Oliver Muller is the founder and CEO of PropertyCard, a UK-based prop-tech startup that is building a super-app that handles all property payments and services such as rent and utilities in one place.

In this excellent interview, conducted over email, we talk with Muller about his entrepreneurial journey, the origin, state, and ambition of PropertyCard, the dynamics of the global prop-tech market, what separates PropertyCard from other players in the vertical, how PropertyCard operates, its business model, team and culture and future plans, his approach to entrepreneurship and work, why thinking long-term is critical, the importance of failing forward, what he has learned from his journey so far and much more.

Ruhul Kader: Can you please briefly tell us about your background and path to entrepreneurship?

Oliver Muller: I was an ex-derivatives trader for Standard Chartered Bank, and was part of the bank’s top FX team in MENA trading up to $1B per day in FX swaps and cross-currencies.

After that, I opened a property fund to manage high-yield affordable homes. While working on this project, I noticed a big problem with managing property. All services and payments are fragmented, which costs money and time and unnecessary delays. 30% of global wealth is in our homes, and 30% of cashflows are linked to our homes via Rents, Mortgages, and Utilities. That’s how I ended up starting PropertyCard to manage it all in 1 place.

What is PropertyCard? Can you please tell us about the products and services you offer?

Oliver: Property Super App to manage all property payments/services in one place. Features:

Every home in the UK, then India, and the world has its own PropertyCard that can be claimed by its Owners/Tenants for free. Then they can manage all the above services and payments in one place. It’s backed by Open-Banking technology and regulated by the Financial Conduct Authority in the UK.

How did you come up with the idea of PropertyCard and in what context? What was the motivation behind starting PropertyCard?

Oliver: I was managing a property fund buying affordable housing units across the UK and UAE. In managing this fund, huge problems arose with managing all the payments and services of every home. PropertyCard was started to manage and consolidate all this in one place.

Super Apps are common and popular in Asia but not yet in Europe and the West. Also, there is no super app for property globally that handles everything in one place and is global. PropertyCard is the first cross-border global property super app doing all.

When and how did PropertyCard get started?

Oliver: We started the R&D/Planning in 2015. In 2017, the company was founded and a global top management team was put in place, which includes Sir Richard Branson’s inner management team from Virgin Group (Will Whitehorn, Chairman and James Kydd CMO, Rupert Darwall Strategist, and others).

In 2022, we finally completed building the product and IP, integrating with industry players. We plan to launch in the UK and Globally between 2023/2024.

What went into building the initial operation of PropertyCard, how did you put together initial investment and other resources to get started?

Oliver: I funded most of the startup costs of the business from 2015-2022 along with a close group of Angel Investors led by Will Whitehorn (Ex-Chairman of Virgin Group) and Stergios Voskopoulos (Ex-CEO of Kanoo Capital). We put together around £1.1M, and it took 6-7 years to put together the most innovative PropTech product of this decade.

We just won 9th place in UK’s innovation rankings ahead of Rightmove and Zoopla (the top 2 portals), and this is before launch. Innovation is the main driver of this business. It took many years to assemble a world-class team that has delivered many unicorns and IPOs. Will Whitehorn was last involved in Purplebricks – UK’s leading online Estate Agent. So we have many experts in the industry with us, and it took many years to assemble the right team that will disrupt the PropTech industry (the world’s largest).

