“I don’t like going to the bank,” says Ahmed Faisal, a 28 years-old founder of an IT company in Dhaka. “Queues make me uncomfortable and it is an unnecessary waste of time.” Mr. Faisal has been doing all his banking transactions online, using online banking facilities and his bank's mobile app. “I can do almost everything online except a small number of things. The experience is not always great. At times, I need to move, albeit unwillingly, to the bank premise. But online mostly does the job these days,” he observes.

Mr. Faisal is not alone. From grocery to fashion to finance, turning online for services has been a dominant trend across the market. While the trend predominantly started in the western markets, where technology has transformed every aspect of finance and life, it did not take long to sweep developing markets like Bangladesh.

The Internet is a great equalizer, at least when it comes to trends and norms. Regardless of your geographic location, we all now live in New York in taste and orientation.

Taste gets adopted faster even when our reality lags and takes time to catch up. This has been the case with banking and financial services in Bangladesh. We have come to see the outcome of this transformation on the heels of the coronavirus pandemic. Financial services have been going digital for a long time in Dhaka. The pandemic has just speeded up that transformation.

The most recent data from the Bangladesh Bank testifies that — digital banking transactions have almost doubled from BDT 6,588.0 crore in March 2020 to BDT 10,371.1 crore in March this year, a staggering 57.42% year-on-year increase. Digital banking users have also skyrocketed over the last two years. The latest data from the Bangladesh Bank suggests internet banking users saw a whopping 31.08% year-on-year increase to 3.47 million.

This offers unprecedented opportunities as well as challenges for the financial institutions in Bangladesh. On the one hand, it offers the potential of infinite scale on the back of the internet and mobile phones without essentially investing in the physical branches. Banks can reach and serve more customers digitally without opening physical branches meaning they can save on real estate and physical operations. And on digital, the geographic boundary is moot meaning you can serve anyone from anywhere.

But that transformation and opportunity come with challenges. Security is a major issue that will require a substantial investment in tech and embrace the ideals of disruptive innovation — investing in innovation and choosing to lose money in some areas in the short-run for the long-term gains.

Moreover, financial companies will have to invest more in customer experience. If existing initiatives are any indicator — users of mobile apps of major banks continue to complain about the poor experience — banks have a long way to go when it comes to technology product design. Both challenges addressed, financial companies have a huge opportunity ahead of them in a digital world.

This transformation is only going to accelerate. Several forces are playing a role in shaping this future. We will look into two forces here: technology penetration and trust.

One: the internet penetration has doubled in Bangladesh over the last five years with an average 13.5% annual growth — some 67% of the country's total population now use the internet. While Bangladesh lags behind its Asia Pacific peers in smartphone usage, the smartphone penetration has seen consistent growth with 41% of total mobile phone users having smartphones.

How do you read this data? The market is changing. The increased internet and smartphone penetration have resulted in the rapid rise of a myriad of digital services such as mobile banking services, online grocery, general-purpose ecommerce, services online, food delivery, etc. The coronavirus pandemic has accelerated that pace.

A segment of the customer has already been sold on mobile banking. They have been using digital banking solutions and pushing for more digitization of banking services. This push has resulted in the launch of excellent digital and mobile banking solutions from financial institutions. The above-mentioned widespread internet and smartphone penetration mean a new wave of users are going to further accelerate this trend.

Two, the rise of mobile financial services such as bKash, Nagad, Upay, Rocket, and commoditization of trust. Mobile financial services have seen phenomenal growth over the last decade in Bangladesh — the transaction of Mobile Financial Services (MFS) reached BDT 35 billion daily ahead of the Eid ul-Fitr in May this year. Companies like bKash and Nagad have played an important role in building awareness in people that you can manage your financial activities using your mobile phones.

This understanding has transformed and will continue to transform financial services in Bangladesh. As Muhammad A Rumi Ali, the Chief Executive Officer of Bangladesh International Arbitration Centre (BIAC), who was the first Chairman of the Board of bKash, puts it: “bKash has done a tremendous job, no doubt about it. But to me, the most important contribution of bKash is not the technology or the scale it has achieved today but the trust it has been able to create among people in technology. At an individual level, people have not interacted with technology in a way that required financial trust. bKash for the first time as a technology wanted ‘trust’ from its users and in most cases, people responded positively. It has created the basic infrastructure for FinTech and that is ‘trust’. That is why I do not see bKash as a delivery channel rather it is something more. It has in a way changed the trust infrastructure of financial services and paved the path for fintech products.”

These two forces, penetration of technology and trust in tech for financial services, are going to transform how organizations deliver financial services and users access financial services in the coming years.

The transformation has already begun, as I mentioned at the beginning of this article. The transformation bKash and other MFS companies started about a decade ago, now is a widespread phenomenon.

MFS has certain limitations such as limits on transaction volume, network disruption, growing per-transaction costs, etc. In fact, MFS user growth has slowed in the recent past owing to several challenges. Ambitious banks and financial institutions can learn from many of these challenges. In others, banks have the advantage of experience and infrastructure to complement.

Today, almost every bank and financial institution have a digital service delivery wing. Banks and financial institutions have launched some of the best mobile apps in Dhaka in the last two years. To name a few: IBBL launched iSmart app, The City Bank introduced Citytouch, EBL launched Skybanking, BRAC Bank launched Brac Bank Astha, Dhaka Bank launched Dhaka Bank Go, and so on. The transformation continues with more financial institutions joining the revolution.

