incentives are very different from other similar models. Moreover, its model resembles agent-led distribution model of bKash and Telecom operators than what other ecommerce players have been trying to do - tapping into mostly government and distribution network of big companies. Deligram has been working to expand the model and integrate it into its core strategy for the past years. It seems the company has a system and an incentive model for its agents in place for scaling the model.

- There is no doubt this is an ingenious strategy. The incredible success of models like bKash and telecom operators is the testament of that. But in order to get anywhere near the success of the agent-led model of bKash and Telcos, Deligram will have work harder to find an incentive model that works for its agents because the dynamics of Deligram’s business is completely different from that of other agent-led success models. We'll have to wait to see how Deligram evolves in the coming years.