Lives and livelihoods are both at risk- this is a situation that the wildest dreamers wouldn’t dare to envision. Global pandemic happens once a century, and we happen to be at the receiving end this time. It has already been an arduous few weeks, and there is no sign of slowing down. The worst is yet to come, and what we can do is prepare ourselves.

I hope that after all of this passes, the market will bounce back fast but we don’t know when that is going to happen. We can assume the worst possible scenario and latch on to what we have, so that when better days come our teams can flourish again.

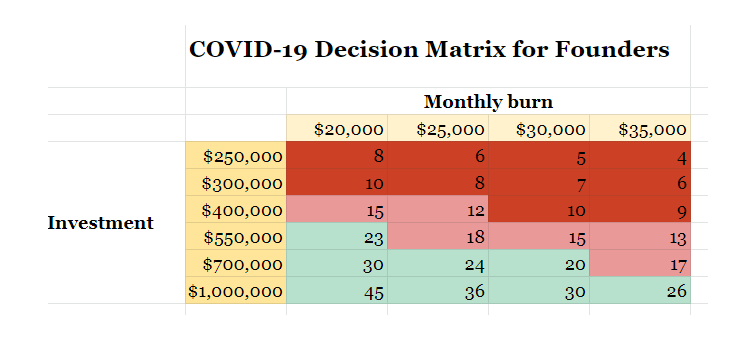

For founders whose businesses rely on fundraising as a key tool to scale and become cash-flow positive (eventually), this matrix below (see a live version here) that I have put together might be helpful.

Every business is different, but what is true for all of us, with the exception of a few, is that the net impact of COVID-19 has been negative.

Why the matrix?

This matrix can help to set targets for your expenses, revenue, and net outflow to prepare for the desired runway. Planning tools in a fast-moving situation can paint the foresight that is needed to protect us from running dry. Data, plan, attack!

How to use the matrix: