iFarmer is a fascinating company — we have written about it a few times here. To offer you a simple overview of its workings, iFarmer works with farmers — it collects investments from retail investors and disburses them to farmers in the form of inputs such as seeds, livestock, fertilizers, and other farming essentials. It sounds simple and straightforward — but it is not.

To make the entire thing work, farmers must earn profits. Retail investors have to earn a return. iFarmer must make money. To ensure a healthy return for everyone involved, iFarmer must have a thorough understanding of the farmers it works with and be able to support them to make money. But financing and supporting farmers is complex — verification and understanding creditworthiness of farmers remains challenging.

This is where iFarmer’s Sofol app comes in. Sofol was launched as an MVP on 15 September 2020, with 5 facilitators from Kurigram, Lalmonirhat, and Nilphamari. The company says it has since onboarded over 18000 farmers through Sofol. The app is part of iFarmer’s strategy to use human agents, mobile technology, and remote sensing to reduce the cost and complexity of working with smallholder farmers.

In an ideal world, Sofol should be used by farmers. In fact, the app was originally conceived for the farmers. But since farmers have low adoption of the internet and smartphone, the company went for an assisted model. Currently, iFarmer’s field facilitators, who work with farmers, use the Sofol app for various purposes: onboard farmers, collecting financing requirements of farmers, disburse inputs, follow-up on financing, share weather updates and advice, and other relevant issues.

Sofol solves several challenges for iFarmer — it makes entire management of farmers relationships easier for iFarmer. Field agents can quickly onboard farmers and maintain constant communication where necessary. Data collection is more streamlined. Proper documentation and understanding of the creditworthiness of farmers are no more unsolvable challenges.

Pay closer attention, Sofol is an important piece of iFarmer’s ecosystem strategy and connects various parts of iFarmer operation on a strong data and monitoring infrastructure.

Using Sofol, iFarmer can develop a better understanding of farmers, farming, and crops and offer superior advice to farmers using iFarmer’s remote sensing capability to improve yield and profit, connect iFarmer’s supply chain business with the Sofol data, and better plan the supply chain and marketing — in fact, the company can create a marketplace within Sofol directly connecting farmers with others to sell and buy products, create robust credit scoring model, and eventually, bring in other financing partners such as financial institutions, provide better insight to retail investors based on real-time farm data regarding their investments and much more.

If it works, the strategy can help iFarmer to sort of "uberize" its model in the future and make scaling straightforward.

II.

The origin of Sofol offers an insight into developing technology products for farmers.

“Our initial target was to help farmers access capital and other resources”, says Muhaiminul Hossain, a Product Manager at iFarmer. “In the beginning, a small group of iFarmer field facilitators would find farmers who needed capital in an area, try to understand their capacity, needs and onboard them. The farmers would then have to submit some documents such as NID photocopy and we would check the veracity of the documents and go forward accordingly.”

The entire process was offline, guess-work mostly, inefficient, and took a lot of time. It was a lot of work for field agents and iFarmer’s central office. It had other limitations. For example, field facilitators would often miss to on-board potential farmers because of the limitations of an offline onboarding system.

In a manual world, following up and maintaining successful relationships with many potential and interested farmers was a challenge for field facilitators. Remembering everything is not easy. Communication with the iFarmer central team was cumbersome as well. The facilitators had to create an excel file with the information of potential customers and send it to the head office for further procedure.

For the selected farmers, the process was no easier. Field agents collect the documents. iFarmer would use the documents to measure the amount of capital one qualifies for and eventually arrange the disbursement — a lengthy process so to say. On top of that, managing existing farmer partners and properly supporting them to succeed was a growing challenge.

Sofol app successfully addresses these challenges. The app makes the work of iFarmer’s field facilitator easier. Field agents can collect and record data within a short time, verify NID of farmers instantly — Sofol has the Government's Porichoy API integrated into it, save information for later follow-up, and onboard farmers on the go. The facilitators can start the KYC application process after collecting basic information from the farmer and the team at the head office can review the information remotely. They can access any information in the app, and don't need to wait for a manual response from the head office anymore. Since Sofol works in real-time, reviewing applications takes less time. Follow-ups with farmers are streamlined.

Sofol currently has two features: KYC, loan applications, and project management for updating farmer's asset information and following up on them. A farmer can apply for capital, get approval, receive advice and work with the field agent. The company says it will launch several new features in the next few months and a full-fledged version towards the end of this year.

Farmers can also get weather updates using the app. “Last year, due to heavy rainfall in September-October many farmers we financed in North Bengal endured heavy losses”, says Mr. Muhaiminul. “We now do a geo-mapping of the regions our farmers live in and measure the probability of heavy rainfall or flood and send updates to our facilitators and the farmers to take required precautions.”

Building tech products for rural farmers requires a deeper understanding of and compassion towards the users. Many people iFarmer work in rural areas do not use smartphones. For some, smartphones are out of reach. Others don’t see much utility in it and find it inconvenient to carry. That’s one of the reasons the company has not rolled out a version of Sofol for farmers.

The company is now seeking to make the app work offline so that field facilitators can use it anywhere anytime — a growing demand from many field facilitators.

The app is designed keeping the taste and needs of farmers in mind. “Sofol is simple and intuitive,” says Mr. Muhaiminul. “We make sure the features of the app work well even in small resolutions and low phone storage.”

The iFarmer tech team continues to look into the usage patterns of farmers and rural people so that they can design products that resonate with them. The company says it eyes the end of 2021 to launch its farmer's app.

