A recent report published by the USAID said, mobile money transfer is on the rise in the country. Since its launch in 2011, mobile banking sector has been experiencing exponential growth. According to the report, the growth has reached a new height in February making the number at $1.42 billion which is BDT 11,104 crore. Bangladesh is among the biggest mobile banking market in the world and accounted for almost 8% of total registered global mobile banking users. Since a large number of population don’t have access to conventional banking, mobile banking has become an instant hit in the country especially to BOP population.

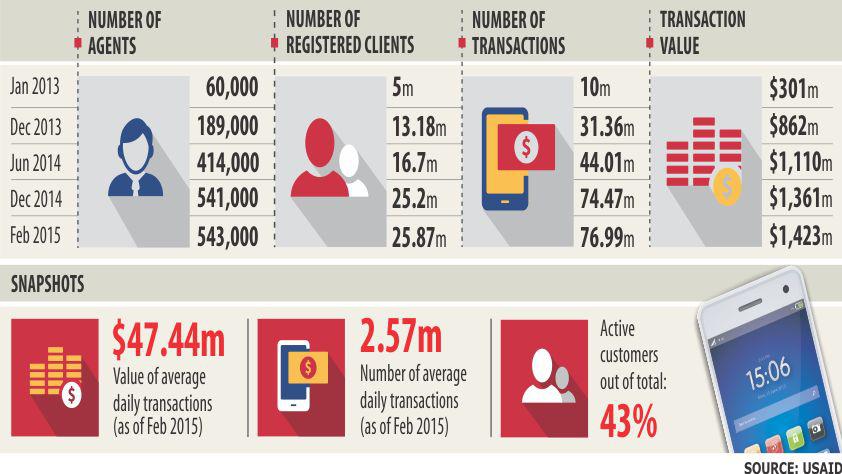

However, the industry has seen its biggest growth between January 2013 and February 2015. During this period of time the number of registered clients increased more than five-fold from 5 million to over 25 million. The number of transactions has also grown significantly during this period of time, from 10 million in January 2013 to just under 77 million in February 2015, making the daily transaction amount via mobile staggering $47.44 million on an average.

The report used desk research and face-to-face interviews with key mobile financial services providers, telecom operators, technology platform providers, regulators, and USAID health and agriculture project staff and 904 beneficiaries to come up with a unified understanding.

Usage

UsageThe reports says: 77% of the respondents were interested in using mobile phones for bill payments (77 percent), savings , 70% in airtime top-ups, 60% in school fee payments and 55% in merchant payments.

Safety has been one of the major critical points for mobile banking. Concern has always been expressed by various stakeholders regarding safety of this system. However, report shows a different picture. Whereas 8% of total respondents doubted about the safety of transaction, some 82 percent of the respondents in the survey certified mobile transactions to be safe.

Transaction fee has also been another concern for many users. Although 61% respondents reported that transaction fees is okay but 26% of respondents disagreed with the statement emphasizing that the transaction fee is still high.

There are at least 10 service providers operating in market. bKash dominates the market with almost half of the market share followed by Dutch-Bangla Bank, rest of the ten providers account for around a quarter of the total market share.

bKash has done an extraordinary work in familiarizing mobile banking in Bangladesh. It has done so awesome that bKahs has become the synonym for mobile money transaction.

According to Mahindra Comviva, a mobile financial solutions provider, Bangladesh is in the leading position in the Southeast Asian nations in terms of Mobile Finance Services. Kamaljeet Rastogi, global head of business development of Mahindra Comviva, said: “Mobile money is growing at the rate of 30 percent per year and this rate of growth is expected to continue for the next two years and then it should become stable.”

Target customers for MFS are mainly people with limited to no access to banking services. It means the current market size is only a part of whole. Given the population size in BOP market in Bangladesh, mobile banking market will be doubled soon.

Sources: USAID, the daily star, Image credit: the daily star