With the launch of its digital wallet service TallyPay, the digital platform for small businesses TallyKhata is aiming big.

The company previously teased its ambition in a pilot program to get into financing through partnerships with banks and financial organizations. It now looks to get real about that ambition. The company says the pilot outcome has been satisfactory and is now working to expand the product.

Being a small business digital platform, TallyKhata has a treasure trove of data about millions of businesses across the country. Using artificial intelligence and data science, it builds a business profile and calculates a digital credit score for each TallyKhata user that financial institutions can use to provide loans. Digital Credit Score is a point-based scoring that assesses potential loanees in real-time and predicts the creditworthiness of the borrowers.

msME (micro, small and medium enterprises) lending is an expensive affair for banks and financial institutions. It offers an excellent opportunity for TallyKhata to present a solution to overcome many challenges banks face in lending to msMEs.

Over the last few years, digitizing small businesses has become a highly lucrative vertical. B2B commerce has seen some of the biggest funding rounds in Asia in the last few years. Bangladesh is also catching up. Several startups have been working in the vertical across lending, ecommerce, and logistics.

TallyKhata, given its scale and penetration among msMEs, has a real opportunity to build credible solutions to address the challenges of small businesses.

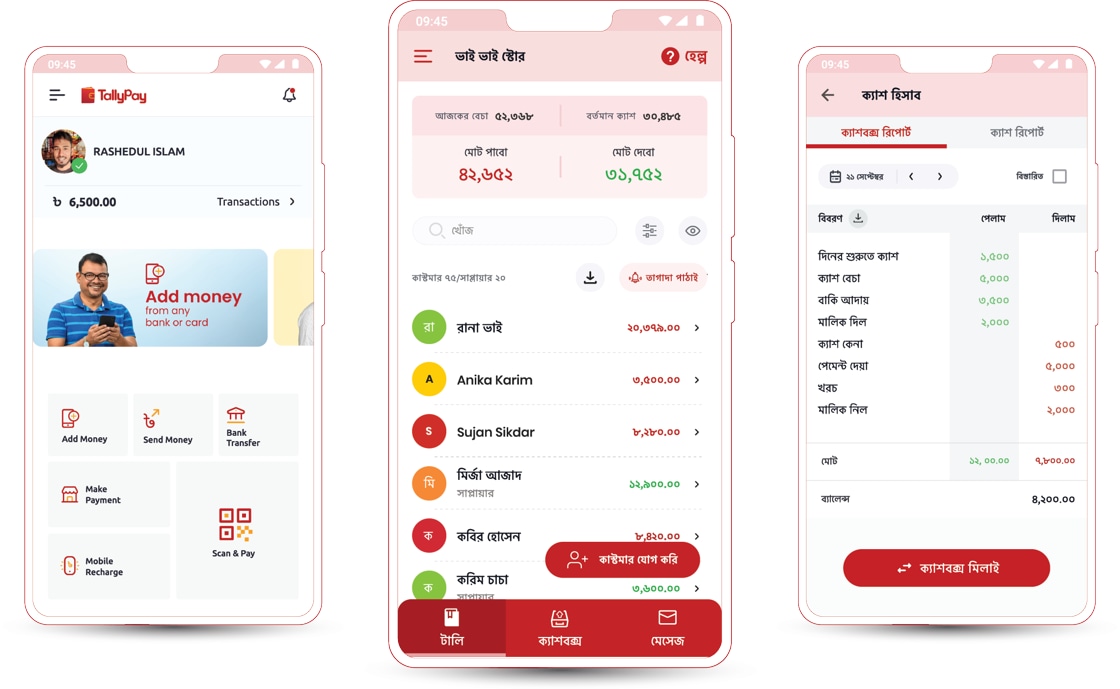

TallyKhata is an app-based digital platform for small businesses managed by Progoti Systems. The app is free and can function without the Internet. TallyKhata comes with three key features for small businesses: ledger, wallet, and loan. Ledger allows small businesses to run their business using the app — record day-to-day transactions, have visibility on profit-loss, and control the business. Users can receive and make payments digitally through a TallyPay account. To expand business, users will be able to get loans from banks staying at stores through TallyKhata.

TallyKhata ledger allows businesses to send transactional SMS as invoices to the customer for each credit sale. This transaction message brings transparency between shop owners and customers resulting in long-term rapport.

Mr. Alamin from Vatara area in Dhaka mentions that transaction SMS is a Wow for him, “I collected 3 years’ old due from an almost-forgotten customer through TallyKhata app. Now there is no scope of confusion between me and my customers about the due amount.”

TallyKhata says they have more than 4 million registered users across the country in the platform, and tens of millions of business transactions are recorded every month.

Progoti Systems obtained a license from Bangladesh Bank to work as a payment service provider (PSP) earlier this year. On 15 May 2022, the company launched a digital payment service called TallyPay.

TallyPay followed a circuitous trajectory since birth. Progoti Systems earlier had the central bank license to work as a payment system operator (PSO). The company had operated mobile financial services (MFS) of four commercial banks, including state-owned Rupali Bank.

In 2020, Progoti began a strategic change of direction to serve small businesses. As a result, it wanted to change its structure of service from PSO to PSP and applied to the central bank for a license. That’s how TallyPay came into being. Progoti's previous attempt at payment with SureCash is a mixed bag. SureCash played a significant role in mass-scale government fund disbursements and education payments. However, it did not scale in the mainstream cash-in/cash-out fund transfer segment of MFS.

