Facebook has been doing several things on the ecommerce front. The company first launched Facebook Marketplace in 2016 in four markets: US, UK, Australia, and New Zealand. It has since launched the service in several new markets including Bangladesh.

On May 19, 2020, Facebook added ecommerce Shops to Facebook business pages and Instagram business profiles. First launched in the US with a checkout feature where sellers can receive payment directly on Facebook for a small selling fee of 5% per shipment. The company has already started to reach out to merchants in Dhaka, in a move that could potentially shape the entire ecommerce landscape in Bangladesh. In December 2020, Facebook announced that it has reached an agreement to acquire Kustomer, a startup focused on customer service technology and chatbots. We wrote about the announcement and its potential impacts here.

****

Facebook exerts unparalleled power in Dhaka’s ecommerce space. These developments in the ecommerce space from the social media giant are likely to affect and shape the ecommerce landscape in Dhaka in the coming years.

In this piece, we take a closer look into Facebook’s ecommerce moves and their potential impact on the digital commerce landscape in Bangladesh. In the end, we will try to tie in all the disparate strings to help you make sense of all these things.

I.

Facebook marketplace: Facebook launched Marketplace in 2016 allowing peer-peer to buy and sell on Facebook. From Facebook’s 2016 announcement:

“To help people make more of these connections, today we’re introducing Marketplace, a convenient destination to discover, buy and sell items with people in your community.”

Facebook then delves deeper into how the Marketplace works:

“Marketplace opens with photos of items that people near you have listed for sale. To find something specific, search at the top and filter your results by location, category, or price. You can also browse what’s available in a variety of categories such as Household, Electronics, and Apparel.” [......]

“Decided that you want it? Send the seller a direct message from Marketplace to tell them you’re interested and make an offer. From that point on, you and the seller can work out the details in any way you choose. Facebook does not facilitate the payment or delivery of items in Marketplace.”

In 2018, on the eve of two years celebration of the marketplace, Facebook announced several new features and made it clear that the social media giant was making the marketplace open for businesses allowing them to add their inventory and promote deals in Marketplace. From Facebook:

“People use the Marketplace to discover, buy and sell items and chat over Messenger. While individual people can list items for sale, businesses can use Marketplace to:

II.

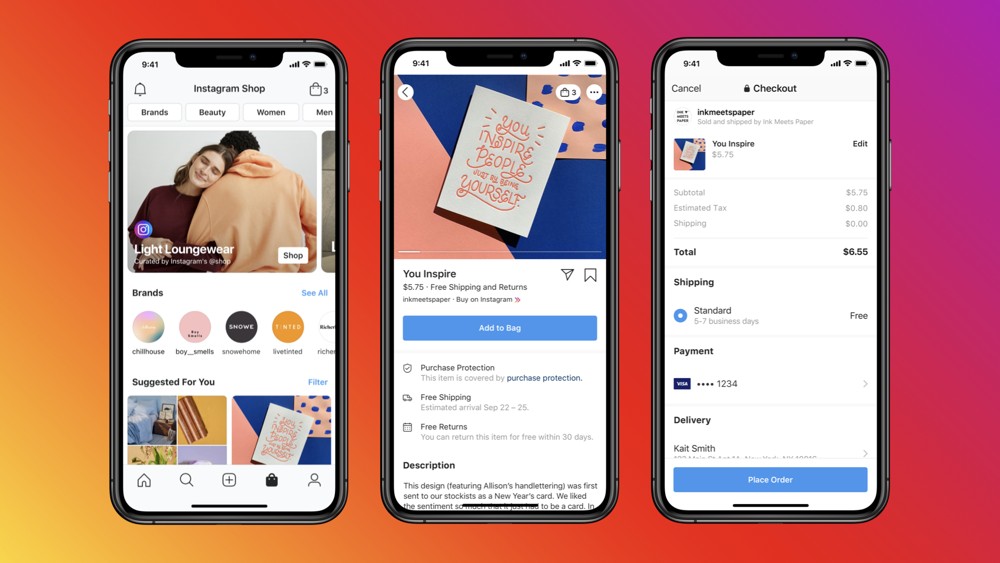

Facebook Shops: Facebook went further deeper into the online shopping space with the launch of Facebook Shops on 19 May 2020. The launch of Facebook Shops lands Facebook in a new competitive circle of eCommerce marketplaces such as Daraz, Evaly, and Ajkerdeal and similar players operate.

