Snap — formerly Snapchat — is headed towards an initial public offering worth perhaps as much as $25 billion, according to press reports. And Fortune magazine notes: Snapchat Likely the Most Expensive Big Tech IPO Ever. But are there issues that need to be considered?

According to David Erickson, Wharton senior fellow, and finance lecturer, Snap plans to sell “non-voting” shares in the IPO — perhaps a first for a company going public and something with which large investors will likely struggle.

Given this, management’s ability to execute will be an even greater focus as investors wonder whether, down the road, Snap will go the way of highly successful Google and Facebook, or struggling Twitter. In this opinion piece, Erickson offers his views.

Since Snap was rumored last year to have filed privately with the SEC, there has been a lot of “buzz” about the IPO. A large part of this interest is with Snap, the four-year-old company known for its Snapchat application, that could, as an article on WSJ.com last October noted, be worth more than $25 billion when it likely goes public in the first quarter of 2017.

Additionally, some of this interest is driven by the fact that 2016 was the quietest IPO market in the US in several years.

EY, in its 2016 Global IPO Trends report published in December, explained that the IPO market in the United States in 2016 was the “slowest year for IPO activity by both deal number and proceeds since the global financial crisis in 2009” and was the “first year since 2000 [that] the U.S. did not feature in the global top 10 deals of the year.”

Snap would be the highest-valued company going public in the U.S. since Alibaba went public in September of 2014.

Since Snap filed its S-1 publicly with the SEC last week, there has also been a lot written already comparing the attributes of Snap, as it gets ready for its IPO, to those of Facebook and Twitter — both leading social media companies when they went public.

One such article in Recode compares the three companies on three key metrics (revenue, profitability, active users) that investors will likely focus upon. Given the interest and buzz already about the filing, there will likely be many more articles written about the Snap IPO before and during its expected roadshow in March.

I have no doubt that Snap, along with its advisors, believes it can go public at around these valuation levels. Assuming a stable, constructive equity market, the buzz associated with Snap given its tremendous growth characteristics, and the dearth of large growth IPOs in the market, I also believe Snap will generate a significant amount of investor demand for its IPO.

“While there are lot of great ideas, execution is always the key.”

My question, though, in the title of this article, is more focused on Snap, the public company in the future. In 12 to 24 months, is the company executing and performing more like Facebook or Twitter? When investors focus on Snap, the public company, I believe two of the things investors will worry most about are both probably related to governance.

Non-voting Shares on Offer

In its filing, Snap outlined that they will be selling “non-voting” shares in the IPO. While there has been a significant number of high-vote, low-vote stocks (commonly referred to as dual-class stocks) that have gone public in recent years, offering “non-voting” shares I believe would be a first for a company going public.

An article in the Financial Times entitled “Snap’s offer of voteless shares angers big investors” notes that the Council of Institutional Investors, a group representing pension funds and asset managers, has already sent a letter to Snap’s co-founders suggesting they reconsider the structure. The article goes on to state that the letter was signed by members representing institutions who control more than $3 trillion in assets.

In our Strategic Equity Finance course at Wharton this term, we have already talked about the high-vote, low-vote structures in the IPOs of such high-growth companies as Facebook and Under Armour, as well as a similar version in the Alibaba IPO.

When we discussed why companies go down this path, it parallels what was written in the Financial Times article referenced above: “proponents of multiple-class share structures say they are the reason visionary founders … have been able to concentrate on building long-term value rather than worrying about short-term share price pressures.”

When I asked our classes two questions about the Snap non-voting structure, I got an interesting result. The first question was: “Do you think Snap’s non-voting structure will matter in the doability of the IPO?” Only a few hands rose in both classes.

The second question was: “Do you think Snap’s non-voting structure should matter to investors longer term?” About half the students raised their hands. This follows the discussions we had in class about the voting structures of Facebook and Under Armour at IPO.

While the “low vote” structure offered in each of those IPOs was probably not well liked by investors, this was the form that was being offered and the only way for investors to participate in the IPO.

However, as the Financial Times article pointed out: “For every Google or Facebook, there is a Zynga or a GoPro,” noted Anne Sheehan, director of corporate governance at CalSTRS, the large California teachers’ pension fund.

