Supershops, which brings all household necessities under one rooftop, started its humble journey in the late nineties and expanded rapidly in the next decade. The number of supershops back in 2001 was as low as 5. Thanks to rapid urbanization, by 2018 the number has rocketed to 150++. Even though the number has increased, the growth of this sector has declined in recent years in terms of revenue earning, the amount of VAT (value added tax) paid and employment. It appears that the slowing down of the growth of this sector is associated with the increase in the rate of VAT in recent years, which has led to a decrease in the growth of consumers.

Currently, the supershops pay VAT at a rate of 5% and around 60 to 75 percent of the products they sell every month are taxable. As many comparable products sold in local grocery shops do not face any VAT, the price of goods sold in supershops is relatively higher than that of local groceries. In addition, to run these stores, the owners have to import expensive equipment to store frozen foods which increases the cost of running the stores even more.

The services provided in the shops also incur a large administrative cost. However, from consumer’s point of view sometimes paying the premium for the same goods that can be found in smaller stores in a cheaper price, does not make sense; as a result, consumers feel discouraged to shop at these supershops. After the VAT hike to 4% in 2015 and to 5% in 2018 the growth rate of revenue of supershops drastically fell as the number of consumers declined.

Considering various benefits generated by the supershops, and the current challenges the sector is facing, the rate of VAT could be reduced to 2% from the current rate of 5% for three years, i.e. until 2021-22.

High-quality products: All supershops have to strictly maintain quality management to obtain and maintain their license to operate. Thus, they source their products from the very best and store them in a proper way to keep the quality of the products as good as possible.

Supporting rural economy: The supershops mainly source many grocery items from rural producers. They give support to the farmers for using better seeds and good quality agricultural inputs. They also maintain good packaging and transport services. Many rural farmers can sell their products directly to supershops by joining in the value chain of the supermarket. Thus, supershops are playing an important role in creating markets for rural products and thus helping the growth of the rural economy.

Employment generation for educated youths: All supershops hire staffs who have some minimum educational qualification. This is not observed in small grocery stores. Plus, the supershops hire staffs for different shifts, thus it is a popular employment opportunity for students who want to do something different other than traditional part-time jobs. And being in a super shop, which has so many moving functions to operate, it is a very effective place to learn about supply chain management for students.

Women-friendly environment: Almost all supershops are strategically located in a secured and safe location which is convenient for women. All staffs are usually trained through a rigorous training process to be shopper friendly. Plus being in a monitored environment, women shoppers feel safe to do their shopping without being disturbed by random strangers.

Liberty to choose by the customers: Since the supershops source products from different vendors and brands, the shoppers get the choice to choose their preferred products from a heterogeneous group under one roof.

Revenue for the government: As the supershops use electronic cash machines and computerized accounting system, it is easy for the government to get revenue from them. These shops also pay corporate income tax and other relevant taxes.

VAT on the trade of supershops was first introduced in 2005 (Table 1) at a rate of 1.50%. It was raised to 3% in 2010. The rate went through various ups and downs since then. It was increased to 5% in 2018.

Table 1: Rate of VAT on Supershops

| Sl.No. | Effective Date | VAT % | Particulars |

| 1 | Wednesday, February 2, 2005 | 1.50% | General order 02/Mushok/2005 |

| 2 | Thursday, June 10, 2010 | 3% | SRO 209/Act/2010/558-Mushok |

| 3 | Wednesday, June 30, 2010 | 2% | SRO 254/Act/2010/574-Mushok |

| 4 | Thursday, June 7, 2012 | 4% | SRO 185/Act/2012/643-Mushok |

| 5 | Monday, January 27, 2014 | 2% | SRO 18/Act/2014/695-Mushok |

| 6 | Thursday, June 4, 2015 | 4% | SRO 128/Act/2015/730-Mushok |

| 7 | Thursday, June 7, 2018 | 5% | SRO 174/Act/2018/797-Mushok |

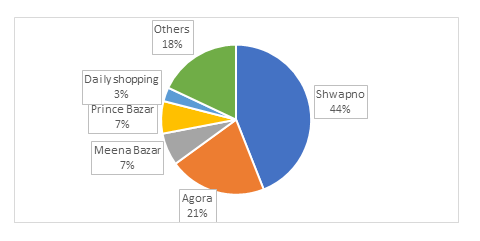

Share of different brands in the supermarket sector

Different brands are operating in the supershops sector while 6 are big brands, i.e. Shwapno, Agora, Meena Bazar, Prince Bazar, CSD, and Daily shopping. Shwapno is the largest supershop having 44% of the market share (in terms of revenue generated by supershop sector). Agora comes in the second position with 21% market share.

