In early July, I hopped on a call with a friend who is a private equity professional in Singapore. For anonymity, I will be referring to him as Salman. While speaking about his experience at Harvard Business School, growing up in Bangladesh, and his private equity fund’s investment thesis, I asked him about the geographies in which his fund is keen on investing.

It went like this:

Me: How much do you have in AUM (assets under management)?

Salman: USD 800M split between two verticals.

Me: Which geographies is your fund looking to expand to?

Salman: Cambodia, Myanmar, and other SEA countries.

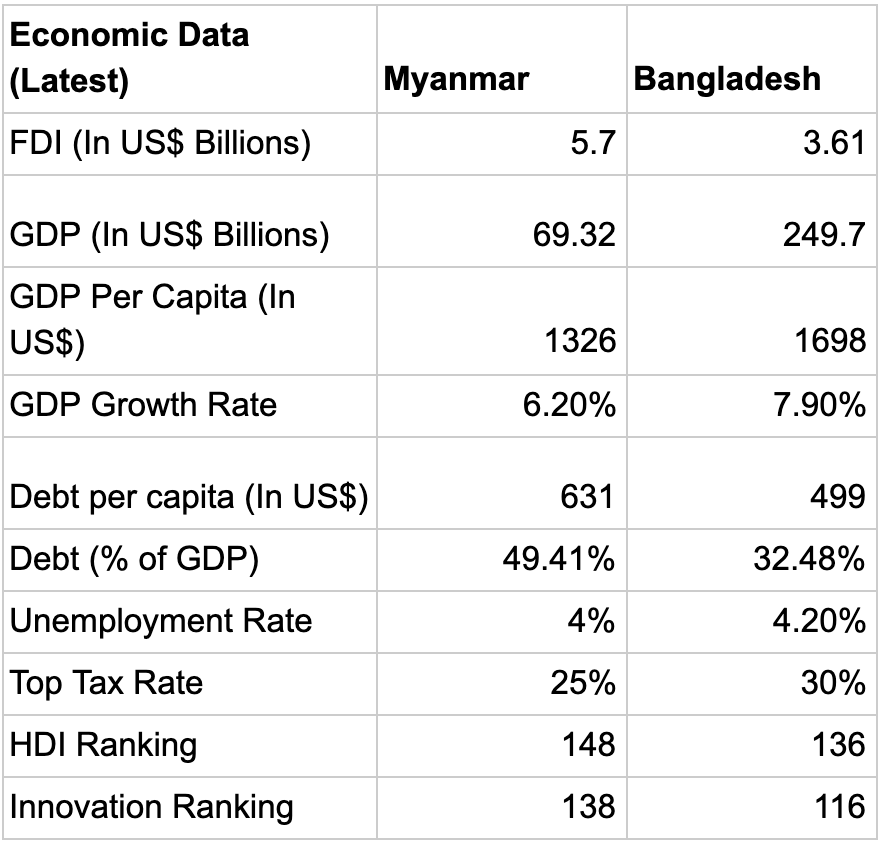

Me: Myanmar has smaller GDP, slightly slower GDP growth, and smaller GDP per capita than Bangladesh — how come Bangladesh is not on the list?

Salman: Good question! Ease of business.

