Over the last decade, technology has taken over the world. Every aspect of our life today is dominated by technology. Finance is no different. Most people no longer want to go to the bank and stand in lines to make deposits or open an account. It is perceived as an unnecessary waste of time. When everything is on demand, just a click or a tap away, why should banking be any different? The pandemic has accelerated this sentiment.

To that effect, most people find the process of opening bank accounts tedious: one of those tasks you deeply dislike but cannot escape. For millennials, it involves everything they frown upon. Going to a branch could be risky and uncomfortable amid a global pandemic. Filling out lengthy-forms. In addition, things and requirements can go wrong such as missing documents, etc. Although some banks and NBFIs offer excellent customer service, overall, it is a frustrating experience.

A new digital product from the country’s leading NBFI IDLC Finance Limited, called IDLC Online Deposit, looks to change that. It wants to give modern tech-savvy customers what they desire: an instantaneous, simple, remote, and secure financial service experience.

IDLC Online Deposit allows customers to create accounts with IDLC and make deposits from anywhere, anytime, which means you will never have to visit an IDLC Branch again to create a deposit account.

“We first began developing digital financial products and services with three major objectives: to offer convenience to our customers, to improve service efficiency and save costs,” explains Mir Tariquzzaman, General Manager and Chief Technology Officer. “We realized that if we improved service efficiency, it would generate cost benefits, and we could allocate a portion of those benefits to our customers. Using the efficiency gained from digitization, for example, we may be able to offer a higher deposit rate to our customers than the regular deposit rate. As it is expensive to serve customers through physical branches, moving online reduces the need for physical locations and saves money while allowing us to serve more customers. We can therefore share the efficiency gains with our customers.”

After months of development work, the product was officially launched on the 1st of September 2021, receiving significant appreciation from users and industry insiders.

The timing of the product launch could not have been better. The global Coronavirus pandemic continues to ravage the world. The importance of digital services keeps on growing. People prefer online financial services. During a pandemic, it is safer.

“The COVID challenge calls for brands around the world to assume responsibility,” says Jane Alam Romel, Group Chief Marketing Officer of IDLC Finance Limited. “The way you handle this responsibility will determine how people perceive you as a brand. It will also determine the relevance of your brand. We view our digital financial products and services through this lens. With COVID, traffic jams, and modern trends such as working from home, our new online deposit product is not just built on technology, but is a responsible one that gives people much-needed comfort and convenience during this extraordinary time. The digital services will change everything if we can make this seamless and make people trust them. It will bring comfort and convenience to our customers if we can gradually build their confidence in the tech-driven products. We consider this an opportunity for us to live up to our responsibility as a brand.”

The product will make life easier for IDLC customers and is likely to find a ready customer in both young and old.

Financial institutions are catching up with the dominant air in the market. In Bangladesh, financial institutions are increasingly relying on technology to serve their customers. Majority banks now offer online banking and have digital service delivery wings. Financial institutions have launched some of the best mobile apps in Dhaka in the last two years.

IDLC Finance Limited has launched several digital service initiatives over the last few years. With the launch of IDLC Online Deposit, the organization indicates a greater technology adoption in its service delivery stack.

“From a philosophical perspective, we don't view technology as a separate department like an MIS department or a tech department that deals with technology related issues,” explains Mr. Tariquzzaman. “We view technology as an integral part of our business processes. Most of our systems work seamlessly and are integrated in such a way that you don't have to do anything additional to generate reports or anything else. It's like I'm doing my daily task and using technology to do my job. If capturing data is required, the system does it automatically, I don't have to do anything. The technology is part and parcel of the whole process and seamlessly integrated into it.”

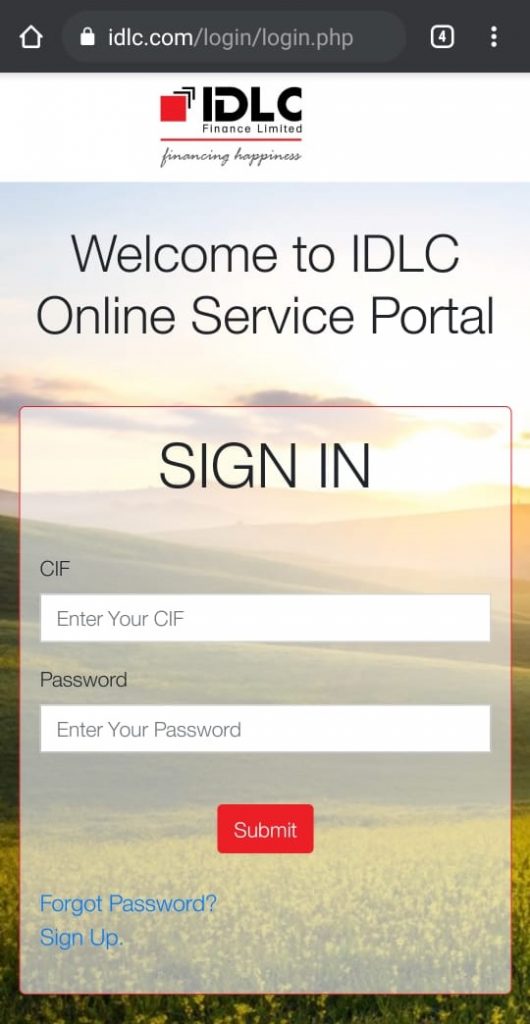

Using the online deposit service, IDLC’s customers can now open accounts online, make deposits, and manage their accounts digitally without ever visiting a branch. The company has created a dedicated online service portal for digital services.