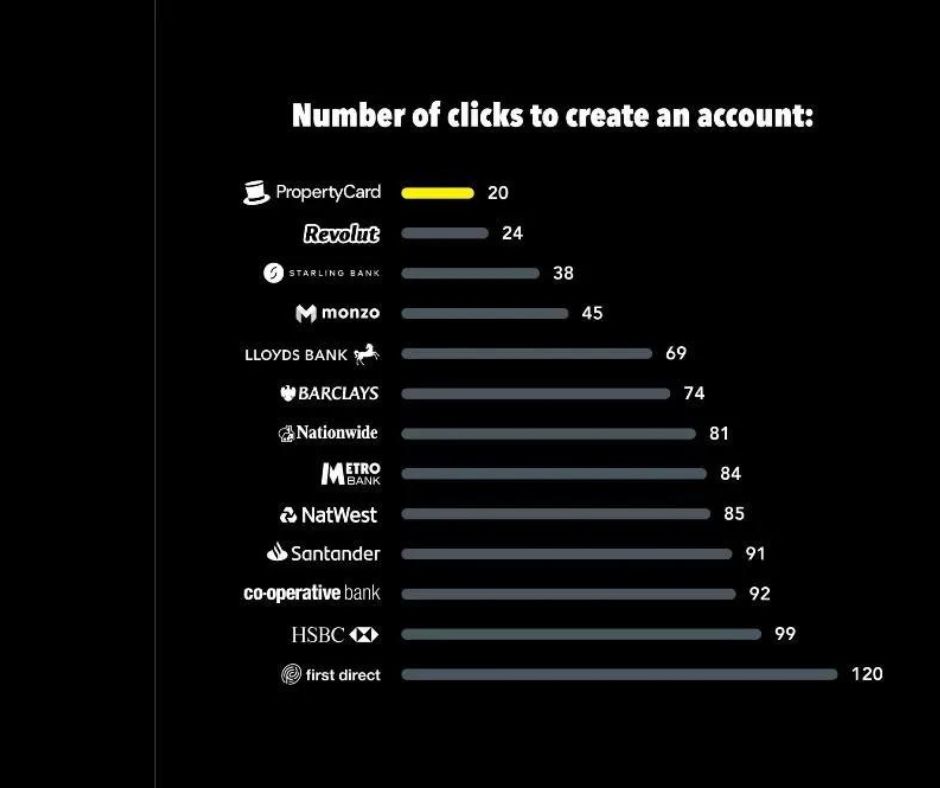

Also, we had full-time designers & UX experts as the core of the team for 7 years. We re-visited the product over weekly sprints (52/year x 7 years = 364 weekly sprints to date) with the main purpose of doing more with less.

This is our mantra as we aim to add new features while removing steps/branches/time/delays for our users. This is what drove the product to this level of innovation where it is able to do what many businesses do – all combined in one place with fewer steps.

Can you give us an overview of PropertyCard today in terms of operation, team, size of the business i.e. revenue/users or other relevant metrics, etc?

Oliver: We are a small team of 6 C-Suite, 12 full-time equivalents (FTE), 10 freelancers, 2 agencies, 6 advisory board members, and interns.

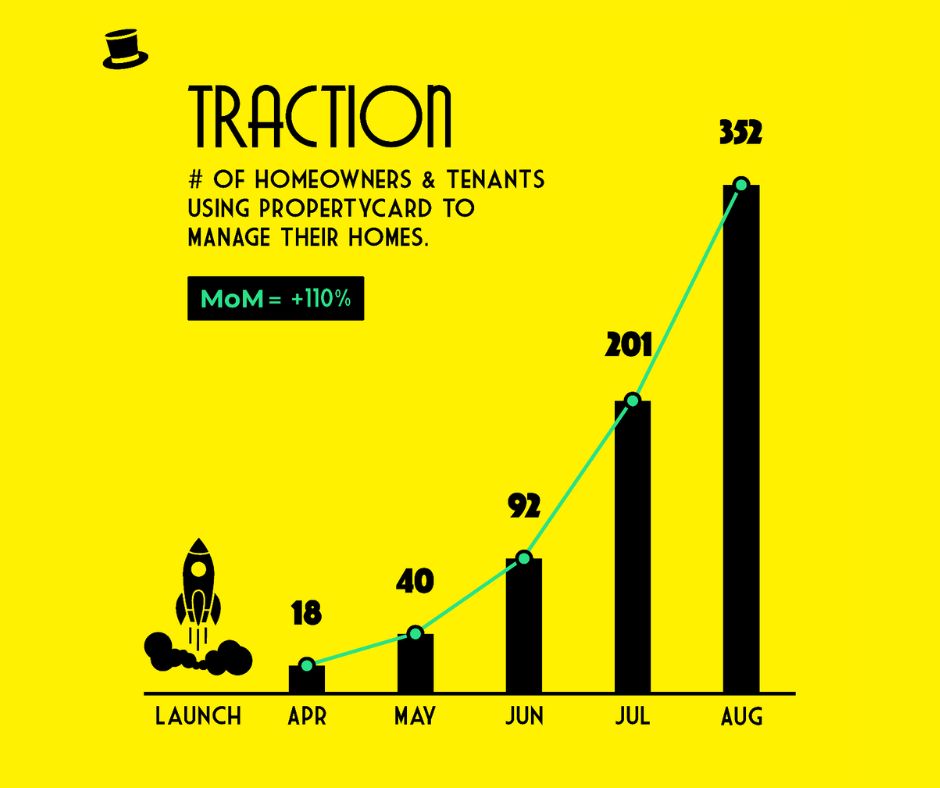

We opened the apps for launch in April 2022 and have been doubling users monthly ever since. Although we started at a small rate, this is now growing. As you can see in our user traction graph, we are on track to be explosive as we take market share.