Table 2: Market Share of different supershop brands (in terms of revenue generation), %

The supershops try to set their outlets in strategic locations where they can attract consumers, who would shop in this kind of supershops. Shwapno is leading the sector with the highest number of outlets (62 outlets). As the area under each outlet varies the actual area covered by outlets of different brands may vary.

Table 3: Number of Stores

| Supershop | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| Shwapno | 40 | 43 | 46 | 47 | 57 | 62 | 62 |

| Agora | 12 | 14 | 14 | 15 | 13 | 14 | 16 |

| Meena Bazar | 9 | 12 | 14 | 16 | 16 | 16 | 17 |

| Prince Bazar | 2 | 2 | 2 | 3 | 4 | 4 | 4 |

| Daily shopping | 8 | 20 | 34 | 44 | 52 | ||

| One stop | 9 | 0 |

Since 2012, Only two corporates entered into supershop business, one (One Stop by Sajeeb Group) couldn’t survive due to insufficient revenue compared to its expense. The other one (Daily Shopping by PRAN RFL) survived to support its backward industries.

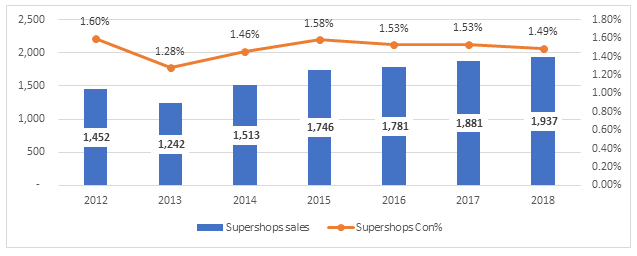

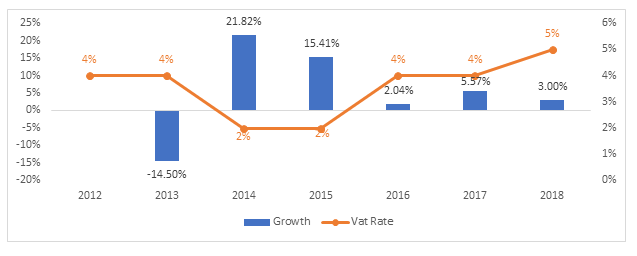

Total revenue generated by the supershop sector was TK1937.40 crore in 2018 which was 3% higher than the previous year (Figure.1 & Figure. 2). If we observe the growth rate of revenue on a year on year basis we would notice that the rate of growth declined drastically from 15.4% to 2.04% during 2015 to 2016 after the increase of VAT in 2015. Again, the revenue growth rate declined during 2017 to 2018 (from 5.57%% to 3%), which could be associated to the rise of VAT rate to 5%.

Figure 1: Revenue in crore Taka

Most of the supershops remain in slow growth in revenue.

Declining growth rates in revenue earned by supershops after an increase in the VAT rate

Though the revenue is rising the growth has slowed down for most of the supershops after the increase in VAT. The growth rates of revenue for different super shop brands are presented in the following figures. It is clear from the figures that the growth rate of revenue has slowed down after the increase of VAT in 2015.

Figure 2: Revenue Growth with VAT %

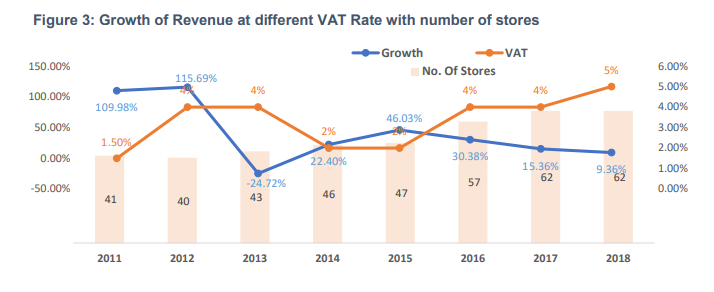

The decline in the growth of revenue earning by supershops may lead to loss of these shops with rising administrative and marketing cost of the shops which ultimately lead to lower VAT revenue earning of the government. The analysis is performed with the data of the leading supershop Shwapno.