The move indicates that Facebook would want to go deeper into commerce, rather than just being the media channel driving sales for merchants and retailers. From Facebook’s Shops announcement:

“Facebook Shops make it easy for businesses to set up a single online store for customers to access on both Facebook and Instagram. Creating a Facebook Shop is free and simple. Businesses can choose the products they want to feature from their catalog and then customize the look and feel of their shop with a cover image and accent colors that showcase their brand. This means any seller, no matter their size or budget, can bring their business online and connect with customers wherever and whenever it’s convenient for them. People can find Facebook Shops on a business’ Facebook Page or Instagram profile, or discover them through stories or ads. From there, you can browse the full collection, save products you’re interested in and place an order — either on the business’ website or without leaving the app if the business has enabled checkout in the US. And just like when you’re in a physical store and need to ask someone for help, in Facebook Shops you’ll be able to message a business through WhatsApp, Messenger, or Instagram Direct to ask questions, get support, track deliveries, and more. And in the future, you’ll be able to view a business’ shop and make purchases right within a chat in WhatsApp, Messenger, or Instagram Direct.”

The company later added a live commerce feature for Shops:

“With Live Shopping, we’re making it easier for people to shop in real-time. We’ve been testing this feature on both Facebook and Instagram, and now Facebook Live Shopping includes new features to help businesses easily set up a live experience featuring products from their Shop and sell directly from the video. Instagram Live Shopping is now available to all businesses and creators using checkout in the US.”

III.

Facebook’s ecommerce moves could complicate the competitive landscape for ecommerce marketplaces in Dhaka. Facebook Marketplace has seen excellent growth in Bangladesh making Facebook groups critical for both individual sellers and brands.

The new Facebook Shops, once launched in Dhaka, can create further competitive pressure on e-commerce players in Dhaka. Facebook Shops consist of a shop tab and a product catalog managed, respectively, via the company’s Commerce Manager and Catalog Manager.

Facebook does not charge any fee for sales on the platform unless you use the checkout on Facebook. In the case of Facebook checkout, Facebook charges a 5% selling fee.

Facebook has given rise to all kinds of entrepreneurial activities in Bangladesh. Small Facebook sellers, aptly called F-commerce, makes up for a significant volume of ecommerce GMV in Bangladesh. Ecommerce companies also use Facebook to generate sales and engagements.

Until now, major brands while working with ecommerce marketplaces did not take Facebook Marketplace seriously. If Facebook decides to introduce checkout and payment in Bangladesh, which the social media giant is likely to roll-out in more markets, brands and small retailers would be happy to explore a new digital sales channel.

IV.

Facebook has been trying to grow its Marketplace for years. It started as a peer-to-peer platform in 2016. Over the last year, the social network has been more actively trying to court brands to not only advertise their products on Marketplace but transact through it as well.

Much of this brand push-started earlier last year and since the launch of Facebook Shops, it has reached a new level. If Facebook decides to offer checkout features in Bangladesh, Facebook Marketplace and Facebook Shops together could become a viable threat to the ecommerce marketplaces in Dhaka.

Facebook charges a lower selling fee: 5% compared to over 10% commission of ecommerce platforms such as Daraz. For now, Facebook remains home to smaller merchants and sellers. The company will gradually move up the ladder to attract more established brands and sellers who work with ecommerce marketplaces. This is going to increase Facebook’s already excessive power in Dhaka’s ecommerce space.

We wrote about the reliance of smaller merchants and ecommerce marketplaces on Facebook for sales in our Facebook’s Excessive Power in Dhaka’s eCommerce and thus a major competition to the ecommerce marketplaces:

“Facebook remains a major challenge for any independent ecommerce platform in Bangladesh. Facebook plays two critical roles in digital commerce. On the one hand, it has enabled a large number of small digital retailers who run their operations using Facebook. Second, almost every independent ecommerce player uses Facebook for acquiring customers. In most instances, Facebook remains the ultimate owner of the customer interaction for all these players and thus demands. This means if these players stop paying Facebook for customers many of these businesses will suffer a significant decline in demand.”

As Facebook dives deeper into commerce directly, ecommerce marketplaces in Dhaka could face significant challenges in their relationship with merchants, smaller ones as well as big brands, as more of these merchants embrace Facebook as an alternative sales channel.

It also plays out well for brands and merchants who are looking to reduce their reliance on the ecommerce marketplace and have a balance in bargaining power in the commission structure.

Facebook’s relatively lower selling fee, 5% of the order, means the ecommerce marketplace will have to negotiate with merchants as well.