Interestingly, in the same week that Snap filed, the CEOs representing some of the largest corporations and institutional investors signed an open letter entitled “Commonsense Principles of Corporate Governance.” Some of the signatories included the CEOs of BlackRock, Capital Group, T. Rowe Price, and Vanguard, as well as such leading corporate CEOs as Warren Buffett and Jamie Dimon.

In the Shareholder Rights’ section of the principles, it states: “Dual-class voting is not a best practice. If a company has dual class voting, which sometimes is intended to protect the company from short-term behavior, the company should consider having specific sunset provisions based upon time or a triggering event, which eliminate dual class voting.”

“Snap has neither the CEO nor CFO with comparable public company experience.”

In the case of Snap’s S-1 filing, it states the two co-founders (collectively controlling 88.6% of the vote) will have a rather unusual sunset and triggering provisions: “The proxy agreement will terminate as soon as any of the followings occur: (i) nine months after the death of both Mr. [Evan] Spiegel and Mr. [Robert] Murphy; (ii) the liquidation, dissolution, or winding up of our business operations; (iii) the execution by us of a general assignment for the benefit of creditors or the appointment of a receiver or trustee to take possession of our property and assets; or (iv) the date as of which Mr. Spiegel and Mr. Murphy terminate the proxy agreement by written consent of Mr. Spiegel and Mr. Murphy, with notice to us.”

Can Management Execute?

The ability to execute is always one of the biggest, if not the biggest, questions that investors have when they make a decision about buying, holding or selling a company’s stock. While there are a lot of great ideas, execution is always the key.

When an investor makes a decision to buy the stock of a company at IPO potentially valued around $25 billion plus, they are hoping it is the next Google (went public in 2004, valued at $23.1 billion; now about $560 billion) or Facebook (went public in 2012 at $81.2 billion; now about $377.2 billion) … not the next Twitter (went public in 2013, valued at $14.4 billion; now $12.5 billion).

“The ability to execute is always one of the biggest, if not the biggest, questions that investors have when they make a decision about buying, holding or selling a company’s stock.”

When investors focus on confidence that management can execute, investors get more comfort with those companies that have a strong, proven record of accomplishment.

This is especially true for high-growth companies where investors’ expectations are often highest — and the risk of missing expectations can often have the most significant consequences given the “beta” [a stock volatility measure relative to the market average] of these stocks. To gauge the strength of management’s ability to execute at IPO, investors will look most closely at the following management positions for companies going public:

In the case of Google, Facebook and Twitter, a brief comparison of these positions at IPO:

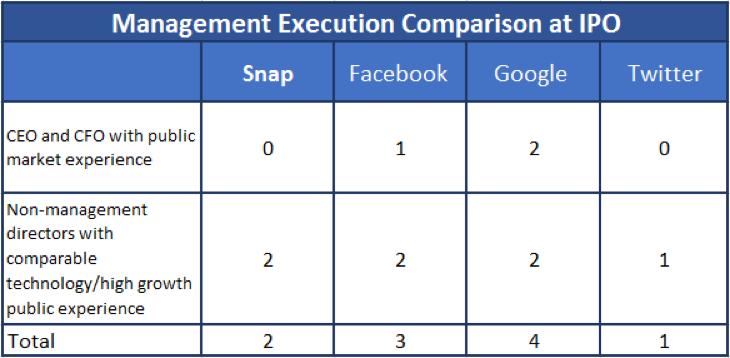

By comparison, Snap has neither the CEO nor CFO with comparable public company experience. In addition, while Snap does have the former CEO of Procter and Gamble (A.G. Lafley) as a non-management director with significant public market operating experience, the two non-management directors that have significant technology and high-growth experience are the former CFO of Silicon Graphics (Stanley Meresman) and the former CEO of JAMDAT, a high-growth online gaming company which sold to Electronic Arts (and now Benchmark Capital partner, Mitch Lasky).

So, when you look at these three companies at IPO, with Snap’s current filing, it compares as follows:

Summary

As Snap progresses to IPO (and beyond), it will be interesting to see how investors view Snap as a public company. While the above management execution comparison looks quite favorable for Snap, the non-voting offering will mean that investors will have to be very comfortable with management’s ability to execute. Over the next year or two, markets will be closely watching execution to get answers.

This story originally appeared on Knowledge@Wharton website.