Adoption of digital modes of payment i.e. Electronic Fund Transfer (EFT), Card based payment, Internet Banking, has made very little progress in first 03 quarters of 2016.

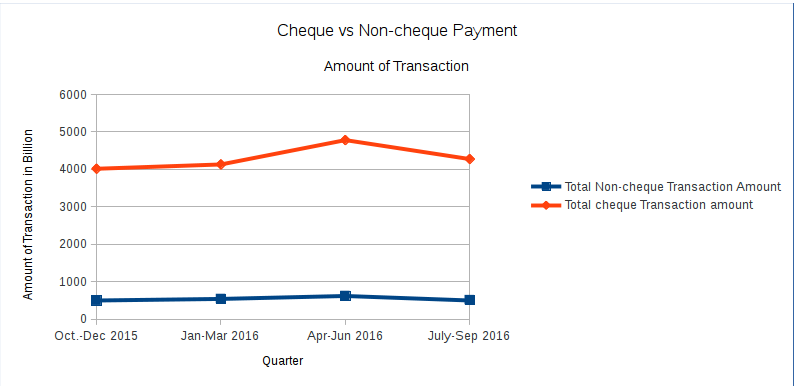

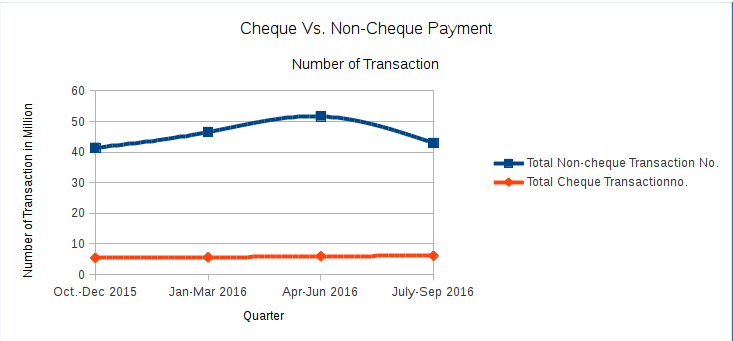

According to the data released by Bangladesh Bank, Cheque-based payment still dominates the payment scenario and is growing in number of transactions, while Non-cheque based payment made very little progress.

A total of 6.10 million cheque-based transactions took place in July-Sept.- 2016 quarter for the amount of BDT 4.275 trillion. This is a 12.55% growth in terms of the number of transactions and 6.45% growth in terms of the value of transaction compared to the figures of Oct.-Dec. 2015 quarter.

In the case of non-cheque based payment or Digital payment, 42.96 million transactions were made for a total of BDT 0.505 trillion, which is only 3.77% higher in terms of number of transactions and 3.44% higher in terms of the value of transaction compared to the figures of Oct.-Dec. 2015 quarter.

While no one expects that digital payment will take over the cheque based payment scenario overnight and we will go cashless, the progress recorded by the financial sector is frustrating, considering various regulatory measures such as the introduction of RTGS, streamlining EFT and others aiming to digitize the overall payment scenario gradually.

The paradox: Business Vs Individual users

An in-depth look at the data from the regulator shows that the number of transactions in non-cheque based clearing of transactions is much higher, approximately seven times than the number of cheque based clearing of transactions. This mean digital transaction has grown or is growing in number but not in volume.

The amount cleared through cheque is 8 times higher than the non-cheque based transactions, meaning that businesses are using cheques more frequently for their large-sized transactions, while individuals are opting more for digital transactions.

This can be further confirmed by looking at the growth of MFS. 24% more funds were transacted in July-Sept. 2016 quarter compared to Oct-Dec 2015 quarter using the medium. Besides, the number of MFS agents and number of MFS transactions are also up by 12% and 8% respectively.

A glaring lack of innovation and willingness

In line with our previous analysis, we are confident that lack of innovation in payment scenario on the part of the financial institutions is a major hindrance when it comes to adoption of digital payment.

Very few scheduled banks now offer online interbank fund transfer facility through their online banking arrangement. Among the few those allow, there are examples of placing high service charge for availing such services, which demotivate the customers.

While banks can easily employ smartphone apps to facilitate banking services at customer's fingertip, thus reducing customer queue in bank premises and enhancing customer experience, there is hardly any drive from the majority of the banks.

Among available digital payment clearing modes, EFT and different types of cards have registered merely 2.5% and 4% growth in transacted amount respectively in July-Sept. 2016 quarter compared to Oct-Dec 2015 quarter.

However, branches of many banks unofficially demotivate EFT transactions and place complex processes that act as a hindrance. For instance, IBBL customer requires a cheque to make an EFT, which is, by no means, make sense on the part of the customer.

Internet banking shows promise

Internet Banking has shown promise as few banks are offering new features like interbank and intrabank transfer, through their internet banking portal and smartphone apps. Internet banking saw a 33% growth in amount transacted in July-Sept. 2016 quarter compared to Oct-Dec 2015 quarter, despite the fact that banks lost 3.19% internet banking users during this period.

Conclusion

While the main purpose of the digital payment is to enable the customer to manage the entire payment cycle on their own, thus making the payment experience and transaction cycle frictionless, the financial sector of the country have a very long way to walk.

As Anir Chowdhury of A2i rightly pointed out in a recent interview with the daily star that collaboration among business, government, and other stakeholders are required to push this agenda of enabling customers.