Having said that, it is not entirely black and white. While Facebook has a huge advantage when it comes to having a large engaged audience, it is not an ecommerce platform for that matter. It does not support fulfillment, at least not yet, which remains a key challenge for most merchants and brand sellers. To that end, ecommerce platforms have an advantage over Facebook. It means there are nuances that we need to take a look into to have a clear understanding of how things are going to be in the months to come. We explained multiple aspects of Facebook’s power in the ecommerce space in Dhaka in Facebook’s excessive power piece:

“Facebook has been playing an instrumental role in the growth of online shopping in Bangladesh. The platform has enabled a large number of small digital retailers who sell products using Facebook pages as a medium for reaching out to customers and selling products. These retailers, often run by solo entrepreneurs or/and eventually a small team, housewives, students, and professionals on the side, build an audience first and then sell products.

The second important role Facebook plays is in digital advertising and customer acquisition. Almost all digital businesses, as well as a growing number of non-digital businesses, in Bangladesh, spend on Facebook advertising. Facebook advertising continues to dominate all ad spending in digital for most businesses. Most ecommerce companies rely on Facebook for customers. Paid advertising on Facebook and other campaigns drive sales.

There is no problem with paying for advertising to grow and achieve your sales target. But if you are an ecommerce marketplace or an online retailer and you need to rely on a third-party platform and pay that third party to acquire customers, then it is a problem.

Ecommerce marketplace is essentially second-tier aggregators. These companies make money, mostly, out of commission from sellers. There are nuances such as many marketplaces invest in white-label brands and make money out of it. Others get into wholesale selling with the seller of their marketplaces and make money from there and so on.

But mostly and if there are some regulatory disciplines, marketplaces make money out of commission. The way they make and maximize this commission is through owning customer interaction thus demand and then making sellers and brands rely on them for customers. For example, why Unilever would pay Chaldal a commission because Chaldal generates orders for Unilever and so on. As Chaldal continues to drive more and more orders for Unilever, Unilever’s reliance on Chaldal for demand continues to grow to allow Chaldal greater bargaining power to grow its commission. But if Chaldal has to rely on a third party for that same demand acquisition and pay them, it means Chaldal’s power will remain limited.

This applies to small online retailers as well. Small retailers who sell through the Facebook page, work hard to build a follower base and then monetize that follower base by selling products to them. But when Facebook exercises platform power and does not allow these small retailers to reach their followers, it means these small retailers don’t truly own their customer thus demand. It means they will continue to pay Facebook for acquiring demand. This is becoming a challenge for many of these small online retailers as Facebook advertising costs continue to grow which continues to gradually eat into the profit of their business. For many, it is gradually reaching a point of the meaninglessness of running a business. The scenario is not all bad though. Facebook ads continue to be the cheapest digital ads available. The platform offers superior targeting technology. It remains cheap to run ads on Facebook. But the problem remains in owning demand. For any business, owning customer interaction is critical for long-term sustainability and predictability, and profit. For digital businesses, it is more so.”

Now that Facebook itself goes deeper into commerce, it poses yet another challenge for ecommerce marketplaces. This is more so for the Bangladesh market given the power imbalance we have discussed earlier in the market. Facebook simply is too powerful to compete within Dhaka’s commerce and advertising scene in many ways.

Facebook now offers payment integration in several markets, which means platforms like Shopup are going to face new challenges. It is not difficult for the social media giant to offer logistics and other relevant integration eventually. It means Facebook could become a real threat to building a sizable dominant marketplace business in Bangladesh. This is more so for the Bangladesh market because in Bangladesh, Facebook, in many instances, is the internet.

V.

There are of course nuances, as I mentioned earlier, and it is not all bleak for ecommerce platforms. First, just because a social giant taps into another vertical such as eCommerce, does not mean it will succeed. Facebook has tried various things in the past including Instant Articles that did not fly. A push into ecommerce could prove to be yet another failed experiment for ecommerce.

While Facebook does want the ecommerce money, advertising is a far greater business for Facebook. It could simply turn all these commerce initiatives into more advertising businesses instead of competing with ecommerce platforms, which are, to some extent, its customers. It could all lead to that direction eventually.

Each tech platform has its purpose. For example, we go to Google for search, to Facebook for connecting with family and friends, we go to Daraz and Evaly for shopping, and so on. It means Facebook diving head-on into ecommerce does not mean it would upend businesses for everyone else.

The social media giant has certain advantages. It has limitations as well. As we discussed earlier, Facebook does not do delivery as yet, which is a major challenge for many merchants, which ecommerce marketplace do provide. There are similar other fulfillment related challenges that ecommerce marketplaces do better than Facebook. We will have to see how Facebook addresses these challenges in the coming years.

All things considered: While Facebook commerce and traditional eCommerce marketplaces are two different channels and both have their own place, it is certainly going to complicate things and create competitive pressure for ecommerce marketplaces in Dhaka given the unparalleled power Facebook has in the market.

Update 01: on February 4 at 9:21 am: This article has been updated to reflect the fact that Facebook Shops checkout is not currently available in Bangladesh.