II.

iFarmer collects a wide range of data points through Sofol. Through the KYC application, iFarmer collects some 40 data points about a farmer consisting of socio-economic condition, personal information, financial information, and behavioral information, etc. The data is used in creating detailed profiles of farmers. With some additional data points, it will eventually enable the company to create robust credit scoring models.

iFarmer has already built a credit scoring model using its existing data and is currently piloting it in Nator and Pabna in collaboration with Mutual Trust Bank and Prime Bank where it is helping these two banks to find 200 eligible farmers to provide loans. The credit scoring model will work as a decision-making tool to finance the right farmers.

“Our initial target is to give an initial score based on the KYC application of a farmer”, says Mr. Muhaiminul. “As we go forward, every time we finance a farmer, it will be added to the overall score improving the overall credit scoring model.”

III.

Sofol makes iFarmer’s collaboration — offering advice and interventions to improve yields — with farmers seamless. When iFramer finances a farmer, the project gets added to the farmer’s Sofol app profile along with necessary follow-up tasks for the farmer such as vaccination, using fertilizer, etc.

Suppose iFarmer has bought a farmer five cattles and the cattles have to be vaccinated within ten days. Sofol adds this information as a project in the farmer’s profile and informs the facilitator of the area to vaccinate the cattle when the deadline arrives.

Using the follow-up model in the app, iFarmer gets to learn about the farm regularly, take measures to intervene and the entire process helps improve outcomes for everyone involved.

“Our long-term plan is to advise farmers on matters like crop density, fertility, etc using data,” says Mr. Muhaiminul.

To that end, iFarmer assesses lands and inquires about the expected yield and previous yield history when it finances a farmer. At the end of the term, the iFarmer reviews the difference between the expectation and the actual outcome. To add to that, using satellite data, iFarmer also collects data of a certain area such as the history of crops of the past few years, soil fertility, the density of crops, etc. In aggregate, these data points can help iFarmer understand what crops yield better and recommend farmers high-yielding and profitable crops.

iFarmer is also using data to understand issues like fertilizer usage and guiding farmers to adopt best practices. Many farmers use excess fertilizers thinking it will produce a higher yield. Whereas an overabundance of fertilizer reduces the soil longevity. “We provide recommendations regarding fertilizer usage based on crops and lands when farmers come for fertilizers from our designated retailers,” says Mr. Muhaiminul. These nudges have been proven useful in encouraging farmers to use fertilizers mindfully.

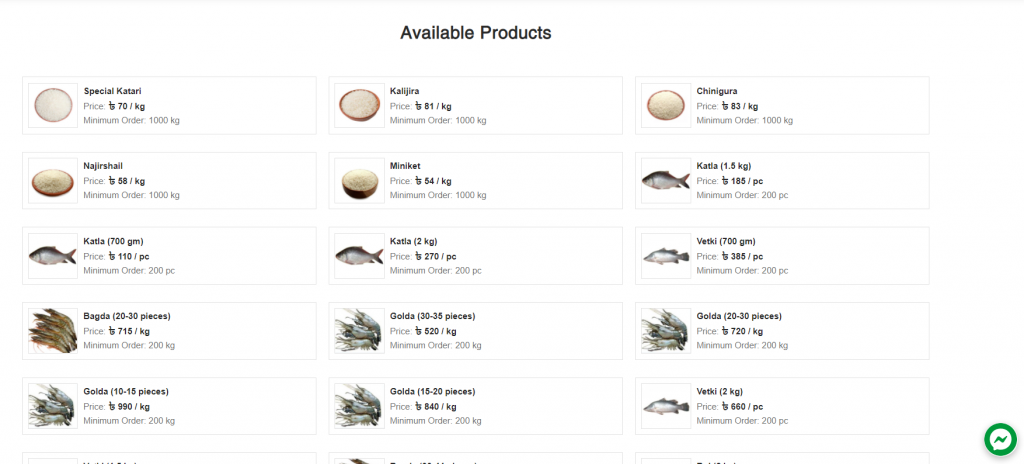

There are other uses of Sofol within the iFarmer ecosystem. Since Sofol has all the data regarding which farm is producing what and how much, it can contribute to streamlining iFarmer’s supply chain business making it easier for farmers and iFarmer to collaborate on market access and work with supply chain partners. It can make the entire planning super-efficient. In the future, iFarmer may create marketplace within sofol helping farmers and customers to sell and buy produce

The future. iFarmer aims to put the Sofol at the center of its interaction with and management of relationships with farmers in the near future. Farmers will be able to get advice instantaneously after posting a photo of their crops in the app. “As we monitor the work of the farmer through our project model, we will be able to provide farmers better advisory service in the future”, explains Mr. Muhaiminul.

Moreover, farmer onboarding gets simpler with less human involvement. Updates regarding farms get automated. Managing investment, disbursement, financing, transactions get streamlined. This means iFarmer will be able to serve a greater number of farmers with less human involvement, a key challenge for the company now since it has to rely on field agents to scale its farm and farmers.

The Sofol data can help identify farmers who are consistently successful in generating positive revenue for themselves, iFarmer, and iFarmer’s retail investors. The performance of farmers over a certain period can be used for creating credit scores and help in making future financing decisions.

iFarmer sees data as one of the key pieces in its overall strategy. “At the core of iFarmer is data”, said iFarmer Co-founder and CEO Fahad Ifaz in a 2020 interview with FS. “We collect some 40 data points from each farmer to understand the risk factors, their socio-economic behavior, and most importantly, farming outcomes. We intend to connect this data to offer more services to the farmers, such as farm input, market access, insurance, banking products, and so on.” Sofol, as it appears, is how that data strategy translates into reality.

Most importantly, the app helps the company materialize its ecosystem strategy. Sofol enables the company to integrate stuff like advisory using iFarmer’s remote sensing capability, the company can create a marketplace within sofol enabling farmers and others to sell and buy produce, uberizing the entire model in the future and making it highly scalable.