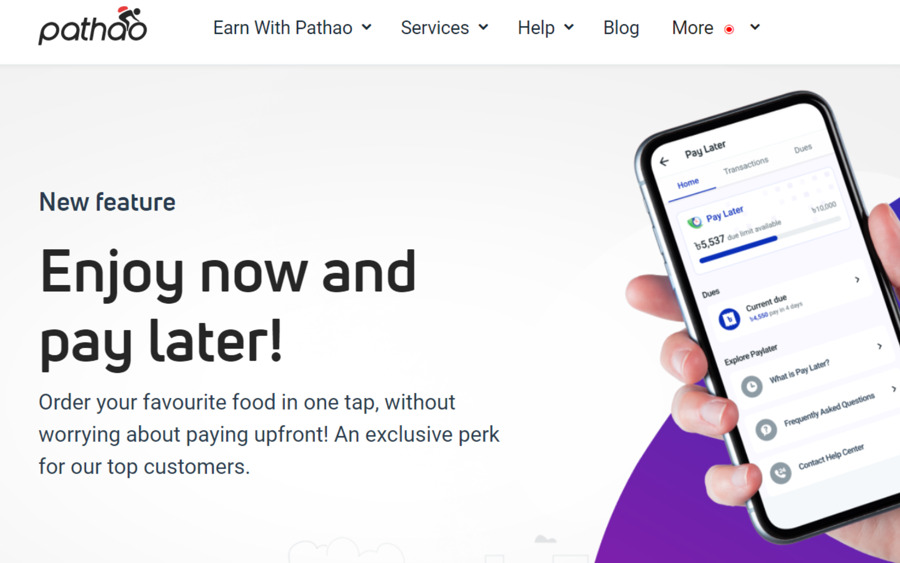

Digital services platform Pathao has introduced a new 'Buy Now, Pay Later' (BNPL) feature for top Pathao Food customers. Rolled out on a test basis to a limited number of users, the feature allows select Pathao Food users to choose ‘Pay Later’ as their payment method to complete orders in one tap.

Each user receives a personal due limit, designed based on a number of factors, which can be spent for 15 days and then repaid in installments over the next 30 days. There is no additional charge or interest. However, a late fee will be applicable for failure to pay on time.

The whole idea behind buy now, pay later is that consumers can shop for things they need immediately while getting a little extra time to pay for them. With the acceleration of digital commerce over the last few years, BNPL has seen explosive growth across markets.

Pathao is the first company to try the feature in Bangladesh.

BNPL is effectively a short-term credit scheme that allows consumers to make purchases, split the cost of goods into installments and pay for them at a future date over time, often interest-free and with fewer hassles.

BNPL arrangements, also called point of sale installment loans, are becoming an increasingly popular payment method in online shopping. However, while using BNPL can be convenient for consumers, there are potential downsides to consider. One such downside is that BNPL allows customers to buy things they don’t need with the money they don’t have.

BNPL is comparable to credit card EMI to a certain extent. The challenge with credit cards, however, is that credit card penetration is extremely low in Bangladesh and the card issuance process is quite complex.

On the other hand, the BNPL approval process is relatively simpler and does not require much documentation. Most BNPL companies only require a soft credit check for approval.

For Pathao, the company says the feature is currently available to select Pathao Food users and it uses internal data and an analytics engine to understand eligibility.

Fixed repayment schedule: BNPL arrangements have a fixed repayment schedule—generally several weeks or months. You are informed upfront about what you'll need to pay each time. Not all purchases are eligible for buy now, pay later arrangements and there are limits.

For example, Pathao has enabled the BNPL payment method for select Pathao Food users, for now. Eligible Pathao Food users can choose 'Pay Later' as their payment method to complete their order with a single tap. The initial spending limit is Tk 2,000, which will be replenished upon repayment. There is no additional charge or interest.

The full amount is due within 30 days and can be paid in parts. If a user fails to pay within the timeline, there will be a late charge of up to Tk 200. Repayment must be made using any digital payment method.