It is noted that the leading supershop, Shwapno is experiencing a fall in the growth of revenue earning with the increase in VAT rate. Before 2012 when VAT was 2%, this supershop was growing at a rate of more than 100%. When 4% VAT was imposed in 2012 the growth of revenue of this shop drastically declined and became negative. Later the VAT rate was again set to 2% in 2014 and the revenue started growing at a rate of 46%. However, the re-introduction of 4% VAT in 2015 led to fall in the growth rate of revenue. And the growth of VAT rate to 5% in 2018 is again leading to decline in revenue growth.

The slow growth of revenue earning by Shwapno is associated with the fall in the number of consumers after an increase in VAT on supershops. A significant number of stores were needed to be launched to ensure this minimum growth. Same-store footfall growth became negative as below.

However, an increase in the rate of VAT has actually resulted in VAT revenue earning at a declining

rate. Even in some years, there was an absolute decline in VAT payment.

Table 4: VAT amount paid by Shwapno (in crore Taka)

| Year | VAT RATE | SALES VAT | VAT ON RENT | VDS PAYMENT | TDS PAYMENT | MINIMUM TAX ON TURNOVER | TOTAL

(In Cr.) | YOY GROWTH |

| 2010 | 1.50% | 0.73 | 1.03 | 0.88 | 1.27 | 4.49 | 8.39 | |

| 2011 | 1.50% | 2.09 | 0.87 | 0.57 | 0.71 | 9.43 | 13.67 | 62.87% |

| 2012 | 4.00% | 3.78 | 0.79 | 1.05 | 0.90 | 20.33 | 26.85 | 96.37% |

| 2013 | 4.00% | 7.38 | 0.89 | 1.73 | 1.21 | 15.31 | 26.52 | -1.25% |

| 2014 | 2.00% | 5.65 | 1.46 | 2.09 | 1.99 | 18.74 | 29.92 | 12.85% |

| 2015 | 2.00% | 10.69 | 2.05 | 2.52 | 2.05 | 16.42 | 33.72 | 12.70% |

| 2016 | 4.00% | 16.41 | 3.53 | 4.34 | 3.70 | 42.81 | 70.79 | 109.91% |

| 2017 | 4.00% | 20.47 | 4.90 | 8.37 | 3.42 | 49.38 | 86.54 | 22.25% |

| 2018 | 5.00% | 25.22 | 5.60 | 7.67 | 2.83 | 54.00 | 95.33 | 10.15% |

Among the revenue components of Government, VDS (VAT Deducted at Source), TDS (TAX Deducted at Source) are directly proportional to Shwapno’s purchase. Shwapno is ensuring that the suppliers are properly paying the VAT & TAX imposed by the Government.

To ensure revenue growth Shwapno had to invest a significant amount in marketing and promotional activities.

Since 2015, discount to customer and promotional expense were significantly increased to attract customers as VAT % imposed by Government was raised to 4% from 2%. This additional expense incurred by Shwapno negatively impacted on its financial statement. To improve financial performance as to meet the shareholders' expectation, during the year 2018, Shwapno reduced its promotional expense and discount on price thus decreasing the operating loss. Though it lost 12% of its customer base.

The slow growth in revenue has actually led to a loss in business of Shwapno.

With such a high volume of loss, it is becoming difficult even for a giant supershop like Shwapno to sustain. It might need to cut down its business. A similar situation is also noticed for other supershops.

At the backdrop of the continuous loss of different supershops or because of very marginal profit they are earning, they are unable to grow at a rate demanded by a rising economy like Bangladesh. Even some of them could not sustain at all. Development of Bangladesh is passing through a transitional phase where per capita income is rising but people do not have sustainability in their increased income yet.

A rising middle class with sustainable income may contribute to the fast expansion of the supershops sector. When the government increases the VAT, the price of the products goes up in supershops which discourages a vast majority of consumers to do their shopping in supershops. They rather go to the local open market and grocery shops.

If the current level of loss continues the supershops will have to bring down their business, which will ultimately lead to a loss in revenue earning by the government from this sector. As Bangladesh is moving forward to become a middle-income country, we would need more supershops, which will promote local value chain of production.

At this backdrop the supershop sector demands the followings:

The proposed 2% VAT for supershops for 3 years will bring the following benefits to the economy.

1. Impact on Company Profit & Loss: Shwapno will have a quantum rise in revenue and number of stores, which will enable a positive EBIT as below. This will make the business sustainable and will encourage shareholders. Other supershops will also feel encouraged to open new shops. New players will emerge in the industry and invest thus making the entire eco-system healthy and more competitive.