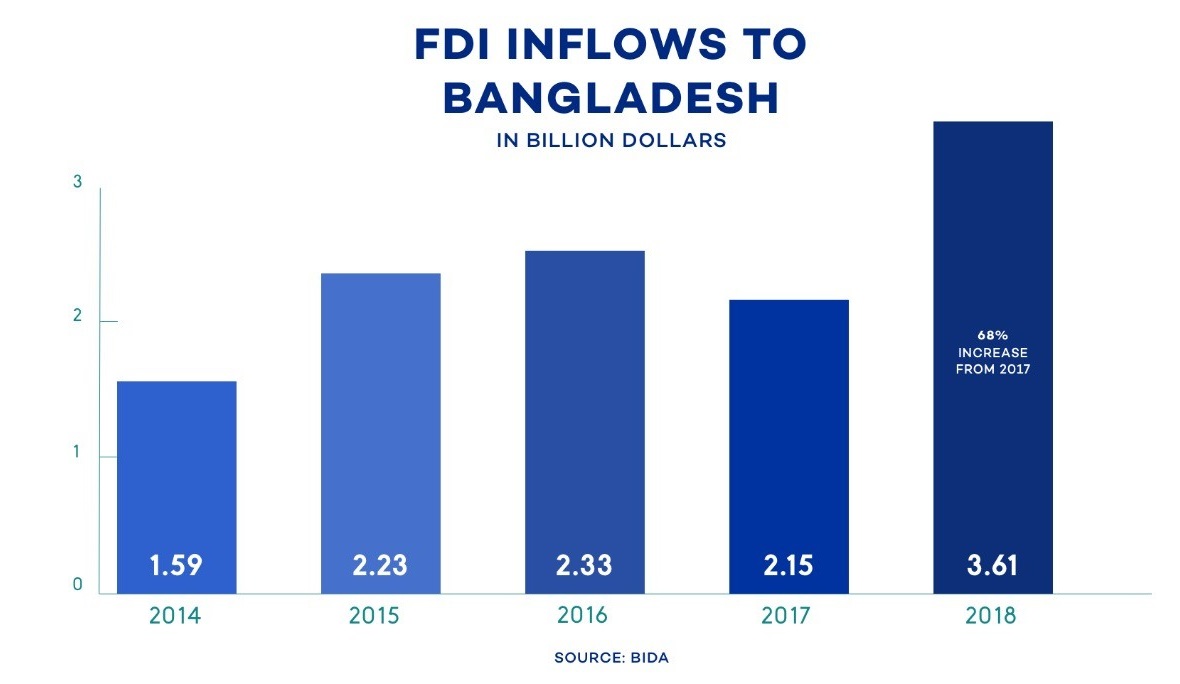

Bangladesh and Myanmar are often compared because of regional proximity and similar GDP growth rate. Despite these similarities, investors regularly express their preference for investing in Myanmar over Bangladesh as evidenced by the vast difference in FDI to GDP ratio.

Salman identified three specific reasons why his fund would think twice before deploying capital into Bangladesh.

In Myanmar, there is one point of contact for all foreign investments, whereas in Bangladesh there are multiple bodies to coordinate with, from BIDA, RJSC, to Bangladesh Bank. In August 2018, Myanmar also introduced the new Myanmar Companies Law (MCL), making it easier for foreign firms to invest in the country. Under the modified law, companies can register by using an online registry system, streamlining the company formation process. However, you would still need the presence of a certified lawyer or an accountant when shareholders sign the incorporation documents.

Policies around ownership and repatriation of funds need to be made clearer in Bangladesh, which are much more straightforward in Myanmar.

In terms of foreign debt financing, repatriation works well in Bangladesh, but it can be slow. What doesn’t work well is equity investments, if that is the aim. Going from private to public is a challenge because of regulators and pace.

[su_divider top="no" divider_color="#adacab" link_color="#edde29" size="1"][/su_divider]

Salman’s perspective is reflective of today’s reality, but Bangladesh is undergoing a transformation, and this reality is changing.

Here are some of the reasons why Bangladesh is in a lucrative position compared to other emerging markets:

The push for a Digital Bangladesh, one of the nation’s primary goals, is based on four pillars — human resource development, pro-poor service delivery, promotion of tech companies, and connectivity of the population. The technology space has enormously benefited from having a stable government.

Being a mobile-first country, Bangladesh is the 9th largest mobile market in terms of the number of subscribers in the world. According to the Bangladesh Telecommunication Regulatory Commission, the number of internet users shot up from 30.48 million in 2013 to 90.05 million in 2018.

The Bangladesh Securities and Exchange Commission is creating a small-cap stock exchange where companies with less than USD 3.5M in paid-up capital can be listed. That being said, while the small-cap stock exchange is a positive step, it shouldn’t function under the same set of rules as the larger stock exchange and include a process that must be easier and faster in order to be effective. Additionally, the formation of BIDA (Bangladesh Investment Development Authority), a number of hi-tech parks, and the introduction of tax benefits for technology companies are making the business environment more accessible.

Bangladesh has a population of 165 million and has consistently been on the list of the world’s top 10 fastest growing economies over the past 10 years. A GDP growth rate of 7.3% projected for 2019, along with a young population (average age of 27), and a widening middle-class can be a powerful combination to spur growth. Educating and injecting capital into this economy properly has the potential to create incredible results.

2% of the world’s population resides in the 8th most populous country in the world — Bangladesh. High density leads to unsolved problems, and if the solution is right, it can have massive upsides. At a micro level, the unit economics of many businesses improve with high density, as revenue per mile goes up.

Frontier investment is not for the faint-hearted. The upsides, though, can be tremendous because of powerful macros, and lower investor competition in grabbing the best companies. Entrepreneurs can fulfill unmet needs, which have already been met in more developed countries.

Bangladesh is at an inflection point — diffusion of technology is about to shift gears across diverse socio-economic segments, eventually mirroring the technology boom we have seen in Indonesia and India. As Salman identified, this boom is dependent on structural improvements to ease business, simplify equity investments and repatriation of funds — all of which has seen serious progress over the past two years.

Originally published at LinkedIn, republished by the author.