Founder and CEO of CloudWell, Anisul Islam, tells his story of becoming an entrepreneur, including how CloudWell came to exist, struggles of the early days, growth and current state of PayWell, the greatest challenges he faced and lessons he learned, raising money, and his plan to take PayWell to the remotest users of the country.

Future Startup: Tell us about yourself. Have you always been passionate about the idea of entrepreneurship? How PayWell came to exist?

Anisul Islam: Going back to the earlier years, I can point out three things that have driven me to where I am today and interestingly they all started with the letter “P”. My first passion was Programming. The other two were: contributing directly to the Profit and Loss of a business, no matter where I work, and solving problems in Payment industry.

I started my career at CyberN, an IBMpartner in 1999. I was a Server support specialist there working with different technologies such as-Linux and IBM systems. In 2000, I joined British American Tobacco's IT division where I worked till 2006. That is where I did a lot of experiments with programming and started to shift my passion toward contributing to the bottom and top-line of a company.

In fact, these attempts of exploration made me think that with my own organization I would have opportunities to do more and could contribute to the national development. So, I joined with a textile entrepreneur in 2007 to further my understanding of business. The venture was called SSL Wireless. Its motto was to deliver various mobile based value-added services to consumers.

Back then, mobile phones were being used as a mere person-to-person communication device. But we saw a host of opportunities which were largely overlooked in Bangladesh, such as mobile voting, various types of VAS. We first introduced audience voting via cell phones and SMS news services and SMS banking in the country.

Within two years most of the TV channels were using our service for sending real-time breaking news through SMS. 15 banks were also connected with us real-time because we were the first one to provide transaction data to the customers through SMS so that they could instantly know what was going on with their accounts. It is what we know as SMS banking now.

Then, in 2011, we started to deploy a payment gateway for merchants jointly with Dutch Bangla Bank Limited. It is currently one of the top merchant payment gateways in the country, thanks to the SSL COMMERZ team.

After 2012, I started to extend my focus to the ecommerce scenario in Bangladesh. I examined the data and found out that at SSL COMMERZ, we have done business with an estimated 10,000 people among whom a significant number was expatriates. The local people were not transacting enough. It means that the system was not working as it should have. People were not using their credit cards online.

This problem or gap, if you say, made us my partner, Faizul and I, to undertake a venture which will try to bridge this gap and seek to educate people about ecommerce and its possibilities. That decision was later translated into this online service delivery model through an organized retail network called PayWell.

It's a project under Cloud Well Limited. We are aggregating different types of services in the same process as happens in the case of online portals and web stores. Anyone can access PayWell via its portal paywellonline.com. There is still no option for credit and debit card transactions but it will be available very soon. Currently, there are options for MFSs and cash payments.

Within two years most of the TV channels were using our service for sending real-time breaking news through SMS. 15 banks were also connected with us real-time because we were the first one to provide transaction data to the customers through SMS so that they could instantly know what was going on with their accounts. It is what we know as SMS banking now.

FS: You mentioned that you had this idea back in 2012. How did you test the idea and get started? How did you validate the idea? Also, how different it is from existing services?

AI: When we first started to look into this in 2012, we were thinking of reaching to our customers through a vehicle. We thought that it would be a retailer-assisted model where the end-users won't need to do the work by themselves.

The service would be provided by, for example, a neighborhood agent who would use our tool to serve the customers. To develop this tool, we studied several models practiced in different countries and fixed a benchmark for us. We brought standard POS terminal which is mainly service delivery tool and accepts credit and debit card as well.

We primarily partnered with some 20-30 agents for beta testing. We started our pilot project in October 2013 in different areas of Gazipur and Dhaka. Fortunately, the model was taken very positively by the people and it became a hit. Within four months, we were able to convince the mobile operators in the country to get into the system.

