PRAN-RFL, one of the fastest growing conglomerates in the country, has quietly been investing in building an on-demand video streaming platform for Bangla content in Dhaka. The platform called JagoLive has been in making for a while now. The news came to wider public consciousness when Muvi, a US-based audio and video streaming solution provider, announced that it has entered into a partnership with PRAN-RFL to enable PRAN to launch its streaming platform building it on audio and video streaming solutions.

This is an interesting move on the part of PRAN and is likely to have a meaningful consequence for the overall streaming business in Dhaka. More on that in a moment. Before, from the announcement of Muvi:

“Muvi LLC, the pioneers of OTT platform technology, on Wednesday announced the onboarding of PRAN-RFL Group, a major corporate house from Bangladesh, leading the way in F&B industry to its clientele.

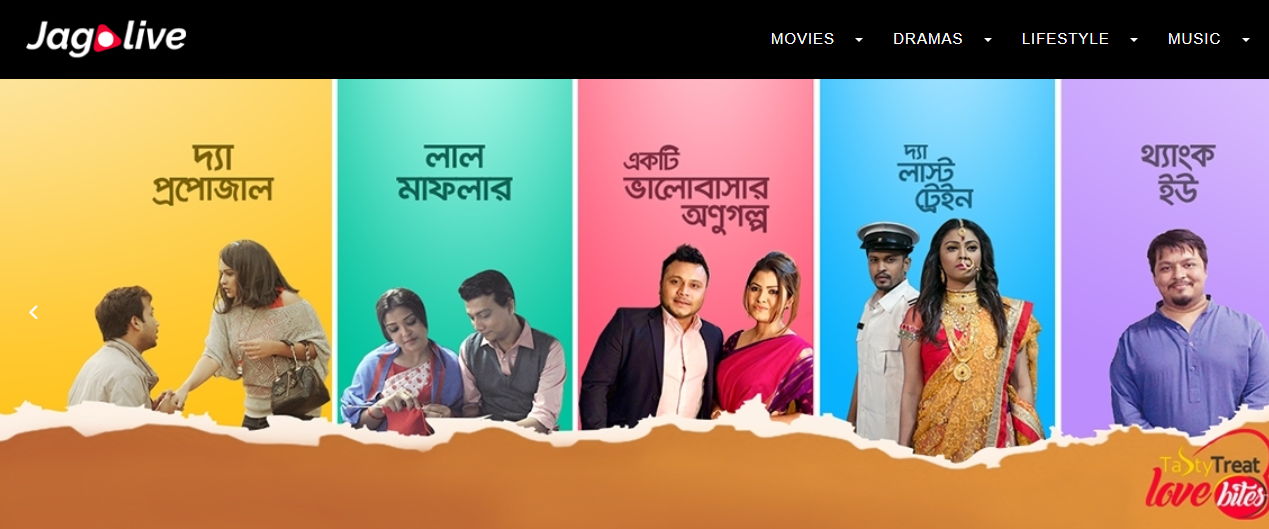

Owing to lucrative prospects in the growing Asian OTT industry, PRAN Group decides to foray into the online video streaming business. The company is set to launch its streaming service by the brand name, JagoLive later this year.

JagoLive is an initiative by the “Digital Media” vertical of PRAN-RFL Group. A deal has been struck to partner with Muvi LLC, a leading OTT Platform provider in the world. The streaming service is being built on Muvi’s PaaS based solution, and platform specialists have already begun the onboarding process.”

PRAN-RFL has been investing in digital space for a while now. Here is a list of PRAN’s digital investments - 1) an online news portal called Jagonews, 2) an FM radio, 3) an online job portal and 4) an ecommerce venture and 5) now an online streaming service. This is a fascinating list.

The former two investments, digital media, and FM radio don’t look something serious given the fact that almost every major corporate house in Bangladesh has a media company in some form. In fact, some of the major media outlets are owned by private corporations.

However, latter 3 initiatives - job portal, ecommerce, and streaming - have to be serious because these require good investment and there is a serious business to be done while a media outlet is seldom considered as a profit-making venture. As I said, ecommerce and streaming demand significant long-term investment and commitment. To that end, it seems PRAN is serious about these businesses.

