We’re seeing a shift in the internet company landscape in Bangladesh. A new wave of vertical players is gaining momentum. Food delivery. Grocery. Gadgets and electronics. Rides. Education. Beauty. Supply chain. Online pharmacy. Travel.

If you look at the trend over the last several years, companies are increasingly going vertical and investors are showing more interest in backing vertical companies. This is a reversal of what happened just a few years ago when every company was trying to build either a super app or serve every customer and all their needs. In the heyday of the ecommerce rush in Dhaka, every ecommerce company was trying to go as horizontal as possible, selling all kinds of products to all kinds of customers.

Those days are apparently gone.

The majority of horizontal ecommerce players in Dhaka have gone out of business. Today, it is Daraz alone. There are a few other players but all of them have reduced their operations to some specific verticals. Contrary to that, we are seeing a fascinating rise of vertical players across segments.

For context, horizontal ecommerce businesses sell products from a large number of categories. In Bangladesh, the most prominent horizontal ecommerce player is Daraz. It sells everything. Horizontal ecommerce players present themselves as a one-stop shop and aim to play strong demand aggregation to create a demand flywheel and thus gain market power.

Vertical e-commerce players, on the other hand, are specialists and usually focus on one single category or a few relevant categories. An ecommerce company that only sells beauty products or mobile gadgets is a vertical e-commerce company. Vertical players usually focus on a single category, go deep into it, and try to build a dominant position in that category. Prominent vertical players in Bangladesh include Shajgoj, Pickaboo, Romoni, and a number of other players across several verticals.

Here is a list of verticals that have seen some of the most prominent vertical players. Please note that the list is not exhaustive and might have missed important players. The purpose is to show what’s happening and where as opposed to giving a full picture of all vertical players.

| Sl | Verticals | Prominent players |

| 1 | Online medicine delivery | Arogga, Osudpotro, Shombhob Health, MedEasy, and several others. This is probably one of the most competitive single verticals at this point. |

| 2 | Digital Health | DocTime, Praava Health, DoctorKoi, and a few others |

| 3 | Beauty and fashion | Shajgoj, Blucheez, Romoni, and a number of others. |

| 4 | Transportation | Shuttle, Jatri, etc |

| 5 | Travel | ShareTrip, GoZayaan, and several others |

| 6 | Gadgets and electronics | Pickaboo and a few smaller players. |

These are only some of the verticals and some of the players in those verticals. Startups are increasingly looking to exploit the vertical nature of many categories instead of going horizontal and spreading themselves too thin.

Part of the motivation, of course, comes from the lessons learned — many horizontal players tried and failed. And part of the reason is also pragmatism and good business decisions. Going vertical is less expensive. It is more approachable. Execution is much easier than otherwise. You can offer excellent service to your customers. And more importantly, winning in one vertical at a time is easier than winning 10 at once. Moreover, going vertical does not mean you can never expand to adjacent verticals, it is just that you want to master one vertical at a time.

Vertical players often do well until a certain point. Whereas horizontal players are likely to suffer in the early days in a market like Bangladesh where the investment scenario and talent landscape make execution super challenging.

There are many reasons why horizontal players failed in the past. But prominent reasons are few.

One, although we offer an encouraging narrative of excellent internet penetration, the real story of internet penetration is much more complex than that. To be clear, this is not a Bangladesh phenomenon per se. It is probably the same in many other emerging markets. It is in India. Not only the total number of internet users is smaller in Bangladesh. Only a small segment of the people who use the internet shop online regularly. A significant percentage of internet users go online to consume content such as Tiktok videos, youtube, and so on. These people do buy online but it is quite sporadic. They order once in a few months and that too they do probably on Facebook.

There is a growing online shopper group. If you are reading this, you are likely in this category. You buy many things online—from groceries to food to fashion. You may even have a Netflix or HoiChoi subscription. You have the spending power and are comfortable buying that lipstick from Shajgoj or Mango from that direct-to-consumer startup in Rangpur. This is the customer everyone desperately wants. And the number of these customers is smaller than you would otherwise think.

Let’s take a look at the overall number of potential ecommerce customers. Daraz said more than 450,000 customers shopped on their platform on the first day of their last 11.11. Daraz 11.11 is like an extreme shopping day when people who never go online also try to go and see the offers.

In 2022, the number of credit card holders in Bangladesh was around 3.7 million. In 2022, total MFS users surpassed 180 million but according to research, only 40% of total MFS users are capable of using the service. More importantly, unlike credit card users, MFS users are rarely the online shoppers that we are talking about.

Several estimates put Netflix as having some 2.5 lakh subscribers in Bangladesh. Another streaming platform Hoichoi is said to have some 5 lakh subscribers in Bangladesh. Chaldal reportedly delivers over 300,000 orders a month. If you triangulate all these numbers, you get a number that is closer to home. And that’s the number every single Bangladeshi consumer internet company is fighting for.