IDLC has invested significant time and resources in designing and implementing the Online Deposit product. The company says it has invested in research to understand user behavior and needs. The outcome: IDLC’s tech team has built an online deposit product that is simple, easy and intuitive.

Any individual, 18 years and older, with a valid Bangladesh National ID (NID), can open an account via IDLC's online deposit service. In terms of documents, you need to upload a scanned copy of your National ID Card, a photo of you and your nominees, and a copy of your E-TIN Certificate. Bangladesh Government's Porichoy API is used to verify NIDs. The application process is automated and flexible. If you don’t have the time to complete applications at one go, you can save and complete later.

Payment for opening an online account has been simplified and can be made online through BEFTN/RTGS/NPS or by depositing an account payee check in favor of IDLC Finance Limited.

As soon as the account has been created, the user is notified by SMS and emailed a deposit certificate. The process is simple, convenient, and secure. It is free and available 24 hours a day 7 days a week. Customers can deposit any amount from BDT 10,000 to BDT 500,000.

While the process is self-serve, if you encounter problems or have questions while using Online Deposit, IDLC support team is always available to help.

IDLC sees digitization as an opportunity to serve more customers, improve efficiency, and offer greater benefits to its customers.

Mr. Tariquzzaman explains, “Historically, we have served customers belonging to the upper socio-economic class. Now, we believe it is important that we serve lower-income groups of customers to improve their access to financial services. By doing so, we will also increase our customer base. The challenge however is that when we are looking to serve more customers, cost and revenue do not justify the effort. This is where technology can make a difference. The discrepancy between cost and revenue can be managed if we use technology. To that end, be it access to finance or financial inclusion, we can take it a long way.”

A new report by the Economist Intelligence Unit (EIU) published earlier this year found that 65% of global banking executives believe that branch-based banking will be “dead” within five years. That new technologies such as cloud, AI, and APIs will have the highest impact on banking and finance in the next four years, according to the report, more so than regulation and changing customer demands. Another 81% of bankers surveyed for the report believe banks will differentiate on customer experience rather than products.

The report highlights the shifting priorities and business model for financial companies fueled by a global pandemic, new technological revolution, and increased competition from fintech companies, and tech giants.

This reality is clearly playing out in Bangladesh. In the last five years, Bangladesh's internet penetration has doubled. With a 13.5% annual growth rate, roughly 67% of the country's total population now has access to the internet. With 41% of total mobile phone users owning smartphones, the smartphone is about to become ubiquitous.

The increased internet and smartphone penetration has given rise to various digital services, including mobile banking, online groceries, general-purpose e-commerce, online services, and food delivery, etc.

During the last decade, Mobile Financial Services (MFS) have seen phenomenal growth, with transactions reaching BDT 35 billion daily ahead of Eid ul-Fitr this year, per BB.

Online banking adoption has skyrocketed as well. The latest Bangladesh Bank data suggests internet banking users saw a whopping 31.08% year-on-year increase to 3.47 million users. The pandemic has further accelerated that growth. In March, digital banking transactions almost doubled from BDT 6,588 crore to BDT 10,371 crore, an increase of 57.42% year-over-year.

This offers an unprecedented opportunity for financial companies to reach an infinite scale. Financial institutions can reach and serve more customers digitally without opening physical branches, saving them money on real estate and operations. Moreover, the geographic boundaries disappear in digital, meaning anyone from anywhere can be served.

“Mobile phones are being used for all kinds of purposes these days, from ordering food to renting cars to requesting banking services,” says Mr. Tariquzzaman. “Even people at the bottom of the social ladder are now using mobile phones for various purposes. This is an unprecedented opportunity. At the same time, we would have to implement changes to our security policy.”

Financial institutions now understand that this is the future of financial services. Technology will be an enabler for new business models and is critical to competitive differentiation.

IDLC says as more customers embrace technology and go digital, the company plans to double down its investment in technology in the coming days. Apart from launching the online deposit product, the company is also eyeing partnerships. It has recently entered into a partnership with bKash. For IDLC, this is just the beginning.

“IDLC will continue to look at technology as a major source of revenue in the future,” says Mr. Tariquzzaman. “That is why we are launching these digital financial products. We hope that this will be a big vertical for IDLC in the future.”