Taptap Send, a US-based immigrant-focused fintech company that provides a no-fee international money transfer service for immigrants, has apparently been working to expand its services in Bangladesh. Online hiring activities of the company show that Taptap Send is currently hiring for a growth launcher position for the Bangladesh market. The role description says “your role will be to lead the launch of Taptap Send in the remittance market from the US to Bangladesh. You’ll quickly understand the customer and community, build an initial strategy, execute on growth tactics, track and report on their success, and iterate over time to ensure that we hit our growth targets.”

It is relevant to mention that Taptap Send service is already available in Bangladesh — the company has made its services available in the country since July 2022. It has partnered with bKash and almost all banks in the country. Bangladeshi immigrants from the EU, UK, US, and Canada can now send money using Taptap Send to bKash mobile and bank transfers to any bank in Bangladesh. The company says it “simply charge a small % of the exchange rate and will not charge any extra fees at all.” The company apparently sees further growth opportunities in the country.

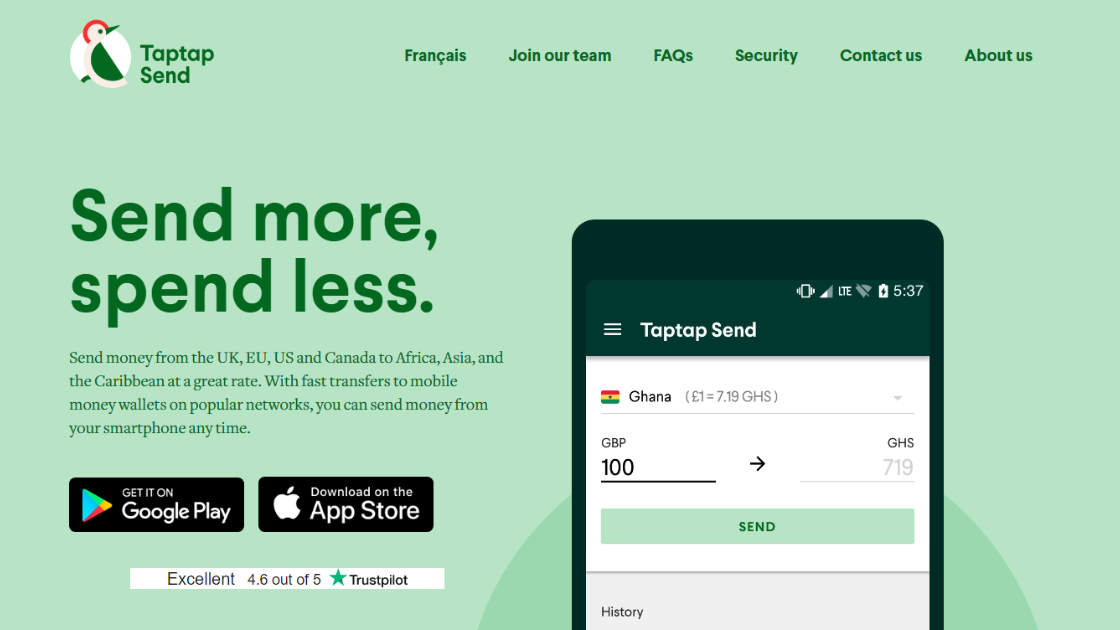

Founded in 2019 by Michael Faye, Taptap looks to take advantage of the growing trend of mobile money services and other distribution networks to offer cost-effective and faster money transfer services. Taptap Send says it allows immigrants to send money home instantly and with no additional fee, saving money in the process. Simply put, Taptap Send is a money transfer app with which immigrants/users can send money internationally.

Taptap Send is currently available in the UK, EU, US, and Canada, and supports payments into Senegal, Mali, Guinea, Ghana, Cameroon, the Ivory Coast, Kenya, Madagascar, Zambia, Bangladesh, Vietnam, DR Congo, Morocco, Sri Lanka, Rep. Congo, Pakistan, Nepal, Ethiopia, Nigeria, Mozambique, Cambodia, Haiti, Tunisia, Uganda, and Lebanon with more countries on the pipeline, company’s website writes.

Remittance is a huge market globally and immigrants from across countries do face a myriad of challenges when it comes to sending money home. Taptap send says it does not want to charge the immigrants. The company’s mission statement says: “Reduce inequity by helping immigrants move money home by becoming the leading cross-border fintech for immigrants.” But how does Taptap make money? Taptap has developed a business model where instead of charging commission or any other fees for transfers, it generates revenue by making a cut on foreign exchange.

A TechCrunch profile on the company from 2021 wrote, that Taptap “has built its whole tech stack from the ground up and says that this lets it pass on lower exchange rates to its customers, typically lower than others that might be serving the same markets. On top of this, there is an economy of scale principle at play here: Having better rates will drive more users, which in turn might not mean better margins but a higher volume of transacting and more returns overall.”

Taptap is founded by Michael Faye, a third-time entrepreneur. A development economist, Michael’s previous two startups prior to Taptap: GiveDirectly and Segovia were also in the fintech space.

Remittance remains one of the major sources of foreign currency for Bangladesh. Several estimates suggest over 10 million Bangladeshis are living and working abroad. To that end, Bangladesh is a perfect market for Taptap.

It appears from the hiring post that the company will initially focus on the US to Bangladesh remittance market — the US as a sender/originator country and Bangladesh as a receiver country. However, it can gradually expand to other major immigrant markets for Bangladesh such as the Middle East and Malaysia.

Mobile financial services such as bKash have played an excellent role in making it easier to send and receive money over the years. bKash also entered the remittance market a few years back and is currently one of the major players for Bangladeshi immigrants across the Middle East and Malaysia. Bangladeshi immigrants also use other formal channels such as banks, Western Union, MoneyGram, and other smaller services and informal channels to send money home.

There has been a rise in the number of startups trying to address various challenges immigrants face across markets including sending remittances. For instance, MyCash Online has been trying to develop various services for immigrants in Malaysia and South East Asian markets. A Singaporean company has since acquired MyCash Online.

However, sending remittances remains expensive to the extent that the UN has set a goal for remittance pricing and commissions to be no higher for any company than 3% of the total sent. Taptap Send says it ensures "as much cost savings as possible to the customer, and as a result, is almost always the cheapest player in the market."