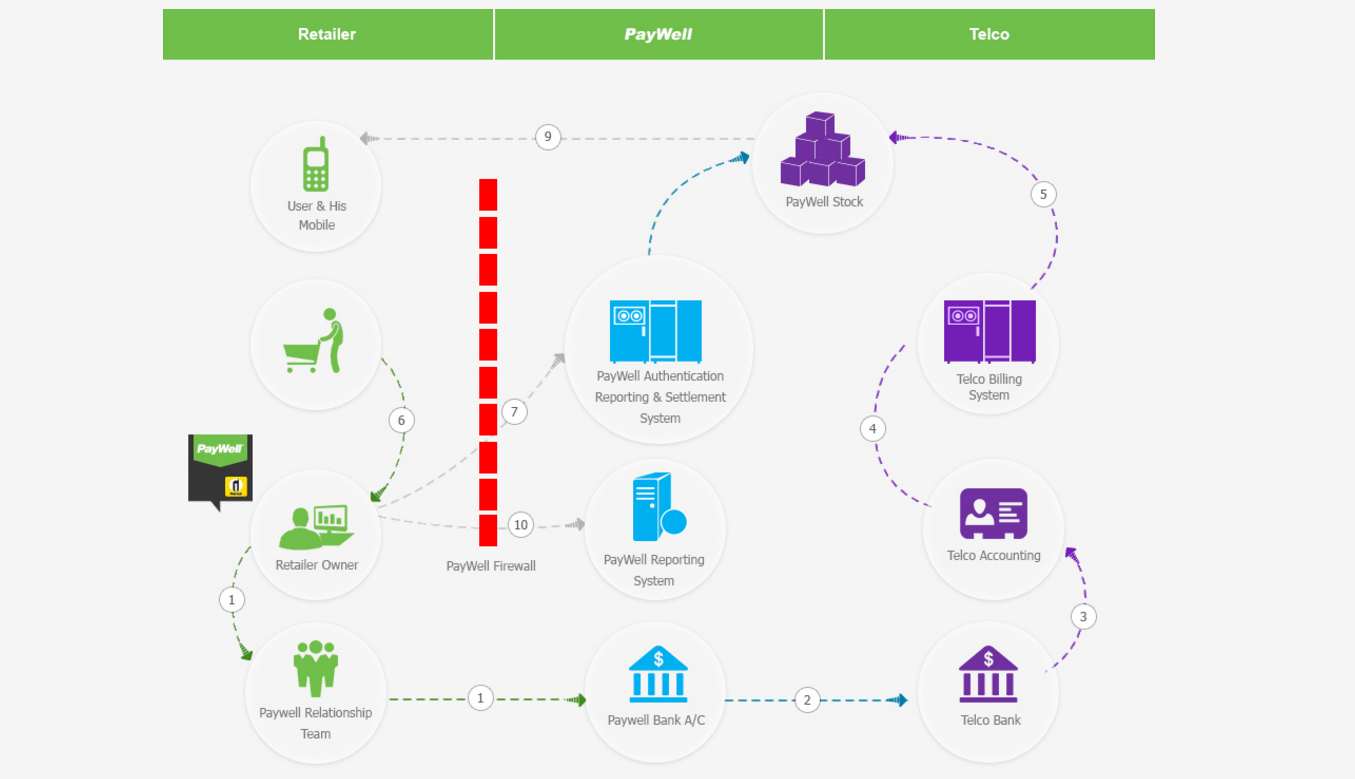

They were connected to us via API. And we connect our retailers through GPRS system. So, when retailers make requests to us from their device, we receive a notification and then validate them. Then we transfer it to respective telecom operators; and, when they finish processing it they send it back to us. As the last course of action, we finally transmit the processed request back to the retailer. The POS terminal also allows retailers to print the results out.

We also provide a solution to those who cannot afford POS terminals: an android app since March 2014. It can be easily downloaded from Google Play store. The only difference between the POS terminal and the android app is that you can't print with the latter one. Other things are same for both tools. Currently, we have around 1,200 POS Terminal users and 300 agents who use the android platform.

One may ask what is so unique about us given that many telecom companies are also offering similar services to ours through agents. What sets us apart from the other service providers is the benefit we give to our retailers: peace of mind.

A retailer providing multiple services at the same time often faces troubles with managing capital. Users also go through the hurdle and have to go to place to place to do different jobs. But with the assistance of our model, an agent can deliver many services at the same time with a central fund. He doesn't need to have different devices as well. This is why retailers are still sticking to us despite the fact that we pay them relatively lower rate of commissions.

As for our end-users, I would say the greatest benefit they get from using our service is accessibility. They can avail an array of services from a single platform and point. It saves time, money and effort.

You need to pay the Polli Bidyut bill, you can get it here. You want bus or train tickets, well, we are here for you. We also take NID alteration requests and payments of passport bills. You name it. Over the years we aim to add more services.

We primarily partnered with some 20-30 agents for beta testing. We started our pilot project in October 2013 in different areas of Gazipur and Dhaka. Fortunately, the model was taken very positively by the people and it became a hit. Within four months, we were able to convince the mobile operators in the country to get into the system.

FS: Tell us about your early days and investments.

AI: The business we are trying to do is long-term in nature provided that we have to work with retailers and agents across the country and convince them to use our product. At the same time, we are trying to solve a problem which pretty complex and no one tried to solve before.

