Compared to 2017, a meaningful number of Bangladeshi companies has raised considerable venture capital funding in 2018. The number of companies, as well as the amount of investment they raised, both jumped significantly.

Venture capital - the money provided by investors to early-stage startups and technology companies with significant long-term growth potential - has changed the world of business across the world. It helps accelerate innovation and technological advancement. In many markets, access to venture capital has played an important role in entrepreneurship development and technological innovation. It is a relatively recent phenomenon in the context of Bangladesh. The venture capital investment ecosystem is yet to develop fully. However, it has improved significantly in 2018 and seen a much higher number of activities than any previous year.

At the same time, we have seen many local startups to set up (foreign) entities outside Bangladesh, mostly in the US and Singapore, and raise investment in those foreign entities and then funnel that money to their Bangladesh operations due to many regulatory and investor preference reasons. Regardless, it was a good year for Bangladesh startup ecosystem in terms of the meaningful funding rounds that took place in the local companies.

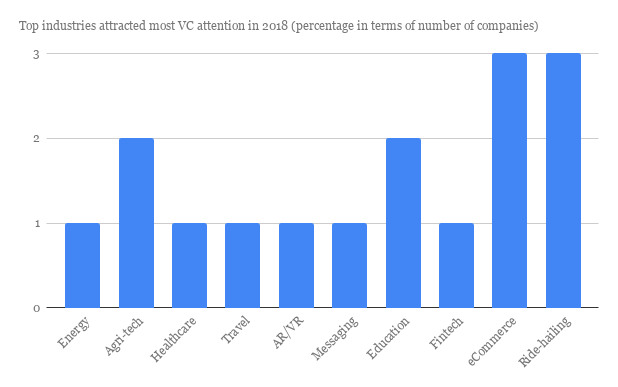

About 22 startups raised money in 2018. From our data, we can see a pattern and clearly all sectors are not attracting equal attention from angels and VCs.

The chart below shows the top sectors that attracted most venture capital attention in 2018 in Bangladesh:

Tech has received significant attention from investors, policymakers and community in 2018. It reflects in the amount of money Dhaka’s nascent tech industry raised in 2018 and the amount of attention it received. From transportation to education to healthcare to commerce, we have seen the impact of technology everywhere. The overall investment ecosystem is not there yet, which is, of course, a challenge for the growth of the industry. Our prediction says we will see significant improvement on that in 2019.