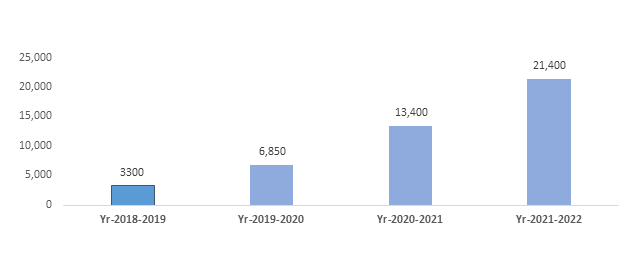

This projected growth mostly comprises of small convenience format under franchise model. Electronic Cash Register (ECR) will be implemented in these stores where full transparency of transaction will be ensured.

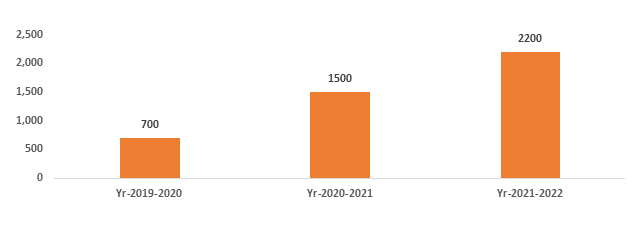

2. Employment generation for educated youths: The sector will create more direct jobs for educated youths in this sector. As the rising unemployment among educated youths is a major development concern of the government, the expansion of supershops will contribute to the solution of that problem.

Figure 9: Projected new Entrepreneurs Created

3. Economic empowerment of women: This sector employs more than 20% women employees. Thus this sector can play a good role in enhancing economic empowerment of women in the country.

4. Skill enhancement of students who are working part-time: Bangladesh is now enjoying demographic dividend (higher proportion of youths in the population) and development of skills of young people will set the foundation of Bangladesh’s journey towards a developed country by 2041. At this backdrop, the part-time job opportunities in the supershops will enable the young students to gain job experience while they are still studying.

5. Increase in revenue earning for the government: if the supershops can attract more customers, the VAT income of the government will rise. If a consumer purchase product from a small grocery shop, there may be no VAT earning from that transaction. However, if the product is purchased from a supershop, the computerized accounting system will ensure VAT earning from that transaction. Thus earning a 2% VAT is better than no VAT revenue earning. More consumers will be attracted to supershops when the price will go down with a reduction in VAT rate. That will ultimately lead to more revenue earning from VAT by the government, rather than the current system of the high VAT rate, lower number of customers and stagnation of this sector.

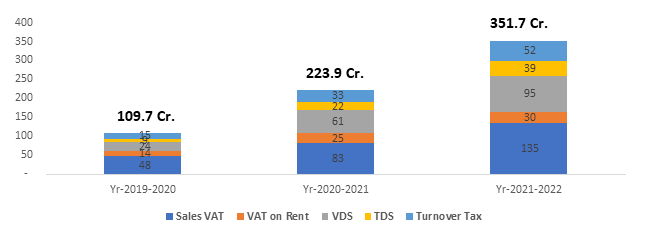

Figure 10: Projected Revenue Earning by Government in Cr. from Shwapno

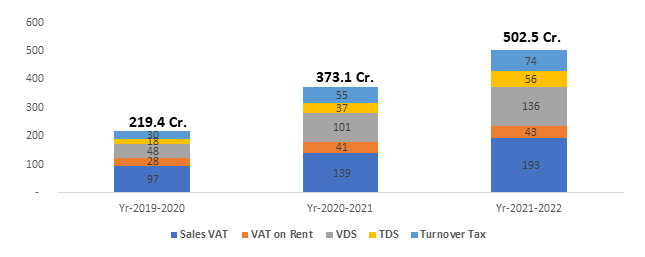

Figure 11: Projected Revenue Earning by Government in Cr. from Supershop Industry

6. Increase in income of all who are involved in the value chain of supershops: The suppliers in the rural areas including farmers, producers of agro-processed products, craftsmen, home-based producers who are associated to the value chain of supershops, can be benefitted from the expansion of this sector. The transport sector is also benefitting from the expansion of the sector. As the right price for the products produced by farmers and small entrepreneurs is a big concern of the government, supershops can provide a good solution for that.

It is highly expected that the current pro-development government will consider the recent challenges of the supershop sector with utmost priority and declare 2% VAT for supershops in the coming national budget 2019-20 and continue that for next three years. This initiative will help this sector to survive, grow; will serve the consumers with better quality products at lower prices, generate employment, empower women and ultimately increase revenue earnings of the government.