Bangladesh has made great economic progress over the past few decades. People have been lifted out of poverty. Per capita income has risen to a new level. Despite these favorable macroeconomic variables, individuals in this country are intrinsically wary of investing. Culturally, investment and building wealth are not something that comes naturally to most Bangladeshis.

There have been some improvements in investment opportunities for the general population in recent years, with startups like iFarmer offering agricultural investments and other traditional options such as mutual funds, however, a lack of financial education coupled with family and cultural orientation continues to exacerbate this reality.

Most Bangladeshis start investing at an older age by putting their retirement savings into a fixed deposit or some other investment that pays a monthly return.

While young people have more opportunities to earn these days, the increased earning capacity has not translated into an increase in investment habits.

Many young people think that they have plenty of time left to build wealth and they will not experience any difficulties in life. Instead of investing, they go through a cycle of earning and spending until it is too late.

But it is important to build a healthy personal finance habit early in life for good reasons we discuss next. Creating wealth takes time. And you will never build wealth by earning alone.

Life is uncertain. Although we live with an optimism bias where we consider ourselves outside of tragedies and trials — bad things happen to other people, not us — but anything can happen to us — unemployment, a string of disastrous investment decisions, being a victim of fraud, getting hit by a risk you didn’t see coming. We cannot fully prepare for life's uncertainties nor can we avoid them. However, it is wise to build a hedge against the uncertainties. Investment is such a hedge. This is what Nassim Nicholas Taleb calls antifragile - the ability to withstand random shocks of life.

Wealth is built over time. The thing that we often overlook in success and wealth building is the power of compounding — it takes a long time to build true wealth. In his excellent book The Psychology of Money, Morgan Housel writes: "More than 2,000 books are dedicated to how Warren Buffett built his fortune. Many of them are wonderful. But few pay enough attention to the simplest fact [......]. The real key to his success is that he’s been a phenomenal investor for three-quarters of a century.”

The importance of starting young lies here. Early starts give you more time, and time builds wealth. Although I do not expect you to become the next Warren Buffet, it gets the point across.

Warren Buffet famously said, "the proper attitude toward investing is much more important than any technical skills." Morgan Housel agrees: “Investing is not the study of finance. It’s the study of how people behave with money. And behavior is hard to teach, even to really smart people.” This is why most people never manage to build lasting wealth despite earning good money. Starting investing early helps you to develop better financial habits. It teaches discipline.

For young people, age allows higher risk tolerance. The downsides of failure and bad investment outcomes are usually limited when you're young. The older you grow, the more financial responsibilities you have. As you take on more responsibilities, your ability to withstand risks decreases. Financial mistakes can be devastating. A 50% loss completely cancels out a 100% gain. But they hurt less when we are young.

If you are young, start with a small investment plan. It will accumulate and compound over time, creating substantial wealth for your retirement. If you start late, you won't be able to do this.

Now you might think I don't earn enough money to save much, let alone invest. It isn't true. Saving or investing is not about how much you earn, but how you spend and plan.

A lot of investment and wealth creation is about mindset. It is much better and easier to increase your income and savings by living frugally than by earning more money. It does not matter how much money you earn if you spend it mindlessly, no amount will be enough.

We all want to get rich quickly when it comes to wealth. Most of our worst financial mistakes are caused by this impulse. Don't look for quick gains. We have seen the outcome of the shortcut mentality in the case of Destiny and multiple stock market crashes in Dhaka over the last decade. So when making your money decisions, think long-term and avoid shortcuts.

We live in a world of mimetic desire. We see an expensive gadget, we want to have one as if having an expensive gadget would solve all our life problems. Often these are sources of unnecessary expenses. Indulging into thoughtless mimetic behaviors is dangerous for your wealth creation. Live within your means.

Finally, investments come with risk. Consistently high returns are never guaranteed. You may suffer losses from time to time. Starting young has such significant benefits because you have more time to accumulate as well as recover if things go wrong.

Now how to start? Your investment approach depends on who you are. Retirement age people tend to favor low-risk or risk-free assets, whereas young people can build portfolios with higher risks but higher returns.

It can be difficult to find the best investment options in Dhaka at times when saving account return rates are declining - now at 6.5%. Especially for those looking for Halal and Shariah-compliant investment options.

In any case, there are several options to get started. Traditional options include DPS, government certificates, stock market, mutual funds, etc. There are newer and alternative options such as iFarmer, a Dhaka-based agri-tech startup, that enables investment in agriculture firms.

Let’s take a look into some of the prominent investment options for individual investors in Dhaka:

DPS: Anyone earning money can benefit from a Deposit Pension Scheme (DPS) bank account. You can deposit a fixed portion of your monthly salary, starting at 500 BDT and increasing to 20,000 BDT or more. You get to choose your maximum maturity value and the number of years you want to save for. For people looking for Halal options, most banks in Dhaka now offer Islami Banking options.