It is hard to predict PRAN’s online streaming strategy. The company plans to open up the platform later this year and hopefully, we will get more information by then to have a better understanding.

From what is available now, it can safely be predicted that the company will go for an ad-supported model which GP’s Bioscope or Bongobd has been doing for a while now.

While ad-supported streaming business seems feasible given the market reality in Bangladesh, it is going to be tall order to make the model work. There are several reasons - 1) digital ad-market is not big enough yet 2) content production and licensing both are expensive 3) you have to compete with Google, YouTube, Facebook for ad dollars and many of these platforms rely on user-generated content meaning they have better cost-advantage. More on this in a moment.

Before that let’s take a look at PRAN’s ecommerce strategy which I hope will help to have an idea about PRAN’s overall digital strategy. I wrote in PRAN’s eCommerce Pursuit in 2016:

“PRAN is approaching ecommerce differently than other local companies that have launched ecommerce platforms.

While most of these companies are looking at the ecommerce as another distribution channel and solely opening it as an extension for selling their own products, PRAN is treating it as an independent venture hosting products of other brands as well. This distinguishes PRAN’s vision for the platform in the long run.”

In the same article, I also pointed out that:

“PRAN is one of the few companies in Bangladesh that has a huge distribution network in place. It has also shown very good capacity in launching and executing new businesses.

The company’s ubiquitous Best Buy showrooms are available almost every corner of the country. This, if utilized properly, will give it an extra advantage over other ecommerce and will allow its ecommerce platform to promise faster delivery from its local shops. However, this will require significant investment in technology and data management.”

In an exclusive interview with FS before his untimely death Othoba’s the then Head of Operations, Ahsanul Alam told us that PRAN maintains an ambitious goal for its ecommerce venture. “Our goal is to be the destination for every conceivable item that you need anytime and anywhere in Bangladesh at the lowest possible price which we consider we can become given the upsides we have with our distribution network across the country.”

These statements do help us to understand the ambition of PRAN in these areas. However, streaming is an entirely different ball game altogether compared to media or ecommerce and will require a different strategy.

Moreover, in ecommerce PRAN has a leverage of distribution and a long list of its own brands. In streaming, it does not have any apparent leverage which will make it even more challenging for the company.

I plan to write a follow-up piece on that in the near future. For today, I want to take a look at the streaming business in Bangladesh as well as the how online video streaming works in reality and what are its major nodes.

We wrote in The State Of Video Streaming In Bangladesh in 2017:

“In Bangladesh, we have a couple of players in the video streaming space. All three telecom operators have streaming services in some form. Grameenphone has Bioscope, arguably the best streaming service by any telecom operator, Banglalink has Banglaflix, and Robi has Robi TV.

There are a few independently run services such as Bongobd, which also maintains Bioscope for GP, and 3rdbell, which came out of the stealth mode recently, and Popcorn Live which is operating at a limited scale.”

And then there is iFlix which has launched its service in Bangladesh mid-2017 in collaboration with Robi. In fact, iFlix is the only subscription streaming service in Bangladesh. For Telcos, streaming is more a means to improve their data revenue performance than a pure business.

Netflix has been offering its service in Bangladesh for a while now although the company does not have a formal operation in Dhaka yet.

There is no doubt that video continues to be a substantial trend.

Platforms across the board are betting heavily on video. Social media sites like Facebook and Twitter are heavily pushing video content. Digital media startups like BuzzFeed, Vox, Refinery29, Mic, our local Daily Star, Dhaka Tribune, Bangla Tribune are investing heavily in the video. There is a growing competition among the digital natives to secure some of the TV ad dollars.

If you look at the imperatives, Bangladesh market is poised for on-demand online streaming services. Smartphone penetration continues to grow. Internet penetration also shows a consistent upward trend. And an increasing number of people, particularly urban population, rely on YouTube for entertainment. This means there is a market for streaming services.

