[su_note note_color="#f9fafd" text_color="#4e8df6" radius="16"]Editor's Note: This is a FS Network generated post. FS Network is our window to interact and give access to industry experts, entrepreneurs, writers, and thought leaders. Join FS Network. [/su_note]

Increasing competition and growing customer expectations are requiring companies, especially small and medium enterprises to sell their products and services at reduced prices and in a significantly faster time-to-market.

With budgets being already stretched, the need for capital is constant. And even though banks have considerably relaxed their lending criteria, it is still a daunting process for most SME owners to apply for a business loan with them.

Some of the factors that are likely to deter SME owners to apply for a business loan with banks are:

• Cumbersome paperwork

• Strict eligibility criteria

• Long disbursal periods

• Rigid loan repayment periods

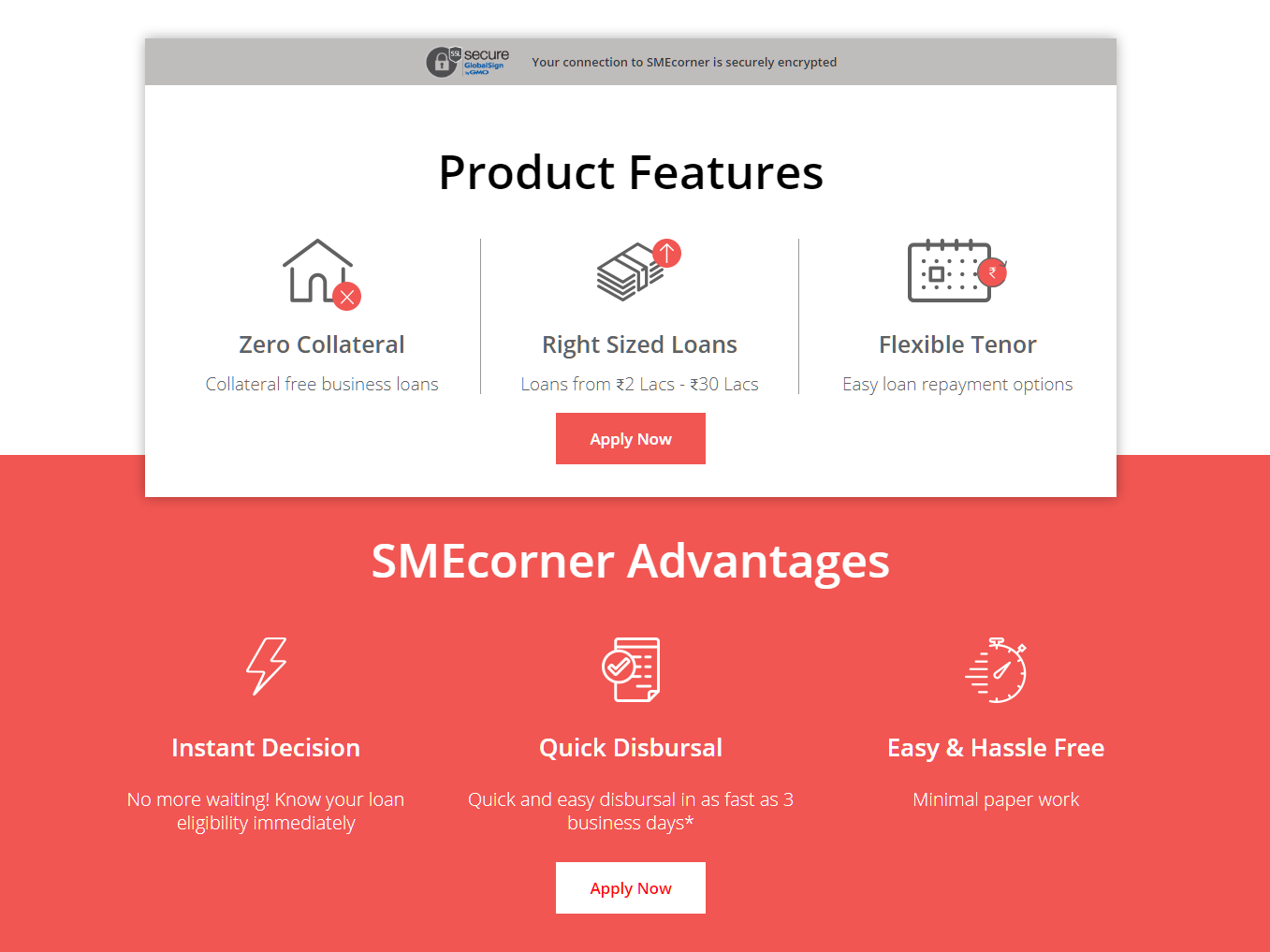

However, according to a report by PwC, over 80% of financial institutions believe that their business is at risk to innovators. The innovators that the PwC report talks about to refer to the financial institutions that offer financial services such as unsecured business loans through an online platform. One such financial institution is SMEcorner – an online lending platform that offers SMEs business loans upto INR 30 lac with no collaterals.

An online platform with a difference

SMECorner is an online platform that has created its business model after carefully examining the SME industry and understanding its needs and requirements on a first-hand basis. They acknowledge the fact that SMEs need access to capital fast and without a tedious process.

That is why they offer unsecured business loans that do not require any assets as collateral and disburse them in as quick as upto three working days, given that the paperwork is in order.

The online lending portal wants to close the lending gap that is impeding the success of this sector by basing their lending process on machine learning, data science and artificial intelligence in a secure environment that is conducive to the growth of the SME industry.

The potential that the sector has to contribute towards the growth of the economy and the employment opportunities that it can provide, has further convinced the stakeholders of SMEcorner that this is the industry that deserves their backing-up and support.

The team at SMEcorner is experienced and share the common vision of bringing agility and ease into the lending systems of the SME sector. Their policies are formulated such that the interests of the small and medium enterprises are best served – loan amounts ranging from INR 2 lac to 30 lac, flexible repayment periods, instant eligibility criteria checking tool, an entirely online application process, quick disbursal, among others, makes this fin-tech company the disruptor to watch out for.

The long future of online lending

According to an article in Forbes, the future of an online lending platform is safe, secure and long as they offer three things that customers are looking for – convenience, the use of technology and easy access to capital that they offer.