Fixed deposit: A fixed deposit is a better choice than letting your money quietly lose value in a savings account. A fixed deposit receipt (FDR) requires you to deposit a lump sum of money for several years. Interest rates tend to be higher for FDR than for normal savings accounts. In fact, the longer the time period of FDR, the higher will be the interest rates. Although the expense of premature withdrawal is a disadvantage, the benefit is that it provides a backup alternative in times of extreme cash flow crisis.

Sanchaypatra: Risk-averse Individuals may invest in savings certificates, namely a five-year Bangladesh Sanchayapatra or three-monthly profit-bearing Sanchayapatra. Sanchayapatra has the highest yield out of all the other investment options: a 5-year Sanchayapatra offers an 11.28 percent return. Since it is backed by the Government itself, investing in Sanchayapatra is a lucrative opportunity for low-income and middle-income groups.

Share market: Putting your hard-earned money into the stock market can be intimidating. You must exercise caution. Anyone with a valid passport or NID and a bank account can invest any amount of money in stocks. All you require is a BO (Beneficiary Owner's) account with a brokerage firm. The brokerage house will guide you in your stock analysis and keep you updated with market trends.

Mutual Funds: If you don't have the time to undertake stock analysis, you can take resort to mutual funds instead. Mutual funds are essentially investment funds formed by pooling money from multiple investors who seek to purchase financial assets like stocks, bonds, etc. The funds are managed in such a way that investors make the most profit from the portfolio. The amount invested in the mutual fund obtains a full tax rebate under the Tax Ordinance of 1984.

Investing in agriculture: Agriculture accounts for around 15% of our GDP. It has proven to be an antifragile sector amid the pandemic. We all need food on our plates no matter what happens. It means investing in agriculture is relatively safer unless nature does not mess with your firm or crops.

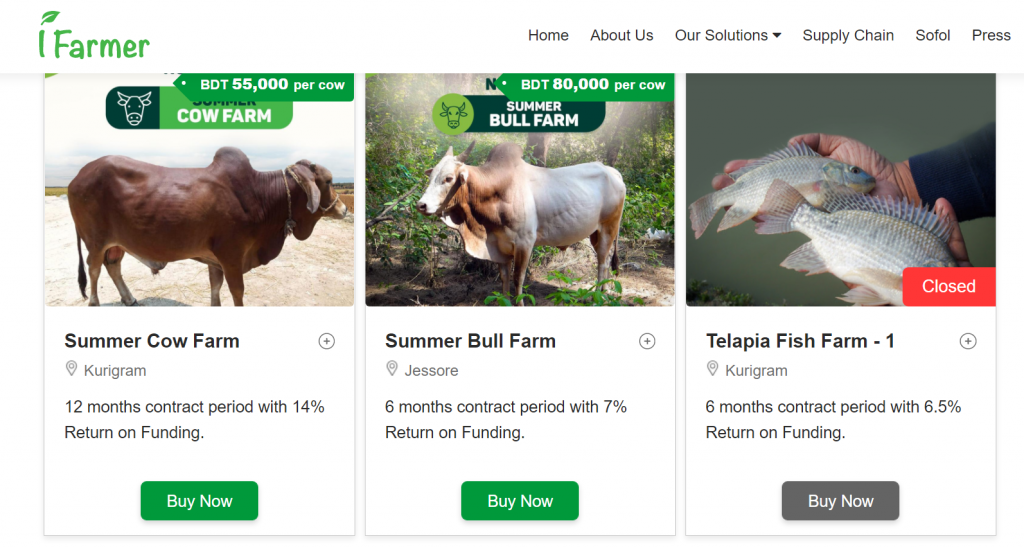

iFarmer, an agri-fin-tech firm based in Dhaka, provides investment opportunities in agriculture firms to retail investors who are looking for alternatives to conventional investment options and cannot invest large amounts. iFarmer uses a portfolio approach to secure desired returns for investors and provides third-party insurance on its platform that investors can purchase. The startup offers a much higher return, upto 20% in six months, than many other traditional investment options available in the market.

Furthermore, the company empowers micro-investors to grow their wealth, i.e. people with minimal income and savings ranging from BDT 10,000 to BDT 30,000 who have difficulty accessing most mainstream investment options. With the growing interest in Islamic Finance, iFarmer’s portfolio includes Shariah-compliant firms as well.

For investors, iFarmer offers excellent options. However, these options remain limited. Personal finance remains an obscure topic in Bangladesh. Money management is rarely taught in schools. Many parents don't discuss money with their children. Parents often think they should not allow their children to deal with money at a young age. Consequently, most young people lack an adequate understanding of investments and personal finance. The opposite should be done by parents.

There should be public and private initiatives to create better investment opportunities for the general population,

In the meantime, for young people, knowledge is no longer a challenge. Learn how to manage your money online and become a savvy investor. Meanwhile, you should never forget that money is not your life's purpose; it is merely a means of living it. Do not allow your drive to create wealth to ruin other areas of your life.

Just like everything else, wealth creation is a journey with ups and downs. Live within your means, stay in the game, and don’t pay much attention to what happens.

*This article is no investment advice. Please do your own research before making any investment decision.