Having said that, in terms of overall market size, video streaming has a long way to go. While internet penetration continues to grow, our internet infrastructure does not seem ready for streaming yet. Broadband penetration is significantly low outside Dhaka and 3G is costly and is of low quality to stream videos.

On the other hand, YouTube remains a key competitor in the space that hurts the exclusivity of the content which means it will be hard to convince people to pay for streaming with licensed content only.

At the same time, a significant percentage of people who pay for cable TV in Dhaka and beyond - people who are the target group for streaming services - do so not only to consume local TV but also to consume English and Hindi channels. This will prove challenging for a local streaming business because they will have to license these international contents. On the other hand, streaming services like Netflix and iFlix already offer these contents.

Bioscope, Grameenphone’s streaming service, Bongobd, and in fact, JagoLive, all these services are working on an ad-supported model. The expectation is to steal some of the TV ad dollars.

To my reading, this will prove challenging for several reasons. One is obviously YouTube as I mentioned earlier.

At the same time, although our digital ad industry is growing, it will be hard to attract TV ad dollar with 1m traffic, which is the highest traffic for any streaming site right now. Exclusive and high-quality original content may help but that is an expensive business model for any platform at this stage in Bangladesh and nobody is trying that yet.

As I mentioned earlier, there is no denying that streaming has a future in Bangladesh because that is the future of entertainment. But I have significant doubt about who will win that future. The strategy that GP’s bioscope and PRAN’s JagoLive current has flaws in it and we have to wait to see how it turns out in the market.

Netflix does deserve a lot of credit for the making streaming a thing. When Netflix started streaming, it was basically a distribution channel. It licensed content from major studios and then distributed them through its streaming platform. In the process, it has built a base of millions of loyal users.

The internet and the psychology of internet have played a significant role in the rise of Netflix and similar streaming services. The internet represents a different mindset which is significantly different than TV or other traditional mediums.

When people gradually started to do away with CD and cassettes, streaming becomes a default mode of consumption. But still streaming was not a thing in it's from today until Netflix, Apple, Spotify came along and made it. I wrote in the introduction of our future of communication series:

“The central difference between internet and conventional media is in the mindset. The internet represents an abundance mentality and freedom whereas traditional media is about scarcity. This is the central reality of this new world that changes many rules. For instance, in digital audience decides what ads they want to attend to and when.

The way people consume entertainment and news has fundamentally changed. This calls for a deeper understanding of the medium not only to do well in digital but also to succeed in the conventional medium. Because the consumption habit of digital does influence the expectation from and consumption habit of traditional mediums.”

Now, consider the fact that internet is a fairly new medium and in Bangladesh majority of the population don’t have access to the internet yet which means the market will grow manifold in the coming days.

There is no doubt about the future of the streaming business and the mindset of the streaming is materially different than TV. So if you are trying a TV-style streaming service that will not work.

Now, let’s get back to Netflix. Netflix started with offering licensed content as a distributor. It is pretty understandable, you are a channel, not a production company. And then the company started to invest in original content to keep people on its platform and over the past couple of years, it has been routinely increasing its investment in original content. There are reasons behind this, major players in entertainment with significant content leverage are now eyeing streaming, for instance, Disney announced that it will launch its streaming service in 2019.

If you take a closer look, content is the most important node in streaming business. People would only pay for a service if they feel like it is worth paying for.

In Bangladesh, challenges for a local streaming business will be multi-facet. Since people consume English and Hindi contents to a great extent, you will have to find ways to offer these contents.

And for local contents, YouTube offers a relatively good monetization model to the producers meaning as an aggregator you will have to compete with YouTube in order to acquire exclusive rights of contents. Finally, you have to produce high-quality content that would help you to build a sustainable differentiation.

iFlix charges BDT 300 subscription fee per month and offers an ever-growing content library. For Netflix, the price is $7-$9 a month. People will still pay for your service if they see value in it.

Streaming is the future of entertainment, but it does not mean that simply launching a streaming service will be enough for your success. Today’s consumers have endless choices, as I mentioned earlier, the internet offers abundance. In order to get their attention, you have to offer something that is worthy of their attention.

-

Notes:

Further reading on streaming business in Bangladesh here.