We started with 12 full-time employees including 4/5 part-time salesmen. My partner and I used to look after the entire operations at that time. So it was quite a hectic job for us. We were also trying to persuade service delivery agents on different regions to get onboard with us to reach out to the market, roll our products out, and also earn revenue in the process.

They were also promoting the company on behalf of us in their respective regions; and, they still do. Since the model how we distribute our service has evolved. We have dealers now in different regions. We provide service directly in some regions and dealer takes care of business for us as well in some other places. In return, we share revenue with them.

As for our end-users, I would say the greatest benefit they get from using our service is accessibility. They can avail an array of services from a single platform and point. It saves time, money and effort. You need to pay the Polli Bidyut bill, you can get it here. You want bus or train tickets, well, we are here for you. We also take NID alteration requests and payments of passport bills. You name it. Over the years we aim to add more services.

PayWell's website went online in 2013. Initially, there were 2 investors with us. They were originally in the tobacco business. They were very convinced when we pitched the business idea to them. Then they decided to invest BDT 10 million and a half in return for 40%equity in the company.

After 5 or 6 months into operation, we had around 700 retailers who were selling our services to the end-users. Then, we felt that more investments are needed for the business to grow. By then, we realized this is a promising space. So, in 2014, we began to talk to potential investors and at the end of the year we got another investment from IIM Asia Pacific Limited, a Singapore-based company. They invested around BDT 20 million for 30% equity of the company. These investments had largely gone into product development, marketing, and public relations. We also got another investment of US $2m dollar this year from Aavishkaar Frontier Fund.

So, this is how our fundraising has been so far. We are hopeful that we will be reaching to a break-even situation within the next 3 years.

FS: Give us a list of the challenges you faced that other people who want to start businesses should also be watchful of and also how you managed to overcome those problems?

AI: First of all, if you want to build a business from scratch, the most important thing you need to do is to stick to the idea. You have to love it like you love a real human being. Boredom might strike once in a while but you must carry on without being distracted. Distraction is a killer.

You have to believe that your efforts will pay off in future. So, you need to keep pushing yourself and be patient. One also needs to remember that here in the world of business every man is for himself. No one would most probably lend you a shoulder when you're down and broke. You are your only driver. So, be motivated and patient, and believe in yourself.

A good team is also a very crucial element for a startup to grow. You got to believe in your team. At PayWell, we sometimes employed authoritarian rule because it is needed. But, at the end of the day, my team matters a lot to me and I believe in them.

After 5 or 6 months into operation, we had around 700 retailers who were selling our services to the end-users. Then, we felt that more investments are needed for the business to grow. By then, we realized this is a promising space. So, in 2014, we began to talk to potential investors and at the end of the year we got another investment from IIM Asia Pacific Limited, a Singapore-based company.

FS: You have started in 2012, raised two investments and has grown significantly,how much has PayWell evolved over the years? How is your growth now and how many people work at PayWell?

AI: We had achieved 70%-80% percent of our capacity covered within the first year. The recent valuation indicates a growth of 60% year-over-year. We obviously need to cover up the remaining 40% to fully leverage our capacity in respect to the system.

At the same time, we are also working hard to expand our capacity because in the next couple of years our requirements will increase considerably. Our reports project 10 times more transactions in the next 1/2 years. That means if we are doing at present, say, 20,000 transactions daily, in the next year it will be 200,000 transactions every day.

As for the team, we have grown significantly over the years. Back in 2014, we have only 20 people in our company. Now we have about 45 people which will increase by 15 more members joining the team by the end of this year.

Talking about growth, I don't think it'll be very definitive until we have run operations for at least 8 years that means 2021. The goal is to make PayWell spread in such a way when you can find our services available within a kilometer distance all over the country. I hope we will be able to achieve that within the projected time.

FS: How many users/agents do you have now?

AI: Currently, we have around 2,500 active users/agents of our service, although the total number of registered users is 5,500.

FS: It is evident that payment is a pretty big problem for ecommerce and getting payments people living out of the capital are often very tough both for the companies, merchants, and the users also. Do you have plans to contribute solving this problem?

AI: We are not particularly contributing to solving this problem right now. But let me give you a case. Imagine you have an apparel web store based in Dhaka. Now, if someone who lives in, say, Srinagar, Munshiganj, visits your website and chooses a product. But you don't have a store there or a way to send the product.

We plan to solve this problem through our agent network. You can contact PayWell to facilitate the payment process. Customers can pick the product from our agent and make the payment as well. This can become a pretty feasible mechanism to take ecommerce across the country.

Using PayWell's service, the customer won't have to worry about authenticity because the neighborhood PayWell agent via whom he is making the payment may probably be someone he knows. This is how PayWell may indirectly contribute to the payment problems throughout the country and also take ecommerce to more people who don’t have access to technology. There is more to it, we will reveal when we feel we are ready.

FS: How does the business model work?

AI: Simply put, we are the distributor for the mobile companies. We receive a commission for every transaction we make from the respective telco. The commission we receive is then shared with our retailers. We are applying that same model for other services like bill payment, train/bus ticketing etc.

The model is pretty simple. However, our upside is that we aggregate a lot of services together that makes things simple for both the merchants and the users.

Q. It's needless to emphasize the hardship that comes along with building a business from scratch. Only an entrepreneur can know what it is like to be in such situation. Tell us your experience as an early stage founder and how it changes your life and affects people around you.

AI: The world portrays entrepreneurship as something full of excitement. You got to believe it if you want to be one. But at the same time, the journey is not only about excitement and freedom and that entire rosy picture. There are real sacrifices one has to make.

Many of the challenges an entrepreneur face could only be understood by another fellow entrepreneur. While an entrepreneur pays heavily, it also brings about hardship to the people who are related and associated with the entrepreneur.

Simply put, we are the distributor for the mobile companies. We receive a commission for every transaction we make from the respective telco. The commission we receive is then shared with our retailers. We are applying that same model for other services like bill payment, train/bus ticketing etc.

An entrepreneur often has a hard time managing his personal life. It has been a tough time for my family. My partner has been very supportive throughout the journey. Similarly, when he needed my help, I always tried to be there. The same thing goes for my family. Without the support of my family, especially my Wife, it would have been very difficult.

I would say today that I am thankful for all the things that I have gone and still going through. From my childhood, you know, I have been very instinctive. I groomed that aspect of my character and it has helped me since.

I have done a lot of experiments along my journey but I always tried to assure a proper cash-flow, because you can't afford experimentation if you do not have cash.

At SSL COMMERZ, there was regular financing from investors. But at PayWell, we didn't have that luxury. That was both a threat and a challenge in the beginning. But it has contributed a lot to my growth and pushed me to the next level.

As I have always believed that with all the disappointments, threats, and economic difficulties, an entrepreneur must keep stepping further because that is what entrepreneurship is all about.

FS: What are your future plans for PayWell?

AI: We are looking forward to expanding our agent base to at least 30,000 within the next four years. We are also planning to add as many services as possible.

Now you can get the bus, train tickets, insurance premium payment and DTH Bill payment on our platform that were added recently, we want to add more services going forward.

FS: What advice would you give to a young person just starting out?

AI: I have two answers for this question. For the kind of business I think has solid future in Bangladesh and then the kind of mindset one needs to develop in order to succeed as an entrepreneur.

The first one is that if someone has a "technology background," I would suggest going for a tech business, more specifically for platform models because this country has got a serious lacking in that area. And we are living in the world of platforms now.

On the other hand, if someone has got more of a ‘financial background and also understands tech,’ my advice would be doing something in payments. There is a lot of problems with payments in Bangladesh. This field calls for serious innovation.

These are the two areas where I think there are real opportunities.

Then there are basic business understanding and acumen. You get to extensively study the business plan. You also need to vet the plan by someone who has got experience but not has an interest in the space. Once you are sure of the idea, you need to ensure investment or a primary fund at least for 6 months. It is important that you get enough time to run a pilot and understand your customers’ response.

If anyone wants to enter into a business, he must ensure the cash-flow. Generally, if there is no return from a business within 6 months to 1 year, then it's better to leave it there. Although, the period of return depends on what kind of business it is, but you should see a clear sign of revenue generation.

This is particularly important for the ecosystem like us where venture funding is difficult to have and there is solid chance that your business would die if you could not generate revenue.

What we, entrepreneurs, here generally do is that we start with raising funds from our friends and family. I think this is the first step one should take. Then, if the company performs well, it will help you to attract further investment.

FS: You have raised investments from both local and international investors. What’s your take on and advice for raising investment?

AI: Unfortunately, the investment scenario in Bangladesh is quite depressing because we still do not have that many active venture capitalists. Startup investment is quite a new thing and funding culture is not there yet.

What we, entrepreneurs, here generally do is that we start with raising funds from our friends and family. I think this is the first step one should take. Then, if the company performs well, it will help you to attract further investment.

Interview by Ruhul Kader, Transcription by Rahatil Rahat, Image courtesy: CloudWell