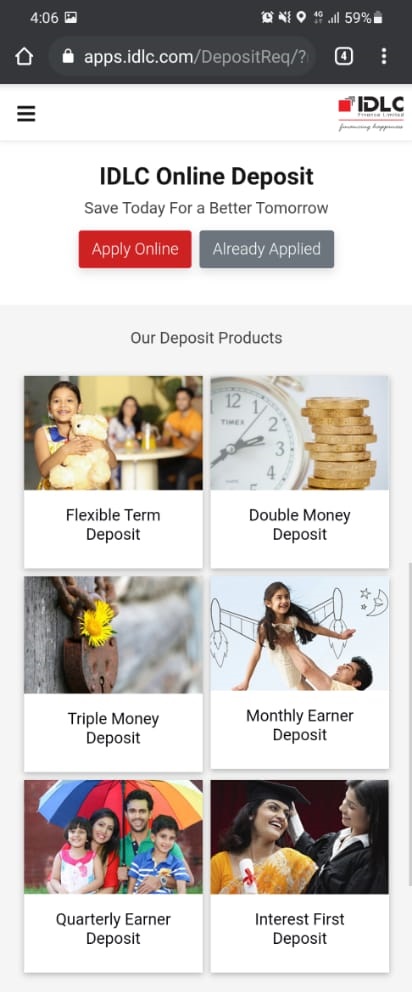

Take, for example, IDLC Finance Limited, the largest NBFI in the country. The company launched a host of initiatives around digital service delivery.

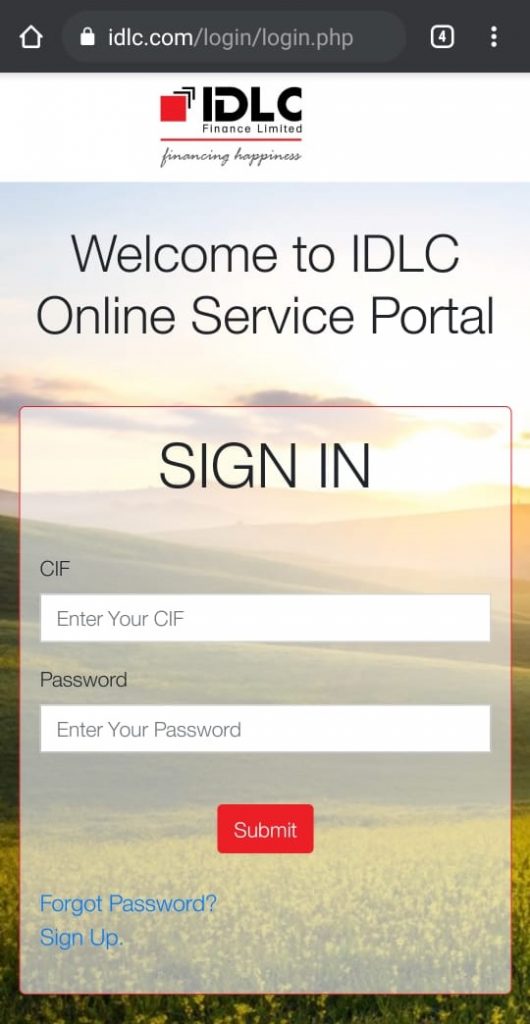

Customers can now open an IDLC account online, apply for a loan, manage their transactions and accounts digitally without ever visiting a branch. The company has created a dedicated online service portal for digital service delivery. The company says a greater digital adaptation is on the way for the NBFI.

Several senior leaders from the banking industry from leading banks like Prime Bank, EBL, The City Bank told us that technology is going to play a strong role in how financial service is being delivered in the coming days.

Almost every bank we spoke with is zeroing in on innovation and has a digital banking team within the bank who are constantly looking for ways to innovate to improve service delivery and make customers happy. Many are restructuring business processes and revamping IT infrastructure to address the changes in the market.

Industry experts predict fintech adoption in the country is just getting started.

“Fintech is going to be huge in a country where there are many more mobile phones than latrines”, says Sajid Amit, Director of the EMBA program and the Center for Enterprise and Society (CSE) at ULAB, who has been studying and following fintech trends across markets for years now. “We have had viral growth in the adoption of mobile communications, internet, and I believe mobile payments as well. So fintech already has established a presence here. In the future, I don't think banks will start creating brick-and-mortar branches all over the country. Because real estate will continue to be expensive. Your mobile phone will be your bank, and you will get loan approvals digitally and money will be transferred to your mobile wallet. You may head over to an agent banking kiosk to get some personalized service or financial literacy session, but many will never have to set foot in a bank branch.”

In today’s world, everything is technology. Finance is no different. Greater adoption of technology is going to be a boon for a greater number of people. It will certainly be beneficial for the financial institutions and will create greater dynamism in the economy.

Mr. Rumi Ali explains: “I strongly believe that the business model that the banking industry now has will no longer be in existence in the next 10 to 15 years”, says Mr. Ali. “If we want to include every person in the banking industry with a bank account and transactions and want to attain the middle-income country status then we must drop this model. It will be useless in the future. To achieve the goals and targets we need to have an enabler in the banking industry. This enabler is fin-tech and its application on hand-held devices. It will create a large multiplier effect on the economy and inclusivity and our GDP will automatically grow. Imagine, if 130 million people out of 160 million get included in the financial system with a bank account and do transactions through the financial system, it will create a huge multiplier effect on the economy.”

This is precisely the future of finance. As more customers embrace technology and go digital, financial institutions will double down their investment in tech in the coming days. The recent enthusiasm over digital financial services from the banks — albeit due to the coronavirus pandemic — offers a glimpse of that future. The future of banking is branchless.