With TallyPay, the company has some advantages. It has several years of experience in building payment products. It understands the market and its limitations. And it has built a successful bookkeeping product for small businesses in TallyKhata that can give it significant leverage in the market.

TallyPay is expected to target msME users of TallyKhata initially. TallyKhata has been working to integrate payment into its app. It has already added Rocket mobile banking, Visa, and Mastercard. The company says it also plans to add other payment options to the app.

Users will be able to collect dues and receive payments from customers, make payments to suppliers, and transfer money with their bank accounts using app linking. It will also enable its merchants to sell mobile recharge and utility bills to make additional earnings. TallyPay also includes add/withdraw money, and send money services.

Bangladesh has more than 10 million small and medium enterprises. The sector makes up approximately 25 percent of the country's economy. msMEs combinedly generate 40 percent of the overall employment. However, the sector is far from realizing its full potential.

msME entrepreneurs face a multitude of challenges. Of which access to finance remains the most important challenge. Over 60% of msMEs lack access to formal credit. According to the World Bank, the msME sector in Bangladesh has a financing gap of $21 billion. The cost of finance and access to finance are considered the two biggest barriers to msME growth.

It is a complex problem. On one hand, msME loan has made good progress over the past few decades on the back of government policy initiatives and private sector efforts. At the same time, it still remains out of reach for a large number of businesses for various reasons. These businesses rely on microfinance institutions, traders, loan sharks, and friends and family for finance. Usually, these loans come at prohibitively high-interest rates.

For financial institutions, msMEs is challenging terrain. It is one of the reasons behind msME loans being relatively small in the portfolios of most banks, despite the excellent growth of the sector.

Many msME entrepreneurs feel shy, discouraged, and even intimidated to visit banks because of the structured ambiance of bank branches. To most of these entrepreneurs, banks look unapproachable and out of reach.

More importantly, many msME entrepreneurs lack basic documents such as trade licenses, TIN certificates, and financial records necessary to secure loans from banks. Lack of awareness regarding how formal lending works is a reason behind this, but banks cannot assess a business for providing loan without proper documents and financial accounts. To work in this sector, banks need to deploy huge resources to understand these msMEs and their business and prepare records for them.

After the disbursement of the loan, loan recovery also takes a lot of effort. Usually a dedicated RM (Relationship Manager) needs to be deployed to maintain these loans. Many financial institutions have found this effort to be expensive. While msMEs are the key driver of the economy, providing loans to the sector is very costly because it is an intensive supervisory credit. As a result, many financial institutions stay away from pursuing msME lending at scale.

This is where TallyKhata comes in.

The company has a plausible thesis. TallyKhata has built an excellent platform with msMEs across the country. Since users keep records of their businesses in the app, this transaction history and other identity information enable TallyKhata to generate credit scores, which then financial institutions can use to lend to these msMEs. This directly addresses the inertia and time constraints most msME entrepreneurs face in seeking formal channel financing.

TallyKhata addresses many challenges that msMEs and financial institutions face when it comes to financing. It can address credit-worthiness challenges by creating credit scores for msMEs. Similarly, it can provide supervisory and collection support using the TallyKhata reminder and messaging platform.

Recently TallyKhata has been selected for Visa Accelerator Program 2022. It is the first Fintech company from Bangladesh in an elite cohort of five startups from the Asia Pacific Region (APAC). In the program, TallyKhata and Visa are collaborating to provide one unique credit solution for users in partnership with a local bank. It’s a complete end-to-end digital credit solution. The borrower will get an instant loan account and Visa card. The loan amount will be used to purchase supplies from dealers and distributors through TallyPay.

"msME is underserved in the case of access to finance. We aim to fill the gap between small businesses and financial institutions. We have a great opportunity ahead to grow and impact millions of families in Bangladesh through digital technology”, says TallyKhata Founder and CEO Dr. Shahadat Khan.

msME lending remains largely a manual process. It is a complex process and inefficient. Most financial institutions have separate departments that deal with various aspects of msME loans.

TallyKhata seeks to change that. The company says it works with an extraordinary number of micro and small business users across the country. It collects detailed profiles of them. Now that it has integrated payments into its app, it offers even more complete information. It has been able to build credit profiles of msMEs that banks and financial institutions can use to disburse loans. It can significantly reduce their operational expenses and also improve efficiency. It will also increase the speed of lending aiding the growth of msMEs and the economy.

Digital lending has become a phenomenon over the years. The Bangladesh Government has adopted the change. In June this year, Bangladesh Bank announced an end-to-end digital loan scheme for small businesses which encourages digital banking initiatives at banks and incentivizes them to use a low-cost fund from the central bank for this.

Digital credit scoring is transforming lending across markets. In India, Khatabook, a similar platform, has been working in financial service disbursement through its platforms. In other markets, financial institutions are increasingly using third-party or internal credit scoring tools to streamline loan disbursement and provide financial services. In Bangladesh, there are several companies that are working on building credit scoring technology.

TallyKhata itself has been working on several initiatives in collaboration with banks, MFIs, and other financial institutions. Done right, it can meaningfully improve access to credit for msMEs and reduce the cost of serving SMEs for financial institutions.