PropertyCard is free for the first home, and £10/home/month after that – similar to a Netflix/Spotify subscription. This is the first pricing model of its kind in the property market where we offer everything bundled together for a flat fee. Most property sites charge exorbitant prices for every service, without loyalty. We offer everything for free for the first home, and the second home is only £10 per month. Pricing may change over time and still provides maximum value with the cheapest pricing of any service around. Similar to Amazon’s model.

We’re on track to hit 2,000 Users in 2022, and 20,000 in 2023, 80,000 in 2024, 300,000 in 2025, 920,000 in 2026. This doesn’t consider aggressive international expansion that may occur. This is the organic baseline.

How does PropertyCard work? How do you work with your partners and customers? How does your operation work?

Oliver: Every homeowner and tenant has a PropertyCard for their home. They simply download the PropertyCard app and claim their free PropertyCard, connect their bank account, and manage all payments/services. The Simplest PropTech product ever built.

Our Operations are centered in Mayfair, London, UK. The rest of our teams are operating remotely hybrid. We give our people maximum flexibility with the caveat that they go over and beyond delivering excellent results. We expect much of our people and set the bar extremely high while providing autonomy and flexibility.

Our approach is to do more with less. This applies to our designs, engineering, marketing, investment ROI, and everything. We look for ways to maximize return on everything we do. This comes from my trading background where traders were assessed by the ‘Sharpe Ratio’, which assesses how much return a trader makes per unit of time/money and volatility. It’s enough to make big returns on our decisions/actions but to make them per unit of time and with less volatility and risk. It’s this philosophy that created the most innovative PropTech product of this decade.

There is no other app that will provide as much functionality with as few pages/buttons/steps/delays/inefficiencies. Our operations center around this business philosophy. And this applies to our partners as well. We plug and plug the winners in our industry so that we extend our reach and enable partners to monetize and generate revenue with us. Everyone is a winner — ourselves, our partners, and most importantly our users who get the best deals/services/payments for their home, with less time to manage it.

Can you tell us about the people and culture at PropertyCard?

Oliver: We have a warrior culture at PropertyCard. Men and women are working together to completely disrupt the world’s largest legacy market/sector. The mountains ahead of us are enormous, and with a warrior mindset we take on this project.

Initially, we faced so much pushback from competitors who try to defend the status quo – real estate is slow, secretive, and private sector because players defend their monopoly profits at the expense of customers who get the short end of the stick. We are putting holes through these legacy systems and old business models and turning it on its head.

The industry is starting to open up more and players are becoming more open to collaborating and working with us – though they have no choice in where the industry is heading.

Everyone is beginning to see that real estate has to open up as a market and players have to work together for customers’ best interests. The world’s cash is in property, and we have to open up this market, make it more transparent, and centralize payments/services for the benefit of customers. Too much time and money are wasted directly or indirectly on the management of this asset and this will change.

To summarize our culture, we have 10 core values:

PropertyCard’s values start and end with Power and Wealth. The reason for this is: Everyone in life is trying to maximize power, to do more with less – gain more resources and time being the most valuable of all.

Whether we realize it or not, 30% of our lives (more or less) are spent in a way facilitating our property. We grow up to study, work, earn, and eventually purchase a home or rent, and continue to operate through life to facilitate this asset. It takes up an overwhelming portion of our lives.

PropertyCard’s mission is to help with this, facilitating power/wealth i.e. empowering homeowners and tenants to simplify the management of this asset. PropertyCard helps optimize the finances of your home, to save maximum money/time which empowers.

Sprezzatura is how we do it. It is an Italian concept “a certain nonchalance so as to conceal all art and make whatever one does or says appear to be without effort and almost without any thought about it.” That’s PropertyCard.

How does your business model work aka how do you generate revenue? What does your revenue and cost structure look like?

Oliver: Our revenue model is simple. Free first PropertyCard, and then £10/PropertyCard/month. Just like Netflix and Spotify. Everything is bundled into 1 PropertyCard and you get the first one free, the second £10/month. This is the easiest/simplest pricing model in Real Estate, with maximum features, savings, and transparency.

Our cost structure includes paying for KYC (when you connect your bank account), other bank charges for your payments, and integrations with service providers, servers, and other business expenses that we cover at a loss for the first home – to accommodate users and show them a good experience. For landlords with 2+ homes we generate £10/month/home.

How have you attracted users and grown PropertyCard? How does your marketing/customer acquisition work?

Oliver: B2C: Digital/Social. ? Facebook, Instagram, Youtube, LinkedIn, and Google. PPC Ads. Top funnel converts.

B2B: Sales team. ? Landlord on-boarding with 2+ homes.

B2G: In talks. ? UK, India Governments.

Was there a turning point in PropertyCard’s journey? How did you find/come to that inflection point?

Oliver: It took 7 years to find that inflection point. I’m a chess master – 2nd in the world right now by the number of failed attempts with over 115,000+ games/puzzles played and over 50%+ losses. I take great pride in this stat because it’s how I operate as a businessman. I fail forward. I am a master at failing forward.

Mistakes have been made for 7 years — every mistake we could possibly make without being fatal, in an effort to circle around the industry and learn the ways that work and don’t, and this brought us to the best PropTech app.

They call ‘PropTech’ the graveyard of VC, and that’s because the market is so large and hard to disrupt, and competitors protect their positions. There is also so much going on in the sector, it’s so scattered and enormous that it’s hard to penetrate a certain angle. That’s precisely why we are building a SUPER APP. Does everything. Not 1 or the other. ALL. Like WeChat in China. PropTech needs a super app that does it all and goes cross-border.

The top 100 global companies don’t have a single property company, even though the sector is 30% of global wealth. This is because NO ONE figured out how to disrupt it. There are no cross-border global players. Every property portal is local. Take Rightmove UK, Zillow USA, PropertyFinder Middle East, etc. Every country has its own local winner – and these winners only handle a few services. We are the first SUPER APP that does ALL features PLUS global cross-border service.

Was there a time during your journey when you thought, "this is not working. Time to close up shop"?

Oliver: I went forward with the aim of finding every single way that does not work, until finding the angle/frame to break through the industry. I was building this product for myself first – as a landlord, property owner, and fund manager. Never did I consider stopping. I bootstrap the business for 7 years watching every player enter the space and then go bankrupt. Very few players remain.

The biggest wave of PropTech innovation and disruption is coming and PropertyCard will lead the way. Innovation is the starting point for this.

No other player has circled and made as many mistakes as we have. That is precisely why we will win. I built PropertyCard as a lifetime legacy business. We’re not in this to sell or spin it to VCs or to pump and dump like most entrepreneurs do. This is a lifetime legacy business that will go on for generations and become the ‘gold-standard’ way to manage homes.

How big is the market for a company like PropertyCard? What are the challenges and opportunities in the vertical?

Oliver: PropertyCard’s market size is Trillions. It can become the largest company in the world. If not PropertyCard, then another player in the space will do it. Our market is larger than Oil, Agriculture, or every other industry. Residential Real Estate is 30% of global wealth. Every home on earth can use PropertyCard. There are 1.2 Billion homes around the world, and we can generate £100+ per home per year, plus additional services revenue. The market for PropertyCard is in the Trillions.

Bangladesh has around 35M+ households. Our pricing of £10/home/month works in all world markets no matter the household size/value/wealth, so even lower-GDP nations like Bangladesh can/will benefit even more from the product, especially with the first home being free initially.

Overall – Bangladesh's market size for PropertyCard can be £3.5B+ per year, plus services, which increase tremendously when you add Sell, Rent, Utilities, and Mortgages. PropertyCard will do to the property market what Uber did to Transport and AirBnb to Rentals – they EXPANDED the original market size.

The only challenge in the vertical is ‘consolidating/bundling’ Utilities and other services depending on available providers in the market. Some countries have these bundled already. In the UK, these are fragmented and PropertyCard has bundled them. In UAE, they are already government-bundled. Bangladesh and other nations will all have their own local setups that need maneuvering before disrupting the market. India’s government is already working on digitizing every home with PropertyCards.

How do you see the competition?

Oliver: Zillow USA and SquareYards India are moving in similar directions, however, their product design and UX is top-heavy with many pages/features whereas PropertyCard is streamlined doing more with less. We also have banking connected and an FCA license, which other players do not. Our business models are different. We are operating like a FinTech Bank that centralizes all in one.

Why is PropertyCard an indispensable solution? What is unique about PropertyCard from a product and competition standpoint?

Oliver: Maximum savings of money and time. This is the number 1 concern of customers around the world. Industry survey results are conclusive. Time and money are the number 1 concern of customers, and PropertyCard saves both. It’s the number 1 PropTech product in terms of maximizing money/time with the least amount of effort from users, and with complete transparency. And plus, it's free. User proposal: indispensable.