Why it makes sense for Pathao: Pathao has increasingly been focusing on an on-demand strategy as the company shifts its strategic direction from a ride-hailing-focused company to a digital services platform.

To that end, BNPL can play a significant role in helping it acquire and retain customers across verticals. Moreover, Pathao is also about to launch its Pathao Pay service, which means it can tie both BNPL and Pathao Pay to leverage its existing market power. It also offers opportunities to partner with financial and retail organizations.

The concern for Pathao, however, is in the fact that the company is into several other products and verticals. While BNPL can be a potential game-changer, it can also end up as a strategic liability for the company. Because while BNPL appears to be a mere feature, its development and management is a complex process.

We have seen a sudden surge in the number of companies offering BNPL financing across markets from the US to Europe to Southeast Asia to India. Some notable names in the space include Klarna, Affirm, AfterPay, which was recently acquired by Square, Mobikwik in India that offer buy now, pay later financing.

PayPal has introduced its own product. In Bangladesh, Shopup has a similar product for smallholder retailers in the form of embedded financing.

Bangladesh’s neighboring market India has seen a rapid growth of the BNPL industry over the past few years. A recent Mint report suggests, “India's buy-now-pay-later (BNPL) industry is set to surge over ten-fold within four years as tens of millions of online shoppers get lured by interest-free credit with fewer hassles. Redseer, an Indian internet business-focused research firm, estimates India's BNPL market will rocket to $45-50 billion by 2026 from $3-3.5 billion now. The research firm also estimates that the number of BNPL users in the country may rise to 80-100 million customers by then, from 10-15 million currently.”

BNPL can be an attractive way to pay for smaller purchases when shopping online. The trend has grown in popularity during 2020 with the rise of e-commerce amid the coronavirus pandemic.

For consumers, while BNPL is a lucrative payment option, it also means you lose out on parks such as rewards and discounts.

For Pathao, which claims to have over 8 million users across its ridesharing, food delivery, and courier services, the feature makes the perfect sense. It can help accelerate its customer acquisition, retention and further strengthen its aggregation power.

Moreover, Bangladesh has a young population. Credit card penetration in the country remains low. It is often difficult for young people to access credit. These factors make schemes like BNPL a highly lucrative payment option to customers.

Pathao has slowly been moving towards a new strategic direction where it aims to become a digital services platform. The shift has accelerated since Fahim Ahmed, the newly appointed Managing Director and CEO of Pathao, took over the leadership position last year. The company has been focusing on several on-demand services verticals. It continues to be a leading player in rides, but it is apparent that the company wants to go beyond rides.

The move makes sense given the global reality of ride-hailing businesses. And it is in accordance with the direction several other ride-hailing companies are taking including Uber. A logistics and delivery focused orientation where food delivery, ecommerce, and on-demand services take center stage for growth.

Pathao is already an important player in food delivery in Dhaka. The company has entered grocery delivery, medicine delivery, general-purpose ecommerce, and healthcare. It has a couple of smaller digital products verticals. With the upcoming launch of its payment product Pathao Pay, it aims to leverage its market power as well as expand into new markets.

Payment is a key component if you want to make on-demand work in the context of Bangladesh. To that end, Pathao getting into BNPL makes perfect sense. It will help the company drive new demands and build retention.

Similarly, BNPL means you can acquire customers without discounts and price incentives. The opportunity to ‘pay later’ is the incentive for customers to buy products from you. To that end, it will improve margins. As Pathao rolls out its payment product, it is likely to open up new doors of opportunities.

While BNPL offers several upsides for Pathao, it is not devoid of challenges. Doing too many things is always risky. It creates execution and management challenges. Dilutes resources. And takes away focus. We have seen the cost of losing focus in many startups in Dhaka of late.

Moreover, while BNPL is a growing trend across markets, it is a relatively new model. And a different and more problematic side of the model is also slowly emerging as the model matures in the form of late fees, interest, mounting debt, and rampant consumerism. Although BNPL as a payment method makes sense, it can create new operational headaches for the company.

A lot depends on how Pathao handles these challenges as the company finally matures the BNPL product and rolls it out to more users in 2022.