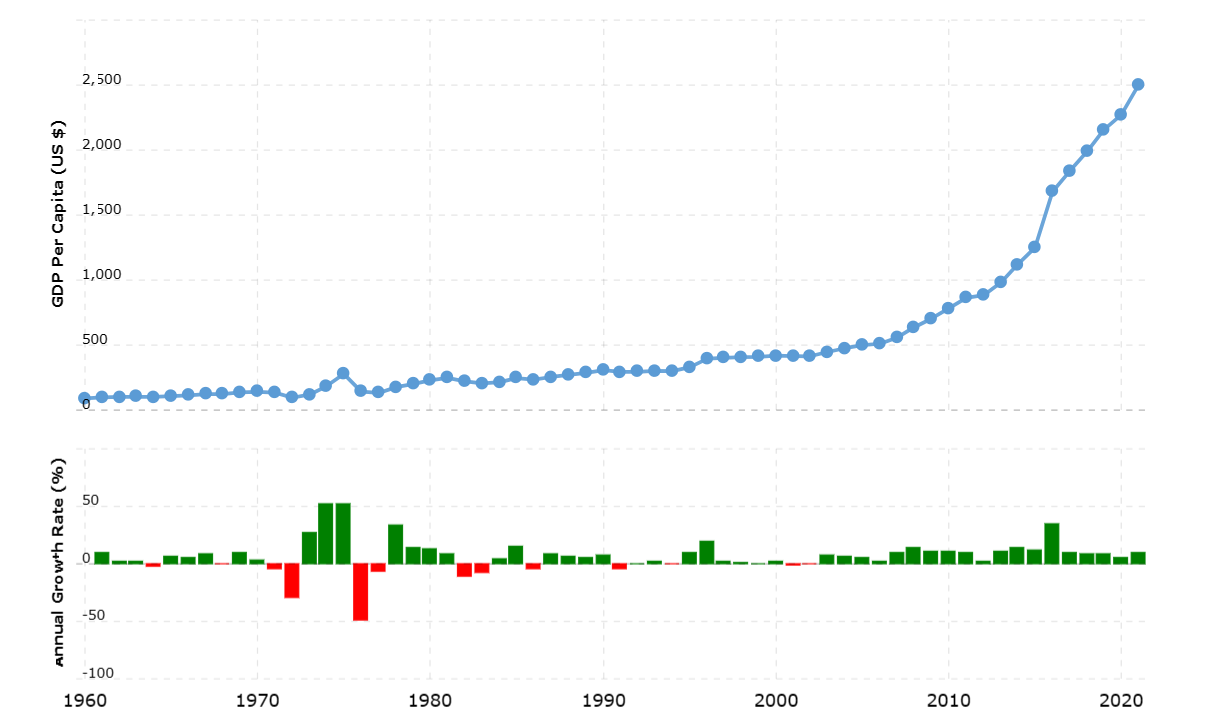

While this base of online shoppers has been growing consistently, the growth has taken some beating of late. The growth of this pie is tied to many different things. One of the most important of them is the per capita GDP of Bangladesh. If more Bangladeshis make wealth, then more people will fall into this online consumer pyramid. Right now, that does not seem to be happening fast enough. More so because of the ongoing economic crisis across the world which has already pushed many people back into poverty. Here’s a graph of the GDP per capita growth of Bangladesh. Notice the growth rates below in green bars.

Bangladesh’s current per capita GDP is a little over $2,000. There’s a direct nonlinear connection between the per capita GDP and the number of active online customers. This was before the pandemic and the current economic crisis. The full impact of Covid and the ongoing economic challenges is still unknown to us, but it has certainly set us back by several years, with millions thrown back into poverty.

If you look into markets like India and China, these numbers are similarly representative. There is no surprise in the numbers.

Coming back to our horizontal ecommerce failure, as you can see the number of customers who can purchase online is small, which has made it costly for almost all the horizontal players to operate.

This has multiple implications if you are a horizontal player. Your communication and marketing budget is always higher but it doesn’t generate enough return. You are spread too thin to focus and dominate any one vertical. Your service deteriorates because you are doing too many things. It leaves customers dissatisfied causing higher churn.

Raising money has been inherently challenging for Bangladeshi startups despite the excellent macroeconomic growth. On top of it, investors see that you are doing too many things at once but have no solid data to support your reasoning.

Learning in entrepreneurship happens in practice. This is part of the reason that is driving the current vertical ecommerce wave.

Winning one vertical is easier than spreading yourself too thin across many categories. Execution is straightforward. Communication is less expensive. If you can win one category, that’s a sizable business and investors are more willing to bet on you than otherwise. This is why vertical players across markets are attracting a lot of VC money.

Competing and staying competitive in one vertical is easier than going to multiple verticals. You can maintain your dominance if you are good at execution and so on.

More importantly, the vertical strategy makes more sense given the limited number of regular online shoppers in Bangladesh. If you are best in your vertical, it is likely that customers in that vertical will flock to you. And it is possible to be the best in one vertical than in multiple verticals.

Finally, vertical players can also expand into adjacent verticals over time. We have seen many vertical players gradually expand into adjacent verticals once they establish their dominance in one category. If you are good at one category and customers trust you in that category, it is possible for you to serve the same customer base with a related product.

But there are challenges for the vertical players as well. There is a limit to the market size. While investors might be willing to back a vertical player in the early days, once you reach the saturation point, they might show reluctance to continue that support. It can create new kinds of challenges for the vertical players. Many vertical players across the market have successfully expanded into relevant categories creating an eventual horizontal positioning. There are examples where companies used investments and business model innovations to fuel growth.

The other challenge for a vertical player can come from the dominant horizontal players. The value proposition horizontal players offer — the one-stop shop for everything — can be a powerful motivator for many customers who may prefer convenience over browsing through multiple sites to buy things.

While the above-mentioned challenges are true, they don’t apply to all vertical players. There are verticals that are large and deep where you can build huge businesses. For the ones the challenges apply, those are not the challenges that you face right out of the gate. Moreover, vertical players also have an excellent set of advantages such as deep category expertise, the ability to serve customers better, and so on. All in all, given the current market reality in Bangladesh, it seems the timing is just right for vertical players.