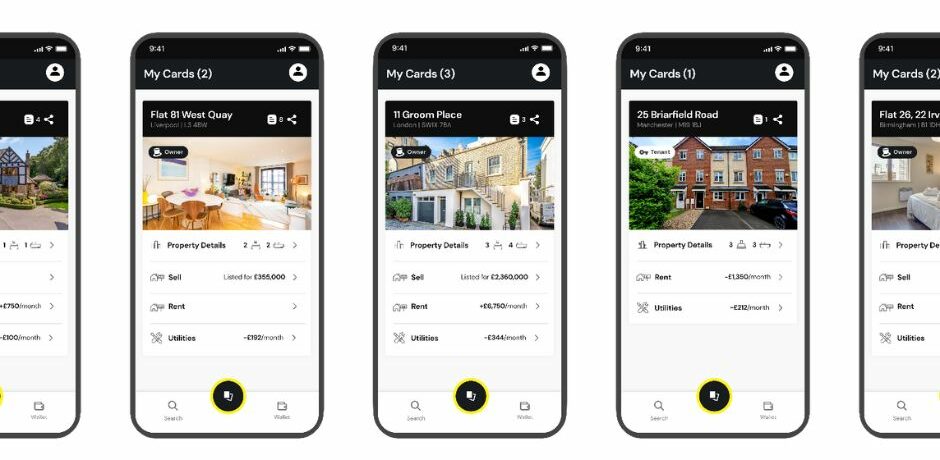

Here is the PropertyCard: There 1 for Owners, Tenants, Agents, and Clerks. Everyone can use PropertyCard. Look how simple it is. And it does it all…

The most unique feature of PropertyCard is its UX speed. It takes 20 clicks to go from Download App to connecting a bank account and making payments. This is faster than Revolut (the fastest FinTech service at 24 clicks). You can see in the below image:

What are the challenges for PropertyCard now?

Oliver: Execute, hyper-scale, government partnerships.

What are the future plans for the next 5-6 years?

Oliver: Government/Landlord partnerships to make PropertyCard a gold standard.

Top five lessons you have learned from your journey so far.

Oliver Muller:

Out-work/Out-fail everyone ? forward.

Be the most innovative brand. Set the pace of innovation. Category King.

Work with the longest-term horizon, not the shortest. VCs always ask me for 2-year hyper-growth plans that’s why I don’t deal with VCs. I speak to my investors/customers/users/employees/partners in years/decades. We make decisions that will hold many many generations from today. My C-Suite management team is on 10-year contracts. This is like Amazon’s C-Suite and PayPal Mafia that stayed together for ages. Excellence compounds over time, you need to play the long game.

Customer service and people are everything. Put them ahead of all. Power is service. The more service you give, the more value you generate for people, and the more power/wealth is returned to you.

Counter-Position Leverage: Adopt the counter-positioning that materially augments cash flow, reduces costs, and cannibalizes competitor business models – these requirements to dominate.

How do you stay productive? What does a typical day for you look like?

Oliver: I have a COO who is a shadow-double with a complimentary but very different skill-set. He compliments and more than doubles my output and productivity.

Mentally my day consists of strategy ? clear space to think and make moves. The fewer decisions I make a day, and the more successful these moves are, the better I’m playing the game. As a chess master working towards being Grand Master, it’s all about thinking further and further ahead. Average players think 1+ moves, Masters 5+, Grand Master 10+. If you compound forward at that level, it’s impossible to beat. Similarly in business, I have teams/managers around me who operate with complete autonomy.

My day starts with a monster’s breakfast and 2-hours at the gym.

Afternoons are for sales/investor-relations calls.

Evenings are for boxing and cardio.

In between: I think.

How do you deal with the challenges and stress that come with being a founder?

Oliver: There is no stress. Or challenges. It’s all part of the game I chose to play. I specifically chose a project that would keep me mentally stimulated for life. Something so large to achieve that it would require daily consistent wins compounded over time for life. There is no end to the to-do list or short-term wins in my opinion. I and my teams need to win every single day forever. Fundraising announcements are not wins (like most startups tout online). Short-term graphs blips are-not-wins. Most of the things our industry celebrates are not wins at all – they are merely vanity horn-tooting.

PropertyCard has a serious mountain to climb – providing every owner and tenant on earth with a super app to manage all payments and services in one place. That’s the goal. And we will work tirelessly daily forever to achieve it.

In answer to your question – this is a passion/legacy project. It’s all love. Challenges/difficulties are part of the game and make it very interesting.

If it were easy, it would be undesirable to me. Its difficulty is its lure. That’s why I play chess. It’s the hardest game I’ve played and cannot be mastered. There’s always a higher level. There are always further moves to think out.

Your favorite books that you would like to recommend to our readers.

Oliver:

Advice for young people who are just starting out.

Oliver: Do 5-10 years of volume-experience-collection: i.e. make as many mistakes across the sectors/areas of interest you have without it being fatal. Collect ridiculous amounts of failed data points in this sphere so you know it well. Then choose one big passion project that leverages your number one skill-set. Spend a lifetime seeking mastery/grand mastery.